Issue, No.15 (September 2020)

Gender: The Hidden Dimension in the Measurement of Economic Inequality

Since the publication of Piketty’s book “Capital” in 2014, the distribution of income and wealth seems to have gained renewed relevance in economics (Sandmo 2015), and economic inequality has taken over an important part of the policy agendas of international institutions and national governments alike. However, the dimension of gender has largely remained hidden in the current debate about, and analysis of, economic inequality. First, the gender dimension is underexplored as regards the explanation of income inequality trends across countries as well as its consequences. As Bateman (2019) notes, economists often focus on how globalization and technological change have contributed to rising income inequality; or, like Tony Atkinson and Joseph Stiglitz, on the reduction in governments’ redistributive capacity via taxation and social spending. Moreover, accounting for gender in analyzing inequality trends is greatly impeded by data constraints: the gender dimension is also hidden as regards the measurement of income and wealth inequality. We therefore still do not know how serious the neglect of intra-household inequality is (Haddad and Kanbur 1990).

When it comes to measuring personal income inequality, intra-household inequality is often omitted, since the standard approach is to compute inequality measures based on household disposable income, assuming that resources are pooled and equally shared within the household. Yet, the evidence that there are substantial inequalities which are linked to gendered power relations within the household is ample. In a forthcoming chapter of the Handbook for Labour, Human Resources and Population Economics, we document the sources of the resulting bias in income inequality measurement. We thus review and link two strands of the literature: First, the literature on decision-making within the household provides theoretical and empirical insights showing that different pooling and sharing patterns exist across households, and that gender is a relevant category in shaping intra-household inequality. Second, the literature which aims to capture the gender-specific distribution of wealth enables to gain insights into the gender-specific distribution of capital income and to make inferences about aspects of bargaining power. Combining the available theoretical and empirical evidence, we provide some indications in which areas better data is required to obtain reliable measures of gender as well as overall income inequality. Such information is even more relevant since the outbreak of COVID-19 as it enables us to gauge the gendered impact of the pandemic (Malghan and Swaminathan 2020), and to design data-based policy accordingly.

