Issue, No.15 (September 2020)

Housing and household leverage under the microscope

Housing is the largest asset in household portfolios1 . It is therefore a fundamental driver of the accumulation and distribution of assets and wealth across the lifecycle and across generations. Housing debt also constitutes the largest liability of household portfolios. One of the reasons why housing is a major vehicle of wealth accumulation is because it can be acquired with leverage. Mortgage debt allows households with low income and few assets, including young households, to accumulate wealth. The benefits of leverage need to be balanced against its risks, and that is a major lesson from the 2008 global financial crisis (GFC). Assessing housing assets and liabilities from households’ perspective requires looking at their distribution, with a particular emphasis on the bottom.

This article draws on recent OECD research (Causa, Woloszko and Leite, 2019) on housing, wealth accumulation and wealth distribution, based on an in-depth analysis of households’ balance sheets from three major data sources: the Luxembourg Wealth Study (LWS) Database, http://www.lisdatacenter.org 2, the OECD Wealth Distribution Database (WDD) (oe.cd/wealth), and the Household Finance and Consumption Survey (HFCS). Informed by new evidence and stylised facts about the distribution of housing-related debt across various socio-economic groups, the article discusses potential policy trade-offs between risks and opportunities associated with the regulation of mortgage markets.

Mortgage debt is the biggest liability in household portfolios

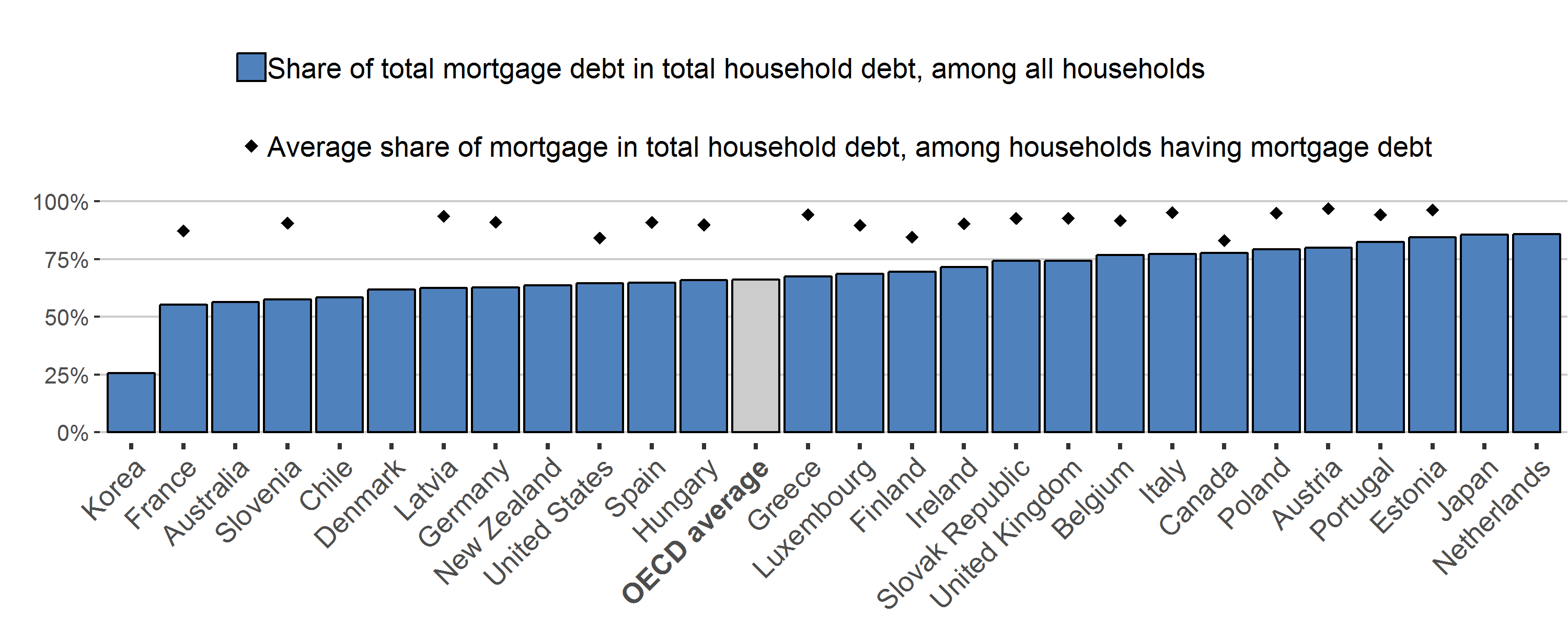

Mortgage debt is the most important component of household debt (Figure 1). At the macroeconomic level, that is, considering all households in the population whether indebted or not, mortgage debt represents more than half of total household debt in almost all OECD countries. At the household level, that is, among households that hold mortgage debt, mortgage debt represents more than 80% of their total debt. From a policy perspective, this makes it clear that monitoring household debt and housing market developments require a careful focus on mortgage debt.

Figure 1. At the macro and household level, mortgage debt is the largest part of household debt

Note: In France, at the macro level, that is, summing among all households whether indebted or not, mortgage debt represents 55% of total household debt; at the micro level, that is, among households having mortgage debt, mortgage debt represents on average 87% of their total debt. The numbers refer to principal residence debt only.

Source: OECD Wealth Distribution Database (oe.cd/wealth), HFCS database, LWS database.

