Issue, No.17 (March 2021)

Financial Information and Investment Decisions: Some Stylized Facts from the United States using the Luxembourg Wealth Study Database

A sound source of financial information and access to financial services are essential for households to make the right decisions for investing, saving, or borrowing. They affect not only the well-being of households but also the economy as a whole. Due to technological transformation, the last two decades dramatically changed the way households obtain financial information, make decisions, and use the resources in their daily financial routines. Sources of financial information that households profited from to make decisions about saving and investment changed over the years thanks to digitalization, and for sure, they supplied a different form of access to asset accumulation and wealth distribution among different groups in society. However, financial information and the ways of providing financial services are not the only factors that influenced household financial decisions and gave them access to financial instruments or borrowing; households have various objectives and preferences for risk, and differ in endowments and identity.

This brief writing aims to examine the sources of information utilized by households for investing decisions. It also assesses to what extent the source of information such as the internet, online financial services, brokers, friends, TV, newspaper, magazines, and advertisement changed over time and whether this correlates with households’ decisions about investments. For this purpose, we present several descriptive results by graphing the source of information used by those who possess financial assets invested in private pensions, bonds, stocks, and alternative investments. We also compare these households to those who do not own investment assets. In addition, we employ OLS regression analysis to assess which sources of information correlate with the stock of financial investments as well as the investments in real assets (defined as real estate that is not considered primary housing, business equity, and other non-financial assets that are not classified as consumer goods). Further, we incorporate financial literacy into the picture of financial information, expecting that more financially knowledgeable persons use more sophisticated financial information protocols.

We exploit the harmonized version of Survey of Consumer Finance (SCF), the US nationally representative survey, available from the Luxembourg Wealth Study (LWS) for the following years: 1998, 2001, 2004, 2007, 2010, 2013, 2016, and 2019. It is worth noting that SCF is a top-notch survey that brings researchers diverse opportunities in household finance research. For our analysis, we employ several LWS harmonized variables that come from the sections of behavioral variables, balance sheet, income, and socio-demographic characteristics of the respondents. Specifically, the variables on financial information provide data on the following sources of information used by the respondent for investing and/or borrowing decisions: (1) lawyer, accountant, financial planner, coded in LWS as a professional source of information (bafi1_c); (2) magazines, newspapers, and books, coded in LWS as mass media sources of information (bafi2_c); (3) internet (bafi3_c); (4) material in mail, TV, radio, advertisements, and telemarketer, coded in LWS as advertisement source of information (bafi4_c); (5) friends, relatives, material from work or business contacts (bafi5_c). The results presented here utilize only a fraction of the information included in these variables because we are only interested in the source of information used for the investing decisions. Therefore, we created the binary variables from each bafi1/5_c variable that takes a value one if the respondent mentions a specific source of information and zero otherwise. The variables utilized in the OLS regression analysis as controls contain information on ethnicity (ethnic_c), age and gender of the respondent (age and sex), education (educ) as well as household disposable income (dhi) transformed using the inverse hyperbolic sine (IHS) function.

Further, using the balance sheet information, we utilized some household financial and non-financial assets to create two subsamples for our analysis. In particular, our subsample of those who invest contains respondents who possess life insurance and voluntary individual pensions (hasi), bonds and other debt securities (hafib), stocks and other investments (hafis), as well as investment funds and alternative investments (hafii). The second subsample utilized in the regression analysis contains only respondents who own real estate other than the principal residence (hanro), the other non-financial assets (hanno) as well as business equity (hannb). Finally, we adjust the abovementioned subsamples with the score of objective financial literacy obtained from the variables bafl1_c, bafl2_c, bafl3_c in such a way that we assign value 1 to a respondent who answered all three questions correctly and 0 otherwise. Our dependent variable for the regression analysis is the natural log of financial investments, namely the sum of hasi, hafib, hafis, and hasii. We also utilize this variable to create quartiles to assess the frequencies of using particular information sources for those households who invest.