Conceptual Issues: Income Statistics and Measurement

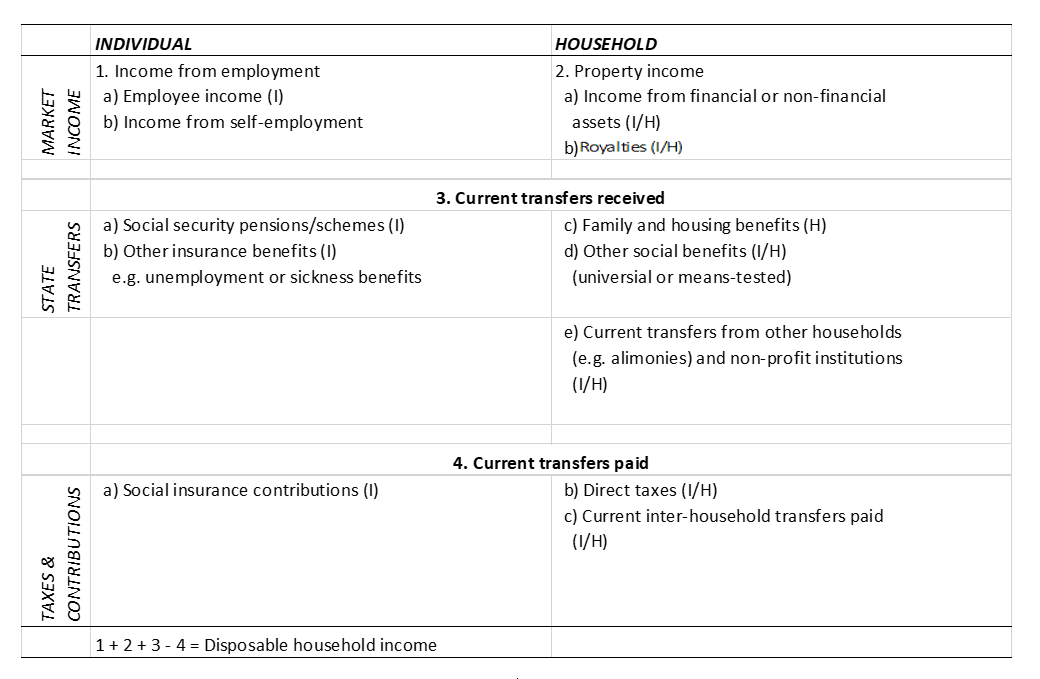

The degree of income inequality within countries is typically measured by statistical information on disposable household income obtained from surveys, which are designed to capture the living conditions and economic well-being of individuals and households. Disposable household income is defined as the sum of each household member’s income net of direct taxes and social security contributions. Ideally, information on different income components would be available at the level of the household as well as the individual. But this is not always the case, either because income is received jointly or because it is recorded at the household level for practical reasons.

Table 1 shows the composition of household disposable income and provides information on the level at which it accrues (i.e. the income unit, reported in parentheses), and the level at which it is typically recorded in household surveys (indicated by separate columns). The only component which is consistently received and reported at the individual level is income obtained from work-related activities. The recipient of property income is the asset owner; income can thus accrue to household members individually or jointly. But independent of the income unit, micro datasets mostly report aggregated figures at the household level.

Household-level transfer income can be paid to individually or jointly managed accounts. Individual level information on state transfers, direct taxes and social insurance contributions is available if they are related to individual employment status. Even if other types of transfers are paid to the individual, they are often merged with other social benefits which accrue to the household. Moreover, tax systems often provide exemptions and deductions at the household level, thereby altering the income unit. Thus, the European Statistics on Income and Living Conditions (EU-SILC), which is the most important source for harmonized income data in Europe, reports direct taxes and social security contributions only as an aggregate at the household level (Ponthieux and Meurs 2015).

In order to measure the degree of inequality in the personal distribution of income, disposable household income has to be allocated among household members. This is typically done on a per-capita basis adjusted by applying equivalence scales to account for different household sizes and economies of scale. Yet, two strong assumptions underlie this computation and interpretation: first, that all income is pooled and second, that pooled income is equally shared among household members. This implies that no differences in living standards within the household exist. From this it follows that although the standard approach views the individual as the relevant unit to evaluate income as the major determinant of economic well-being (Ponthieux and Meurs 2015), it is unable to provide an accurate assessment of individual conditions, particularly as it ignores the actual relations of individuals within the household.

Table 1: Income components, income units & income statistics

Source: Adapted version based on Canberra Group (2011) and Ponthieux and Meurs (2015).

Columns indicate the level at which statistical information is available, labels in parenthesis indicate whether the income unit is the individual (I) or household (H).

Intra-household resource allocation and decision-making

Data availability is even more limited when it comes to individual preferences, resources, power and decision-making processes. These are typically not available in high-quality quantitative data but are required to open the “black box” of the household.

Issues of data availability may have been compounded by theoretical approaches which did not emphasize decision-making and resource allocation at the intra-household level. Textbook models in family economics do not allow for intra-household differences in resources; they either ignore differences in preferences (Samuelson 1956) or aggregate preferences through an altruistic household head (Becker 1981). Either way, they presume fully pooled income. More recent game-theoretical approaches deviate from this assumption and show that inequality within the household can stem from the outcomes of cooperative (Lundberg and Pollak 2008) or non-cooperative (Chen and Woolley 2001) bargaining processes. Feminist (economic), sociological and psychological accounts, on the other hand, explore the role of social norms in explaining “how changing norms affect microeconomic resource allocation and how intra-household resource allocation itself – and the strategic interaction that determines it – reinforces and challenges prevailing social norms” (Katz 1997: 38).