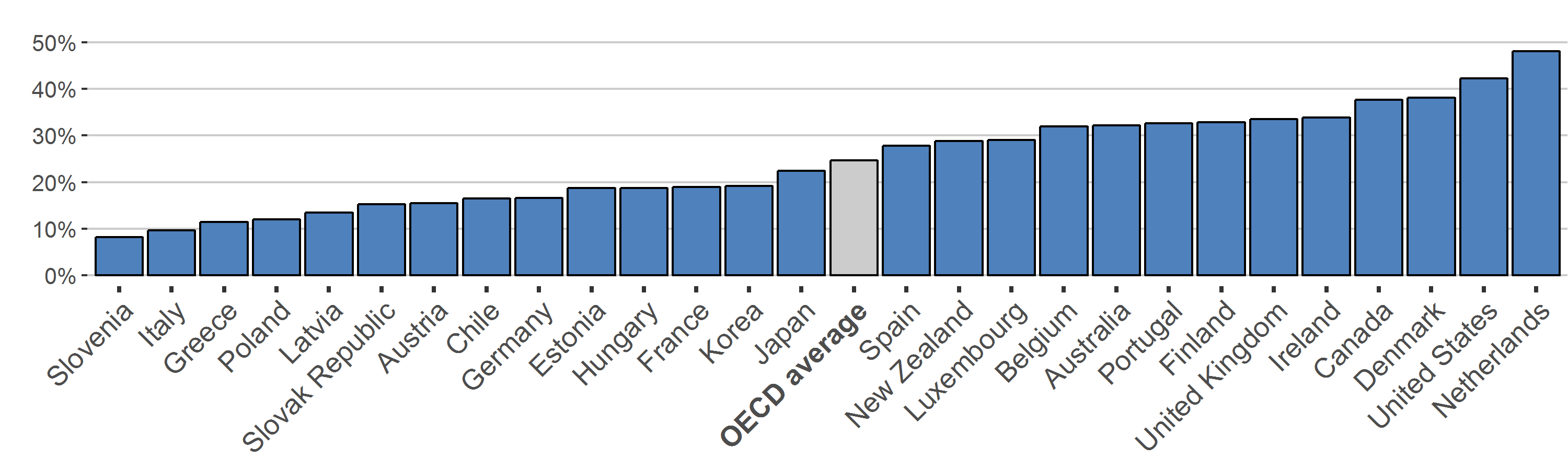

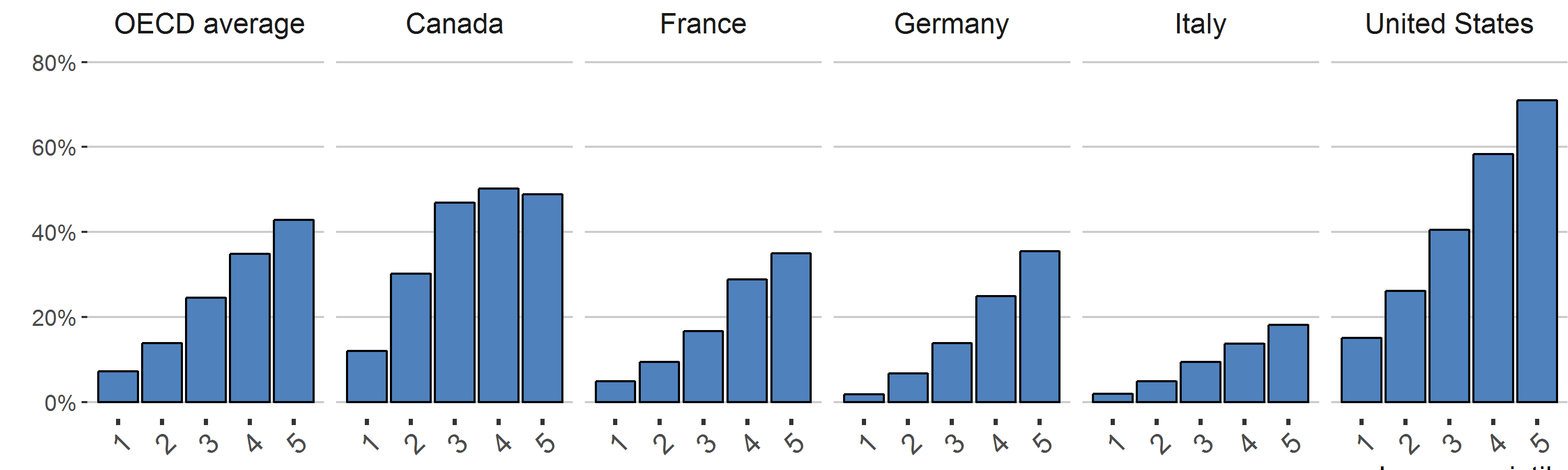

The proportion of households that hold a mortgage varies significantly across OECD countries (Figure 2, Panel A). On average across the OECD, around 25% of households have mortgage debt, ranging from around 10% in Slovenia and Italy to between 40 and 50% in the United States and the Netherlands. One key stylised fact is that the participation in mortgage debt increases broadly monotonically with household income (Figure 2, Panel B). This is not surprising as mortgage markets are regulated and bank lending is conditional on household repayment capacity, measured primarily by their level of income. Yet the link between household income and mortgage debt is somewhat steeper in some countries than in others. This may be indicative of differences in the prudential regulation of mortgage markets for both the borrower and the lender, in addition to housing affordability.