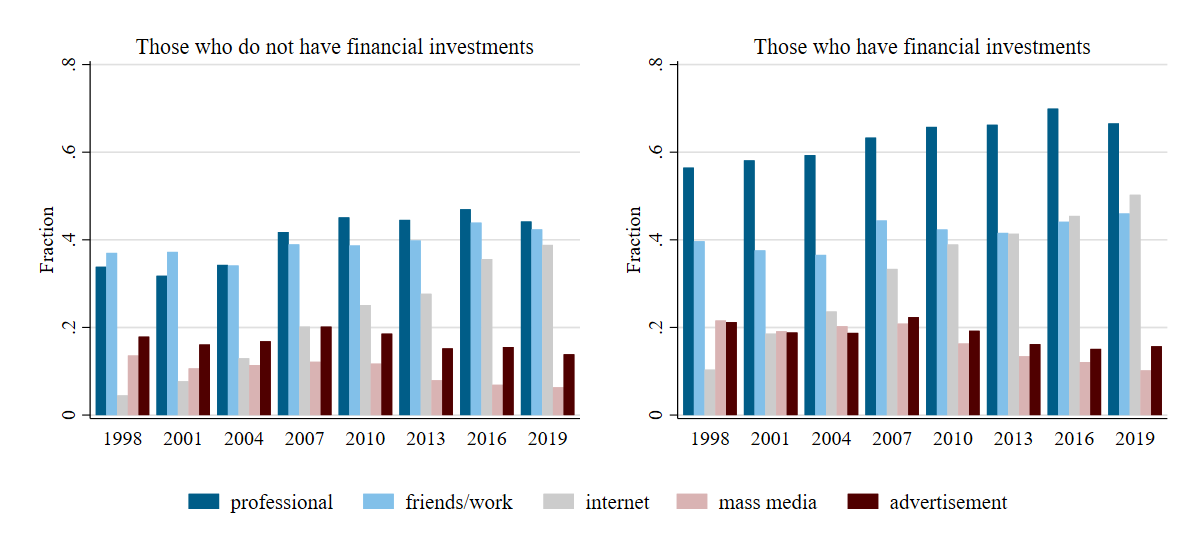

Figure 1. Sources of information used when making investment decisions: percentage of respondents for two subsamples: those who possess financial investment and those who do not

Source: Luxembourg Wealth Study (LWS) Database.

Figures 1 and 2 display the descriptive statistics for the sources of information used when making investment decisions. Figure 1 compares those who do not have any financial investments with those who possess financial investments as defined above. Comparing these two groups of households clearly indicates that financial investment owners rely much more on professional advice from lawyers, accountants, and financial planners than their counterparts. There is not much difference between these two groups in terms of social network usage (friends, relatives, work) and other information sources. The overtime comparison brings attention to internet usage as a source of investment information. As one would expect, the growth of internet is evident over the last 21 years. The recent decline in getting information from magazines, newspapers, books and advertisements might reflect the increase of the internet as an emerging source of information, starting around the mid-2000s. Social networks’ overtime role does not seem to be declining, as this source of information might be easier and cheaper than professional advice and most likely exemplify the personal trust in family, friends, or the work environment.