Empirically, control over resources and responsibility for tasks is studied most extensively for the Global South (Doss 2013), e.g. on intra-household decision-making and poverty (Findlay and Wright 1996, Vijaya et al. 2014), farming (Anderson et al. 2017), health (Dito 2015), and children and their health (Richards et al. 2013). For Europe, the empirical evidence of intra-household dynamics and the distribution of decision-making power within households is more limited. Mader and Schneebaum (2013) and Ponthieux and Meurs (2015) use the 2010 special module of the European Union Statistics on Income and Living Conditions (EU-SILC) survey to study the management of financial resources within the household.

These (cross-)country studies show that financial decisions within the household do not result from actual and distinct bargaining but are rather the result of established daily practice or of conforming to social norms. In particular, gender is the most important factor in determining which household decisions a person will make on their own, which are left to their partner, and which are made jointly. Whereas traditional gender roles prevail in Europe with women responsible for everyday and child-related decisions and men handling major financial decisions, couples with smaller differences in education, income and employment status are more likely to make decisions jointly.

Gender Wealth Inequality

As a key determinant of capabilities, wealth matters for social and economic inequality within households: the level of asset holdings affects each partner’s bargaining power, and it determines the amount of capital income which accrues to each household member. However, even more blind spots regarding the gendered distribution of wealth exist than for the distribution of income. Whereas advances in data availability and quality have enabled some insights the main issue is that wealth itself is mostly recorded at the household level. This not only underestimates inequality (Frémeaux and Leturcq 2019), but also misses the gender dimension of wealth inequality if equivalence scales are applied without supporting data on the demographic characteristics of individual wealth ownership.

Data issues might be part of the reason why the literature is far from unanimous in answering the question whether there is a gender wealth gap – as opposed to the well-researched gender pay gap. Although the theoretical and qualitative literature emphasizes that household resources (both income and wealth) cannot be assumed to be pooled, most studies are restricted to investigating the gender wealth gap at the household level. The strategies typically applied are: (1) Divide wealth equally among all (eligible, typically adult) household members; (2) limit the sample to single-adult households; or (3) “assign” households a gender by using a reference person in the household.

Several studies use household-level data on the U.S., including the Panel Study of Income Dynamics (Schmidt and Sevak 2006), the National Longitudinal Survey of Youth (Yamokoski and Keister 2006), and the Wisconsin Longitudinal Survey (Ruel and Hauser 2013). For eight European countries, Schneebaum et al. (2018) use the Household Finance and Consumption Survey. Deere and Doss (2006) review the available evidence for fifteen countries in Latin America, Africa, and Asia, which often uses asset information in household surveys. This literature shows not only that a wealth gap exists between single-adult households headed by females as opposed to males, but also between men and women within couple households. The gap is particularly salient at the top of the distribution, that is, where the majority of wealth is owned due to the right-skewed distribution of household wealth. Furthermore, this literature documents compelling evidence for a marriage wealth premium.

The important exceptions to the literature’s reliance on household-level data for net wealth focus on Europe. They are based on the wealth module of the German Socio-economic Panel (Sierminska et al. 2010) and the French non-core data of the Household Finance and Consumption Survey and its national precursor, the Life History and Wealth Survey (Frémeaux and Leturcq 2019). These studies also show a gender wealth gap, which can be partly explained by differences in men and women’s demographic and especially in labour market characteristics. Sierminska et al. (2018) find that the rising importance of labour market characteristics lead to a falling gender wealth gap over time. Individual-level studies also confirm the marriage wealth premium (Lersch 2017). Important caveats and exceptions apply first and foremost to the severe data limitations that wealth researchers face, but issues surrounding selection bias and reporting errors remain. In particular, the available evidence suggests that the gender wealth gap is right-skewed – yet survey and item non-response of the richest households lead to under-reporting at the top of the distribution. The paucity of data sources compounds these problems, since cross-checking with other data sets is all but impossible regarding the gender wealth gap.

