Issue, No.25 (March 2023)

Varieties of gendered inequality outcomes

Historically labour policy trends and comparative data have revealed significant cross-country differences in gendered political economies in industrialised countries. Nevertheless, the dearth of research into gendered labour market policies as a separate field of study tasked with investigating the effects these policies have on gender inequalities is somewhat surprising. Comparative research on gender inequality trends, and most notably on ‘within’ gender inequality’, has received less attention than gender labour market outcomes, such as employment rates, which alone cannot reveal the standard of living of working women. Little effort has been made to detect how different labour market regimes affect gender inequality, particularly during macroeconomic shocks and instability, such as the global financial crisis. The gender effects of the global financial crisis of 2008 in advanced economies remain significantly underexplored, though the consequences of gender inequality are likely to remain for many years. Were declining gender wage gaps paralleled by growing inequality among women, similar to what happened among men? Did certain women subgroups shoulder the cost of economic recession more than other groups? These questions are important, albeit rarely asked.

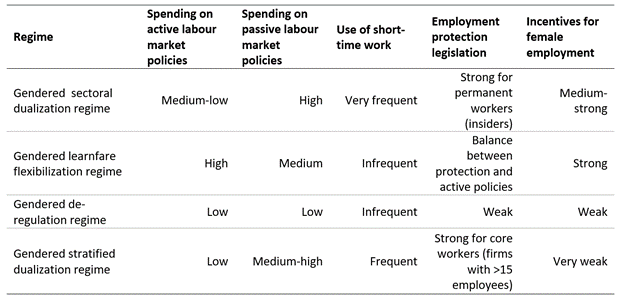

A new book offers a re-interpretation of labour market policy regimes from a gender perspective (Mulè and Rizza 2023). The study investigates the USA and the UK, as cases of the gendered liberal deregulation regime, Norway and Denmark as countries representative of the gendered learnfare flexibilization regime, Germany and the Netherlands with regard to the gendered sectoral dualization regime, and Italy and Spain as examples of the gendered stratified dualization regime. The features of these regimes are summarized in Table 1.

Table 1. Regimes of gendered labour market policies

The book also analyses between and within-gender inequality, drawing on the Luxembourg Income Study datasets to examine evidence across the eight high-income countries representatives of what we call ‘labour market policy regimes’ from 2007 to 2015. The research investigates gender inequality trends before and after the global financial crisis. It adopts several indicators, such as the ‘added-worker effect’, the gender share of involuntary part-time employment after the crisis, female income inequality before and after government intervention as measured by the Gini index, and inequality within and between subgroups of women as measured by the Theil Index. For all countries in our sample, these indicators were investigated at two specific periods: one pre-crisis (2007), and one post- crisis (2012–2015). The study uses several analytical techniques, including the framework of decomposition analysis and quantile regression. The decomposition approach deals with group heterogeneity within a country by breaking down individual inequality into between-group and within-group components to study inequality across social groupings within nations. Decomposition by population subgroups aims to assess the contribution of individual features, such as age, occupation, presence of partner and age of children, to total inequality. We chose five factors as the possible drivers of income inequality within and between women: age, age of children, presence of a partner, the composition of the household, and occupation. We investigated the evidence available before and after the economic recession and how the crisis affected within-women and between-women inequality.

Our line of enquiry critically moves beyond the conventional analysis of gender, where gender is represented in terms of a homogenous group. Women do not constitute a cohesive social unit of identical individuals, all facing the same circumstances, positions, settings and status. Women undergo various experiences and social positions, which must be accounted for. The scant literature on within-women inequality differentiates women by social class, measured by educational attainment, income level or occupation. Our research enriches this literature by breaking down ‘gender’ into sub-groups according to age, marital status, number of children and occupation to explore whether there is any evidence of income inequality between and within women subgroups among countries.

Our evidence suggests that the eight countries we studied featured different gender inequality outcomes. Decomposition analysis of gender inequality indicates that before the onset of the economic downturn, market income inequality was higher ‘within’ the female workforce than ‘within’ that of male workers in almost all gendered political economies. Second, and focusing only on women, after the crisis, market income inequality increased more sharply in the stratified gender dualization regime, represented by Spain and Italy, indicating the greater vulnerability of women workers in those countries. In the gendered sectoral dualization regime of Germany and the Netherlands, market income inequality fell, perhaps due to the ‘added worker effect’ or the implementation of more effective gendered labour market policies. This result is consistent with recent findings that indicate higher earning penalties in labour markets with weaker employment protection legislation for women, especially in a context of high macroeconomic volatility. Our results for disposable income inequality show the importance of government cash transfers in mitigating market income inequality among women in all four regimes of political economy we examined. As expected, there was a more substantial buffering effect from the tax and transfer system in the two Scandinavian countries and the Netherlands. In contrast, its impact was weaker in the USA. These figures suggest that in most countries, discretionary governmental policies shield women’s incomes against economic downturns. In Spain, however, disposable income inequality rose, indicating that government policies were insufficient to protect women’s living standards. Spain was one of the countries hit hardest by the recession. Different starting levels of inequality, and the political-economic institutions underlining this situation, may have worsened the opportunities for female workers. The findings point to the crucial importance of women-friendly policies in buffering the adverse effects of the global financial crisis on inequality ‘within’ women subgroups.