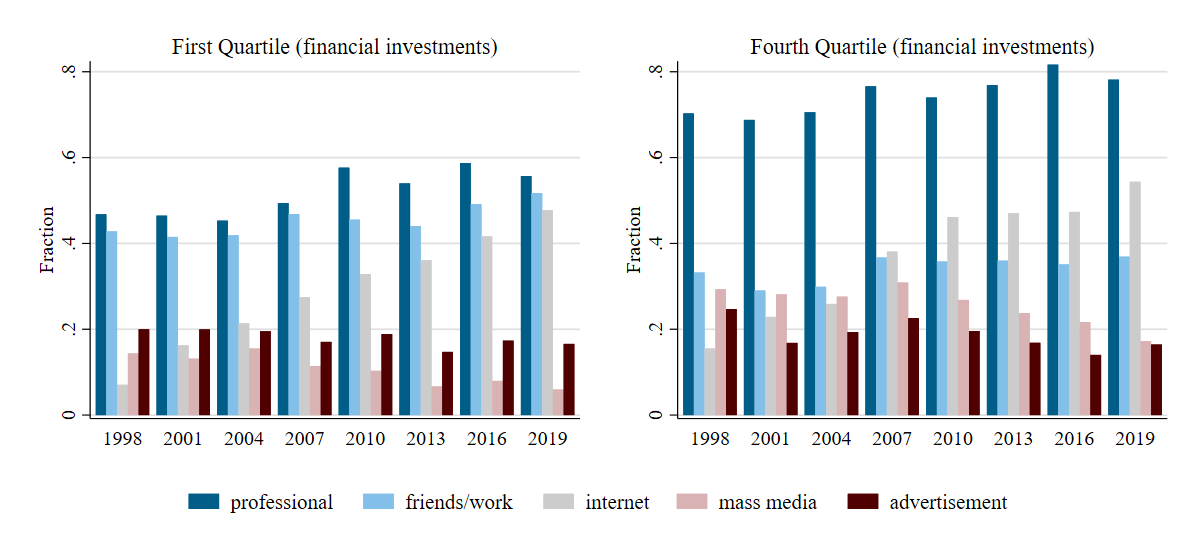

Figure 2. Fraction of respondents reporting various sources of information used for investments for the first and fourth quartile

Source: Luxembourg Wealth Study (LWS) Database.

Figure 2 displays a percentage of respondents from two quartile groups (the bottom and the top) for those who have financial investments. Between-group inequality for those who possess financial investments is extraordinarily high. The mean household financial investments for the group from the first quartile is below $4 thousand for all analyzed years, while for the group in the fourth quartile, it is above $2 million in 2019 data. Clearly, there is a difference in particular sources of information by financial investments quartile. Here, too, the data suggests that the professional advice increases dramatically for those in the fourth quartile. The tendency to consult the mass media seems to decline for both groups, but it is more visible for the rich.