Measuring Overall Income Inequality: The Way Forward

The (feminist economic) literature on decision-making within the household opens the black box and helps us to understand the complex gendered nature of within-household dynamics. It shows that we cannot expect all individually received income to be pooled, nor pooled income to be necessarily shared equally among household members. Moreover, evidence on the financial organization of the household indicates that the allocation of responsibility for financial means follows traditional gender norms and feeds back into gender inequality. Although empirical endeavours to capture the gender wealth gap are at least as constrained by data-availability at the individual level as income-inequality measurement, the available evidence indicates that the intra-household distribution of asset ownership is not equal, especially at the top of the wealth distribution. Wealth ownership then plays a role in the distribution of property income and bargaining power within the household. Taken together, these insights indicate that estimates of overall income inequality which disregard intra-household inequality are likely to be biased. But how large is this bias, and what can be done to improve income inequality measurement?

In one of the first accounts to investigate “How Serious is the Neglect of Intra-household Inequality?”, Haddad and Kanbur (1990) present evidence that the error in nutritional-status inequality in the Philippines amounts to 30% or more. They thus conclude that “[t]he neglect of intra-household inequality is likely to lead to a considerable understatement of the levels of inequality and poverty.” More recent research provides evidence that the underestimation of inequality is equally severe with regards to wealth. Malghan and Swaminathan (2017) show that 32% of total wealth inequality in Karnataka, India, is due to inequality within coupled households. In a comparative study of 37 countries based on LIS data, Malghan and Swaminathan (2016) show that earnings inequality within heterosexual couple households amounts to 30% in South and Central American countries, but in high-income countries such as Germany, Iceland, Luxembourg, the Netherlands, Norway, Switzerland and the United States the intra-household contribution share can even be larger than 50%.

Although scarce, the empirical evidence suggests that a substantial share of overall income inequality is due to inequality within the household. Thus, improving the quality of income inequality and gender inequality estimates requires household surveys to be adapted so as to enable to consistently and comprehensively account for the intra-household distribution of economic resources. One step forward is to exploit existing information to produce income inequality estimates adjusted for inequality within the household, with a special focus on its gendered nature. The second step is to make it possible to make income and wealth data available at the individual level in household surveys by identifying the lowest receiving (owning) unit. A third step forward concerns the integration of insights from the decision-making literature and the need to intensify the exchanges between methodological approaches. Qualitative research from the feminist and socio-economic literature provides valuable insights into intra-household dynamics regarding the financial management of economic resources, which should act as a complement to quantitative inequality research. Besides being of interest in its own right, qualitative findings are important inputs to the generation of survey questions which enable researchers to obtain quantitative information on the share of pooled income, different sharing patterns, and how this varies according to individual and household characteristics. Such information can be used to produce estimates of intra-household inequality which are theoretically grounded and based on empirical evidence, rather than being derived from ad-hoc rules. It is thus crucial to grasp how serious the neglect of intra-household inequality is, and to account for gender-specific effects in designing policies to combat rising income inequality and the social and economic hardships produced by the COVID-19 pandemic.

References

| Anderson, L, Reynolds, T, Gugerty, M (2017). Husband and Wife Perspectives on Farm Household Decision-making Authority and Evidence on Intra-household Accord in Rural Tanzania. World Development 90: 169-183. |

| Bateman, V (2019). The Sex Factor. How Women Made the West Rich. Polity Press, Cambridge. |

| Becker, G (1981). A Treatise on the Family. Harvard University Press, Cambridge, MA. |

| Canberra Group (2011). Handbook on Household and Income Statistics, second ed. United Nations Economic Commission for Europe, Geneva. |

| Chen, Z, Woolley, F (2001). A Cournot-Nash Model of Family Decision Making. The Economic Journal 111(474): 722–748. |

| Deere, C, Doss, C (2006). The gender asset gap: What do we know and why does it matter? Feminist Economics 12(1-2): 1-50. |

| Dito, B.B (2015). Women’s Intrahousehold Decision-Making Power and Their Health Status: Evidence from Rural Ethiopia.Feminist Economics 21(3): 168-190. |

| Doss, C (2013). Intrahousehold Bargaining and Resource Allocation in Developing Countries. The World Bank Research Observer 28(1): 52–78. |