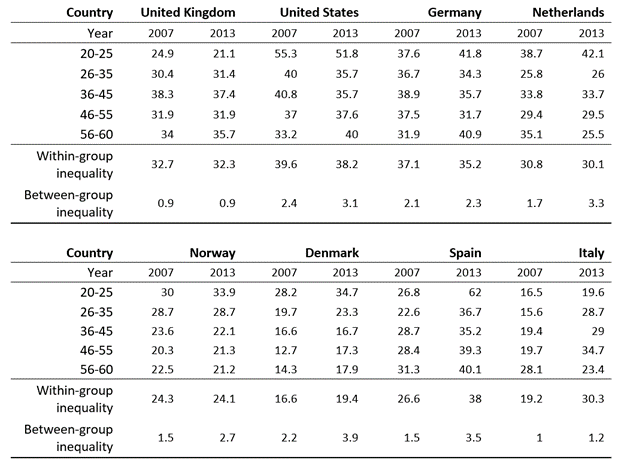

The decomposition analysis by age shows that inequality ‘between’ age groups increased in all countries except the UK, where it was stable (Table 2).

Table 2. Inequality within and between female workers, by age subgroups

Source: own calculations from LIS

Between 2007 and 2013, female within-age group inequality dropped in both the gendered sectoral dualization regime of Germany and the Netherlands and in the liberal deregulation regime of the USA and the UK, but rose slightly in Denmark and significantly increased in those countries adopting the gendered stratified dualization regime of Spain and Italy. Spain stands out as the country with the most dramatic increase in inequality among young women aged between 20 and 25 (36.8 pp), whereas the UK and the USA exhibited downward trends in this age group, probably as a result of a more flexible labour market, although in our baseline year of 2007 inequality among young women was highest in the gendered political economy of the USA (55.3%) and lowest in Italy (16.5%).

The interaction of gender and age may worsen the conditions of young women workers. The increasing dualization of the labour market seems to have particularly severe effects on the gendered stratified dualization regime. In this regime, young women are exposed to the increasing flexibility of the labour market but are less protected by compensating measures, contrary to what happens in the gendered learnfare flexibilization regime. During the Great Recession, the dual effect of greater flexibility and weaker employment protection in the gendered stratified dualization regime widened the gap between our four clusters of gendered political economies. Inequality among the insiders, that is, older women workers (>36 years) declined in most countries, pointing to the buffering effect of ‘insiders’ benefits, albeit with the important exception of the gendered stratified dualization regime countries. Inequality ‘between’ age groups increased in all countries except the UK, but its contribution to total inequality was much lower than that of ‘within’ age group inequality.

Decomposition by household type shows that in countries with inadequate provision for reconciling work and family responsibilities, such as in the stratified gender dualization regime of Spain and Italy, within-group inequality was higher at the beginning of the recession and rose much faster than in the other countries. The low levels of de-familialization of the stratified gender dualization regime mean that mothers cannot rely on extensive public care for dependent family members, thus reducing their possibility of working longer hours or finding a new job. Single mothers experienced lower inequality in Germany and the Netherlands, due to lower overall wages earned by this subgroup, or to the buffering effect of social welfare benefits.

Decomposition by occupational subgroups shows that income inequality ‘within’ women was significantly lower in Denmark and the Netherlands, and highest in the USA. In Denmark, inequality levels were lower in all occupational subgroups mitigating income polarisation within and between female occupational groups. In this country, the policy of wage compression and collective bargaining agreements, and the policy mix of generous passive labour market policies and active policies compress the wage structure. Nevertheless, Denmark exhibited the largest increase in inequality after the recession, which to some extent may have been driven by critical changes to its flexicurity regime and cutbacks to the generosity of unemployment benefits.

To properly evaluate gender inequality when glass-ceiling effects are present, we studied different segments of the distribution because gender wage inequality cannot be understood only as a difference in mean or median income between women and men. To delve into gender wage inequality at the top of the wage distribution, we followed the literature that uses the quantile regression technique. Consistent with previous work (Korpi et al. 2013), our results indicate that glass ceiling effects were stronger in liberal deregulation political economies than in gender learnfare flexibilization political economies. This finding may be the product of a policy process based on cooperative rather than competitive behaviour by social partners.

References

| Rosa Mulè and Roberto Rizza (2023). Gendering the political economy of labour market policies, Routledge, London. |

| Walter Korpi, Tommy Ferrarini, Stefan Englund (2013). Women’s Opportunities under Different Family Policy Constellations: Gender, Class, and Inequality Tradeoffs in Western Countries Re-examined, Social Politics: International Studies in Gender, State & Society, Volume 20, Issue 1, Pages 1–40. |