Issue, No.16 (December 2020)

Taxation of Families and ‘Families of Taxation’? Inequality Modification Between Family Types Across Welfare States

Introduction

Rising inequality has become a major feature of scientific and public debates. In the light of the crisis, many scholars have called for the state to intervene by increasing transfers or cutting taxes. However, welfare states do not solely shape redistribution by setting the tax rate and deciding on the amount of benefits. The design of tax breaks and the definition of the tax unit are equally important. For instance, different family types may be treated differently because tax systems provide family type-dependent benefits, including child allowances, marriage premiums or preferential tax schedules.

These policies of tax design, however, may encourage either de-familialization, by enhancing individual autonomy (for instance, single-parent allowances), or promote familialization through strengthening individual dependency on the family (for instance, joint taxation). Furthermore, these policies might thwart the redistributional goals of social policy. It is, therefore, pivotal to scrutinize family-related tax benefits when interested in income inequality between types of families.

In a recent paper (Schechtl 2020), I examine income inequality between the six most prevalent family types (married without children, married with children, unmarried without children, unmarried with children, single parent, single) of non-retiree households before and after income taxation across welfare states. To this end, I draw on harmonized income, transfer and taxation data from 30 countries in the Luxembourg Income Study (LIS) Database and estimate between-family-type Theil indices as measures of inequality before and after fiscal intervention. In order to assess how welfare states’ tax policies structure income inequality between family types, I empirically identify family-related tax policies and evaluate their impacts using linear regression.

Background

In general, familialistic policies emphasize and enforce the caretaking responsibility of the family, whereas de-familialistic policies advocate the welfare state’s responsibility to do so. However, both concepts should be understood as extremes on a continuum. Hence, the concept of familialization stresses the institutionally driven dependency of individuals on their family context, which is particularly interesting when scrutinizing income inequality between family types (Sainsbury 1999). For example, policies promoting familialization may be defined as promoting a single-breadwinner model with a stay-at-home spouse (Rastrigina and Verashchagina 2015; Leitner 2003).

Nevertheless, how are patterns of tax policy associated with the modification of income inequality between types of families? To scrutinize these structures, the specific design of a welfare state’s tax system is pivotal

First, the overall level (1) of taxation indicates the distributional power: if there is no noteworthy income tax, redistribution may be insignificant. Second, the overall progressivity (2) of the tax structure may hint at its capacity to reduce market income inequality. However, there are at least four different aspects within the income tax code that are tied to the marital status and the household composition. First, countries differ in the income tax filing unit (3), which most commonly is the individual or the married couple. The joint filing of married couples assumes that income and consumption are shared within the household and, in effect, means that the marginal income tax rate is dependent on the spouse’s earnings. Therefore, joint filing has been criticized as a strong familialization policy that leads to persistent gender inequalities (McCaffery 2009). Applying individual filing means that all individuals are treated separately regardless of their marital status when assessing the income tax. This is usually understood as a de-familialization policy design in the tax code because it assumes the complete independence of individuals within households (Sainsbury 1999).

Second, income splitting (4) aggregates the spouses’ income and calculates the tax burden on the combined income. Therefore, this is in fact a particularly strong version of joint filing. In most countries, married couples benefit from income splitting if they have unequal incomes (e.g. US and Germany). Therefore, strong incentives for the weak labor market attachment of secondary earners are commonly assumed (Rastrigina and Verashchagina 2015; Alm and Melnik 2004). The significant implications for gender inequality and individual autonomy have been widely discussed (McCaffery 1999).

Although most welfare states apply individual filing, this does not mean that the tax rates of spouses are independent from each other, nor does it mean that family-oriented mechanisms are absent in the tax code. Many countries with individual filing at least offer some kind of special dependent spouse allowances (5) for the breadwinner (Rastrigina and Verashchagina 2015). This mechanism reduces the taxable income of the main earner if his or her spouse has no or low income and hence promotes the dependencies of non-earner or stay-at-home spouses. Consequently, these tax characteristics are best described as familialization tax policies.

On the other hand, special single-parent allowances (6) reduce the tax burden for single parents. In contrast to the tax mechanisms mentioned above, such allowances are designed to secure a single parent’s autonomy instead of binding it to the ex-spouse’s alimony. Hence, it represents a de-familialization tax policy.

Taken together, the country-specific design of joint filing, the specific case of income splitting and the offer of dependent spouse allowances are implicit indicators of the degree of familialization in a welfare state’s income tax system. Although in many countries there are additional characteristics that can be used to evaluate familialization in the tax code (e.g. the degree of transferability of basic allowances between spouses), the six aspects described above should be key determinants.