| Findlay J, Wright R.E (1996). Gender, poverty and the intra-household distribution of resources. Review of Income & Wealth 42(3): 335-351. |

| Frémeaux, N, Leturcq, M (2019). The individualisation of wealth within couples: The implications for taxation. Revue de l’OFCE 161(1): 145-175. |

| Haddad, L, Kanbur, R (1990). How Serious is the Neglect of Intra-Household Inequality?The Economic Journal 11(402): 866-881. |

| Katz, Elizabeth. (1997). The Intra-Household Economics of Voice and Exit. Feminist Economics 3(3): 25–46. |

| Lersch, P.M (2017). The Marriage Wealth Premium Revisited: Gender Disparities and Within-Individual Changes in Personal Wealth in Germany. Demography 54(3). |

| Lundberg, S, Pollak, R (2008). Family Decision-Making, In: The New Palgrave Dictionary of Economics, 2nd Edition, Palgrave Macmillan, London. |

| Mader, K, Schneebaum, A (2013). The gendered nature of intra-household decision making in and across Europe. Department of Economics Working Paper Series 157, WU Vienna University of Economics and Business, Vienna. |

| Malghan, D, Swaminathan, H (2016). What is the Contribution of Intra-household Inequality to Overall Income Inequality? Evidence From Global Data, 1973-2013. LIS Working Paper Series No. 679. |

| Malghan, D, Swaminathan, H (2017). Intra-household Wealth Inequality and Economic Development: Evidence from Karnataka, India. IIM Bangalore Research Paper No. 487. |

| Malghan, D, Swaminathan, H (2020). Inside the Black Box: Intra-household Inequality and a Gendered Pandemic. LIS Working Paper Series No. 797. |

| Malghan, D, Swaminathan, H (2020). Inside the Black Box: Intra-household Inequality and a Gendered Pandemic. LIS Working Paper Series No. 797. |

| Piketty, T (2014). Capital in the 21st Century, Harvard University Press. |

| Ponthieux, S, Meurs, D (2015). Gender Inequality. In: Atkinson, A.B., Bourguignon,F (eds) Handbook of Income Distribution, Volume 2A. Elesvier, Oxford/Amsterdam, p 981-1146. |

| Richards, E, Theobald S, George, A, et al (2013). Going beyond the surface: Gendered intra-household bargaining as a social determinant of child health and nutrition in low and middle income countries. Social Science & Medicine 95: 24-33. |

| Ruel, E, Hauser R. M (2013). Explaining the gender wealth gap. Demography 50(4): 1155–1176. |

| Samuelson, P (1956). Social Indifference Curves. Quarterly Journal of Economics 70(1): 1–22. |

| Sandmo, A (2015). The Principal Problem in Political Economy: Income Distribution in the History of Economic Thought. In: Atkinson, A.B., Bourguignon,F (eds) Handbook of Income Distribution, Volume 2A. Elesvier, Oxford/Amsterdam, p 3-65. |

| Schmidt, L, Sevak, P (2006). Gender, Marriage, and Asset Accumulation in the United States. Feminist Economics 12(1-2): 139-166. |

| Schneebaum, A, Rehm, M, Mader, K, Hollan, K (2018). The gender wealth gap across European countries. Review of Income and Wealth 64(2): 295-331. |

| Sierminska, E, Frick J. M, Grabka M.M (2010). Examining the Gender Wealth Gap. Oxford Economic Papers 62: 669–900. |

| Sierminska, E, Frick J. M, Grabka M.M, Piazzalunga D (2015). Wealth Gender Differences: The Changing Role of Explanatory Factors over Time. Available via www.ecineq.org/ecineq_lux15/FILESx2015/CR2/p168.pdf. |

| Vijaya, R.M, Lahoti, R, Swaminathan, H (2014). Moving from the Household to the Individual: Multidimensional Poverty Analysis, World Development 59: 70-81. |

| Yamokoski, A, Keister, L (2006). The wealth of single women: Martial status and parenthood in the asset accumulation of young baby boomers in the United States. Feminist Economics 12(1-2): 167-194. |