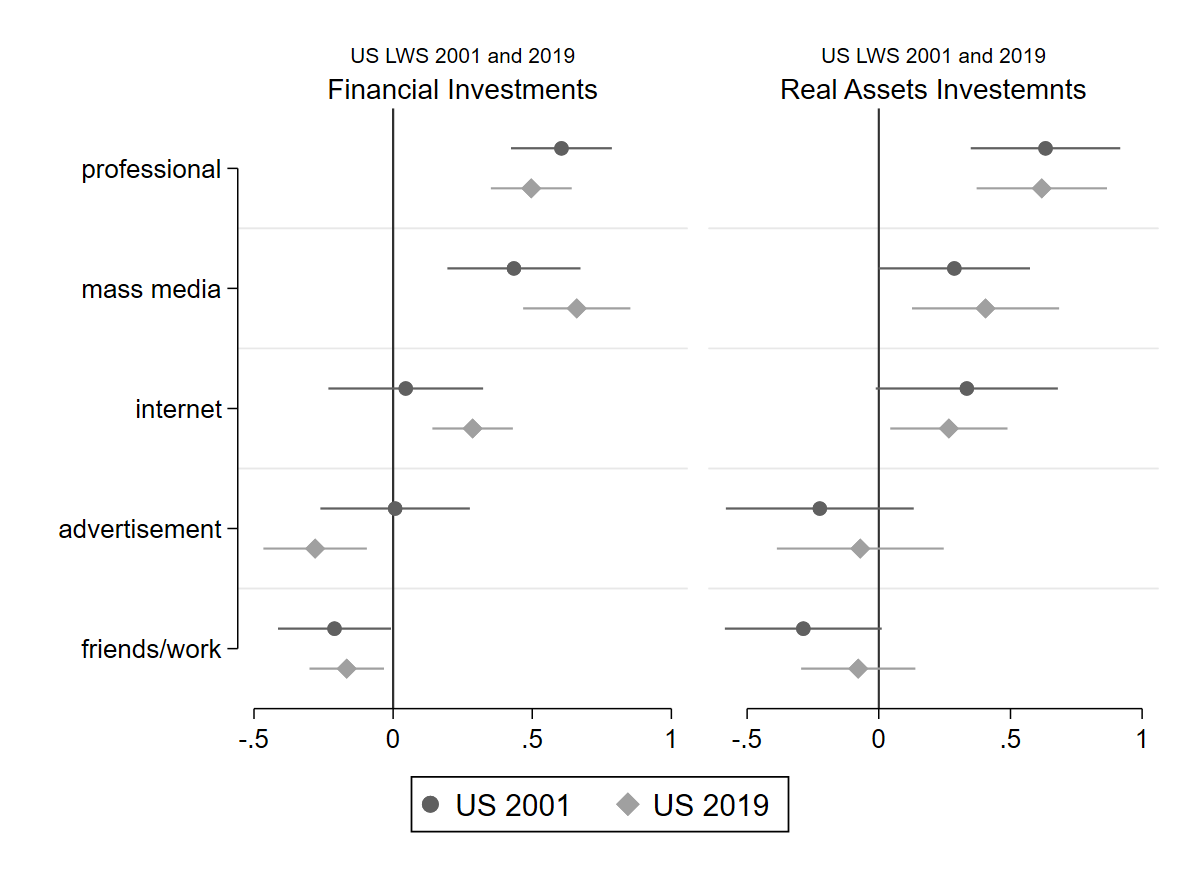

Figures 3 and 4 display the regression results for two years, 2001 and 2019, where the dependent variable is financial investments and the real assets investments as defined above. We use the standard procedure for regression estimates to account for the multiply imputed data. Only the coefficients and confidence intervals for financial information are shown for these figures, but the control variables, as mentioned above, are employed in these regressions.

Figure 3. Coefficients and 95% confidence intervals for OLS regression models: dependent variables financial investments (left panel) and real asset investments (right panel)

Source: Luxembourg Wealth Study (LWS) Database.

As shown in Figure 3, both professional advice and mass media play a significant and positive role (the largest coefficients) for the financial and real assets investments for the years 2001 and 2019. Even though there is, on average, a decline in usage of mass media as a source of financial information as presented in Figure 1, its importance to potentially influence financial assets accumulation is increasing over time. Thus, one would argue that respondents might not realize that information taken from newspapers and books can influence financial decisions to accumulate assets more than the information found on the internet. The negative relationship between information used from friends, family, and work and financial investments for both years might be surprising. This relationship is not statistically significant in 2019 for the real assets investments. The correlation between advertisement and investments is either insignificant or negative. The internet’s role for financial investment shows to be necessary for investments but insignificant for predicting the financial investments in 2001.