These specific family-related aspects in the tax code should therefore influence inequality between types of families. In particular, married couples and couples with children are expected to benefit from familialization policies when compared to other family types. Usually these family types have higher equalized market household incomes than unmarried or single people or single parents. In general, high tax levels and substantial progressivity should significantly reduce income inequality between these family types. However, if family-related aspects in the tax code systematically benefit those family types that have a higher mean income (e.g. married couples) compared to those with a lower mean income (e.g. single parents), then the reduction in income inequality between these family types may be lower than expected.

Discussion

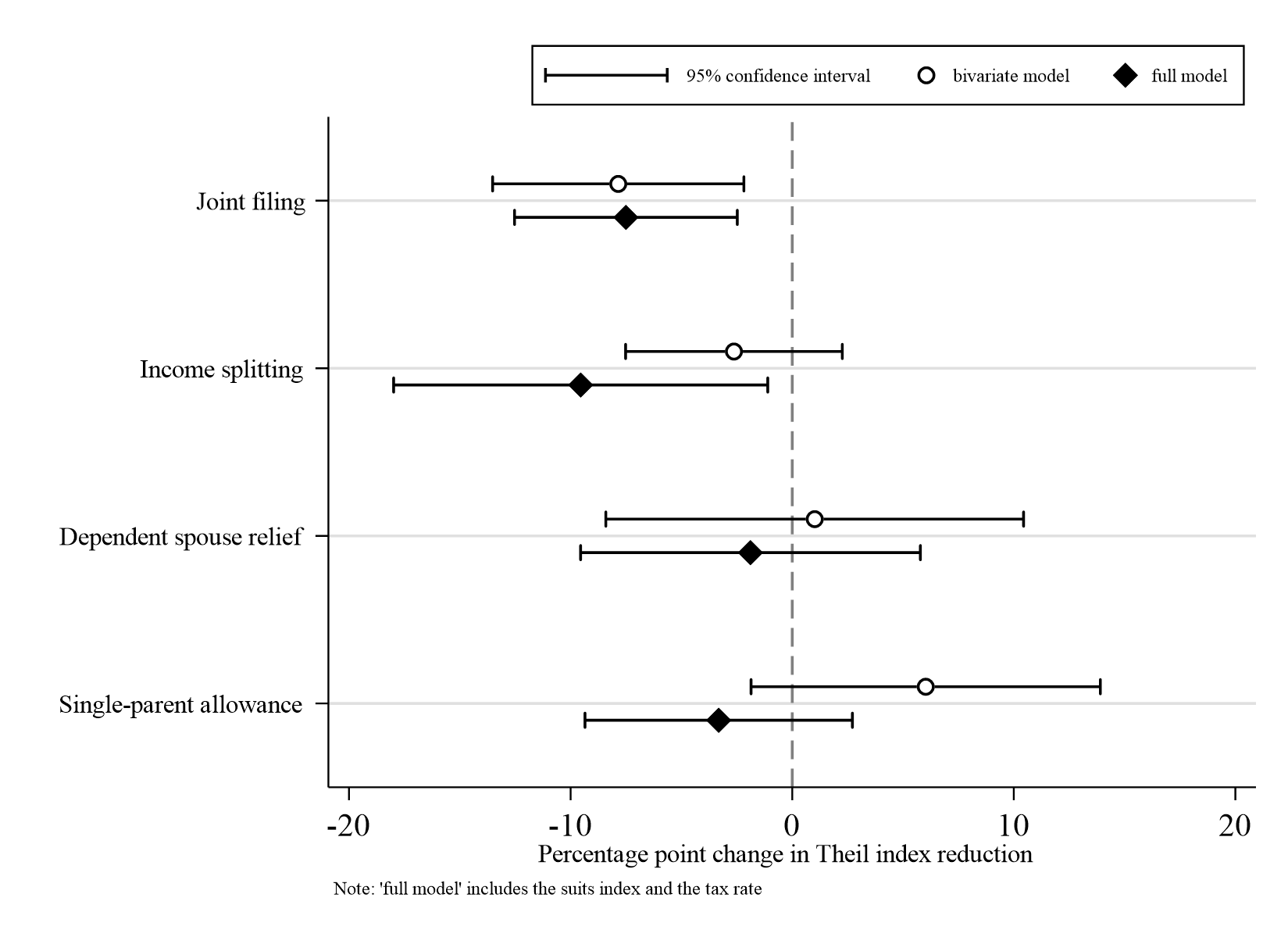

As Figure 1 indicates, income splitting and joint filing are negatively associated with the reduction in income inequality between types of families. This confirms the expected pattern of familialization policies thwarting the redistributional goals of social policy. Estimates for dependent spouse allowance and single parent allowance are, however, inconclusive.

Figure 1: Tax induced change in between family type income inequality

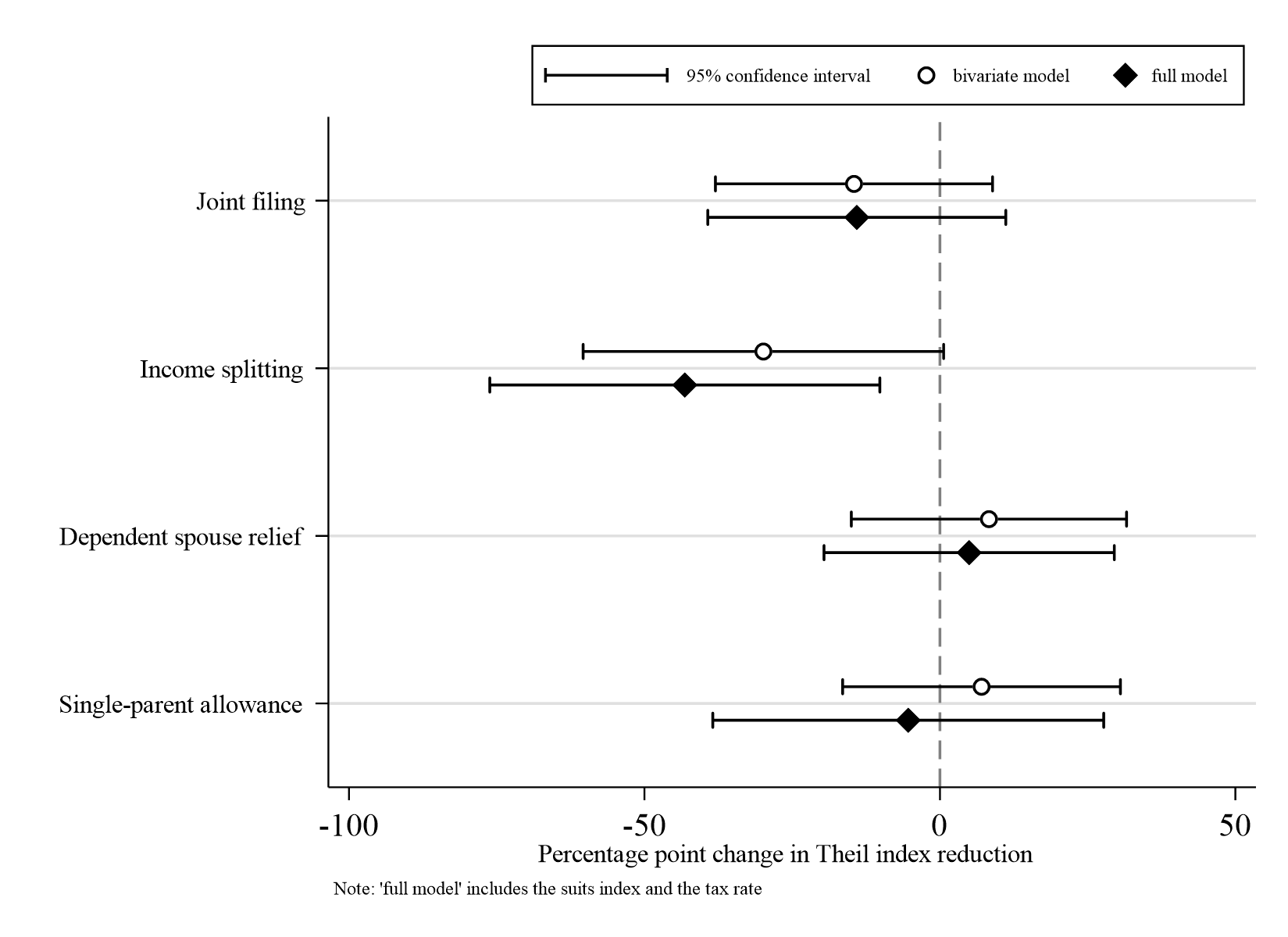

Joint filing and income splitting could particularly benefit married couples. Hence, the association of family-related tax benefits and income inequality between married couples only and all other family types combined should provide further insights. Figure 2 indicates the associations of tax policy dummies and the change in income inequality between married couples and all other family types. Interestingly, the income splitting coefficient is substantial and significant while the joint filing coefficient is less pronounced. This hints at the fact that unmarried couples in many countries can file jointly. Income splitting, however, seems to be exclusively designed for married couples.