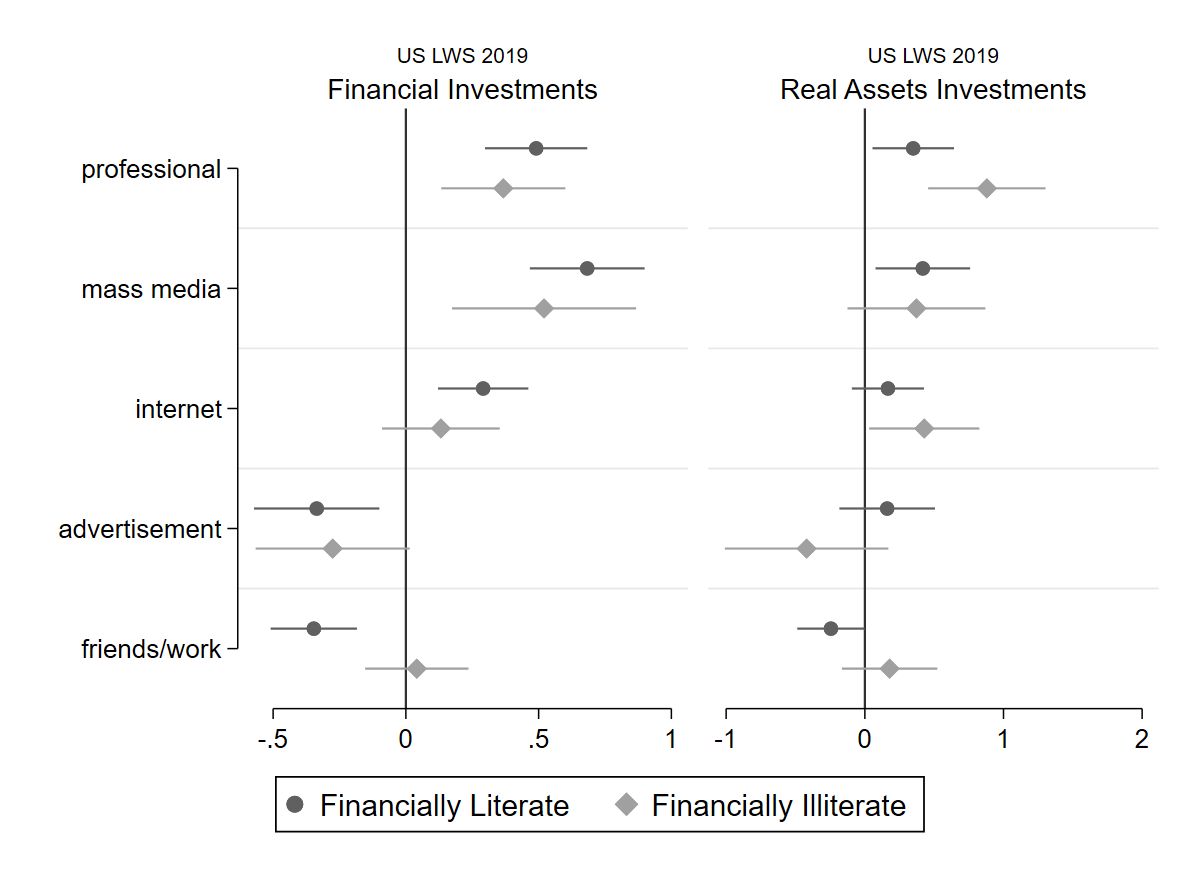

Figure 4. Coefficients and 95% confidence intervals for OLS regression models: dependent variables financial investments (left panel) and real asset investments (right panel) for accounting for the objective financial knowledge

Source: Luxembourg Wealth Study (LWS) Database.

Finally, Figure 4 displays the results for four OLS models, this time only for 2019 due to the lack of financial literacy question in 2001. Again, the dependent variable is either financial investment or real assets investments. The models are estimated for two subsamples, one for those who are financially literate and the second for those who received zero scores on three objective financial literacy questions. The results in Figure 4 indicate that professional services’ use is positively correlated with both financial and real assets investments for both subgroups. The financially knowledgeable benefit also from the information available in mass media, but advertisement and social networks are unbeneficial for the financial capital formation. The relationship is not valid for this group of respondents when we look at real assets investments as the dependent variable. While there are some differences between financially literate and illiterate in terms of information used to invest, one source of information might be good for both, namely professional advice, specifically for those who have trouble understanding basic finance concepts. A relatively cheap source of information, such as a social network or internet, might not necessarily turn out as the best source of information for financial investments for those less knowledgeable. Yet, the internet could help this group of people to make better choices while investing in real assets. By relying on social networks, the financially literate could experience a decrease in investments (ceteris paribus).

In conclusion, further research could be performed by the LWS users to investigate the various parts of wealth and income distributions, distinguishing asset and income poor, middle class, and the high income and net worth households, to explore how diverse sources of financial information associated with household investments. Further, the regression analysis could be performed using the various financial information variables as dependent variables, instead of explanatory ones, to establish what factors shape the usage of multiple sources of information for the investment decisions. Clearly, the reverse direction of the relationships could be justifiable, so this short research presentation does not anyway claim a causal relationship between various sources of information when making investment decisions and the stock of financial investments.