Figure 2: Tax induced change in between family type income inequality (married vs. others)

These findings relate to previous research in two ways. First, it seems that familialization policies in general not only hinder individual autonomy and gender equality (Orloff 1993; Saraceno 2016), but that in the case of taxation, these policies may create inequalities between types of families at the same time. Welfare states without joint filing not only have significantly higher levels of between-family-type inequality reduction but greater individual autonomy due to individual filing as a critical de-familialization policy. At the country level, this interpretation may imply a lose-lose situation of family dependency and income inequality. In this context, the individual is thus confronted with economically beneficial family dependency at the cost of a loss of individual autonomy. As familialization policies provide additional benefits for breadwinners with dependents, they discourage more autonomous individual arrangements.

Second, and as widely discussed within the economic literature on labor market incentives for secondary earners, familialization policies in the tax code potentially hinder female labor market participation. The tax code promotes a strong breadwinner model in most countries with joint filing and progressive income taxation due to lower marginal tax rates for the primary earner. Again, while this is widely known to exacerbate gender inequality (Sainsbury 1999; McCaffery 2009), as the study at hand indicates, it is also associated with greater income inequality between family types at the macro level.

The social and political implications are, however, manifold. In the light of rising inequality and escalating public debt, it is debatable whether these tax expenditures are desirable or affordable. For the public budget, tax benefits essentially represent a loss of revenue. In the German case, abolishing income splitting and introducing individual filing would lead to an estimated increase in income tax revenue of more than 1.1 per cent of GDP, which is more than 10 per cent of the total income tax revenue (Bach et al. 2011). Female labor market participation is expected to rise substantially, which may reduce the substantial gender pay gap. Furthermore, the additional tax revenue may be used for social transfers to the poor. In other words, politically these familialization tax policies seem to cut public revenue and foster inequality, while socially they appear to promote family dependency and a traditional division of labor.

This study contributes to our understanding of the consequences of institutionalized differences in the tax treatment of family types. It sheds light on the pivotal yet largely overlooked role of taxation when scrutinizing horizontal inequality between family types. Focusing on (de-)familialization tax policies with different consequences for inequality, this study emphasizes the role of family tax policy as a form of social policy.

References

| Alm, J. and Melnik, M. I. (2004). Taxing the “Family” in the Individual Income Tax, Andrew Young School of Policy Studies, checked on 8/2/2019. |

| Bach, S.; Geyer, J.; Haan, P.; Wrohlich, K. (2011). Reform des Ehegattensplittings: nur eine reine Individualbesteuerung erhöht die Erwerbsanreize deutlich, DIW Wochenbericht 78 (41), pp. 13–19. |

| Leitner, S. (2003). Varieties of familialism: The caring function of the family in comparative perspective, European Societies, 5 (4), pp. 353–375. DOI: 10.1080/1461669032000127642. |

| Luxembourg Income Study: Database. https://www.lisdatacenter.org. LIS. Luxembourg. |

| McCaffery, E. J. (2009). Where’s the Sex in Fiscal Sociology?: Taxation and Gender in Comparative Perspective, in Martin, I. W.; Mehrotra, A. K., Prasad, M. (Eds.): The new fiscal sociology. Taxation in comparative and historical perspective, Cambridge: Cambridge University Press, pp. 216–236. |

| McCaffery, E. J. (1999). Taxing women. How the Marriage Penalty Affects Your Taxes, Pbk. ed. 1999, Chicago: University of Chicago Press. |

| Orloff, A. S. (1993). Gender and the Social Rights of Citizenship: The Comparative Analysis of Gender Relations and Welfare States, American Sociological Review, 58 (3), pp. 303–328. |

| Rastrigina, O. and Verashchagina, A. (2015). Secondary earners and fiscal policies in Europe, European Commission. |

| Sainsbury, D. (1999). Gender and Welfare State Regimes, Oxford: Oxford University Press. |

| Saraceno, C. (2016). Varieties of familialism: Comparing four southern European and East Asian welfare regimes, Journal of European Social Policy, 26 (4), pp. 314–326. DOI: 10.1177/0958928716657275. |

| Schechtl, M. (2020). Taxation of Families and “Families of Taxation”? Inequality Modification Between Family Types Across Welfare States, LIS Working paper Series No. 800, LIS Cross-National Data Center in Luxembourg. |