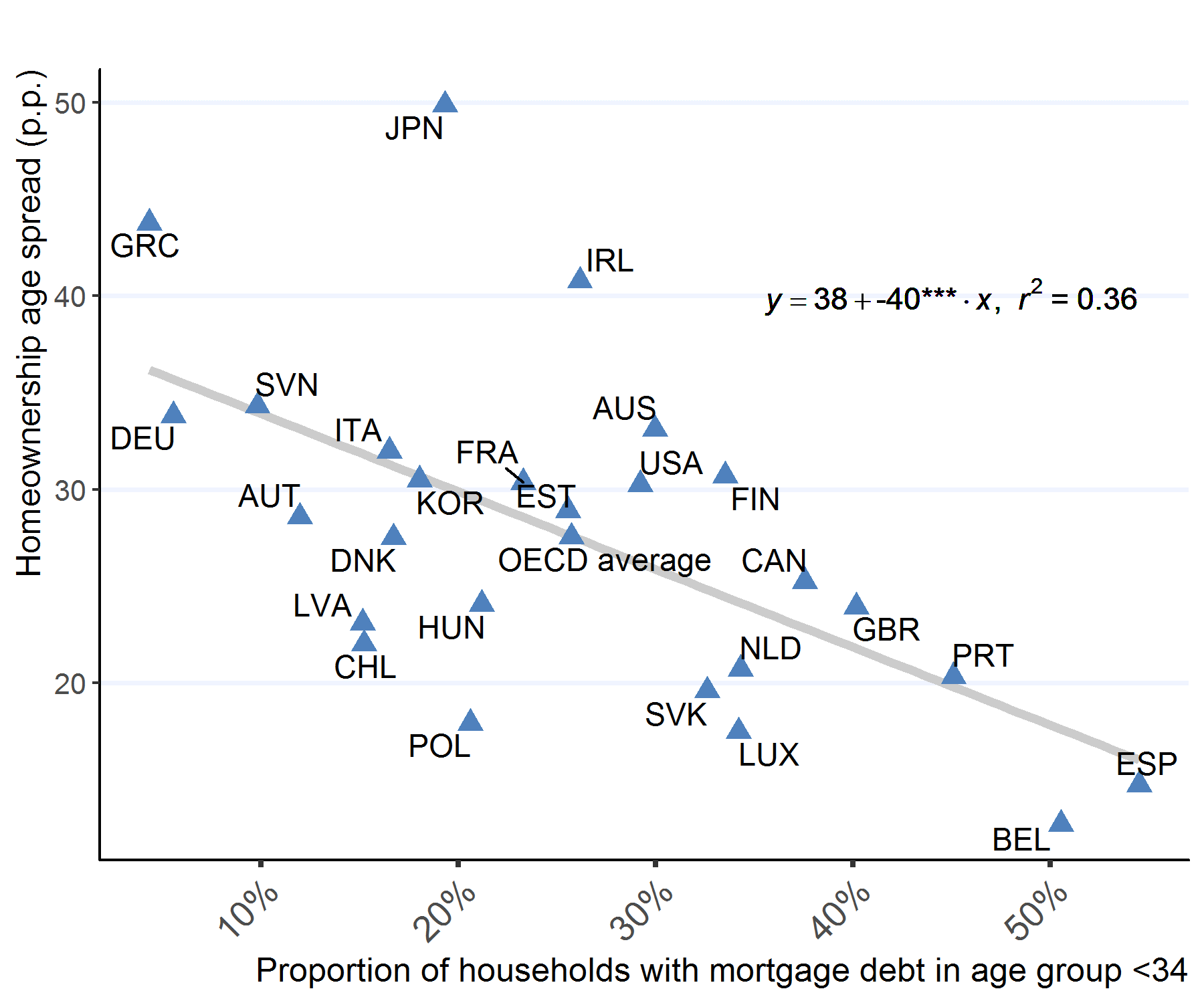

Access to mortgage debt for young households is likely to be one key driver of homeownership for this group, given their relatively low levels of wealth and income. Across OECD countries, the higher the participation in mortgage markets among young households, the lower the difference in homeownership between young households and the rest of the population (labelled “homeownership age spread”) (Figure 3). The literature shows that younger households are relatively more sensitive than other groups to policy settings affecting homeownership, in particular mortgage market regulations (Andrews, Caldera Sánchez and Johansson, 2011.3 Cross-country differences in homeownership age spreads are also likely to reflect differences in the dynamics of housing affordability. This has been emphasised recently in countries with large house price increases, such as the United Kingdom, where a so-called “broken housing market” is driving a generational divide in homeownership whereby young households have been priced out of the market (IFS, 2018).

Figure 2. OECD countries exhibit great variation in households’ participation in the mortgage market, and participation increases with the level of household income

Panel A. Proportion of households with mortgage debt across OECD countries (%)

Panel B. Proportion of households with mortgage debt across the income distribution, OECD average and selected countries (%)

Note: The numbers refer to principal residence debt only.

Source: OECD Wealth Distribution Database (oe.cd/wealth).

Mortgage debt is both an opportunity and a risk

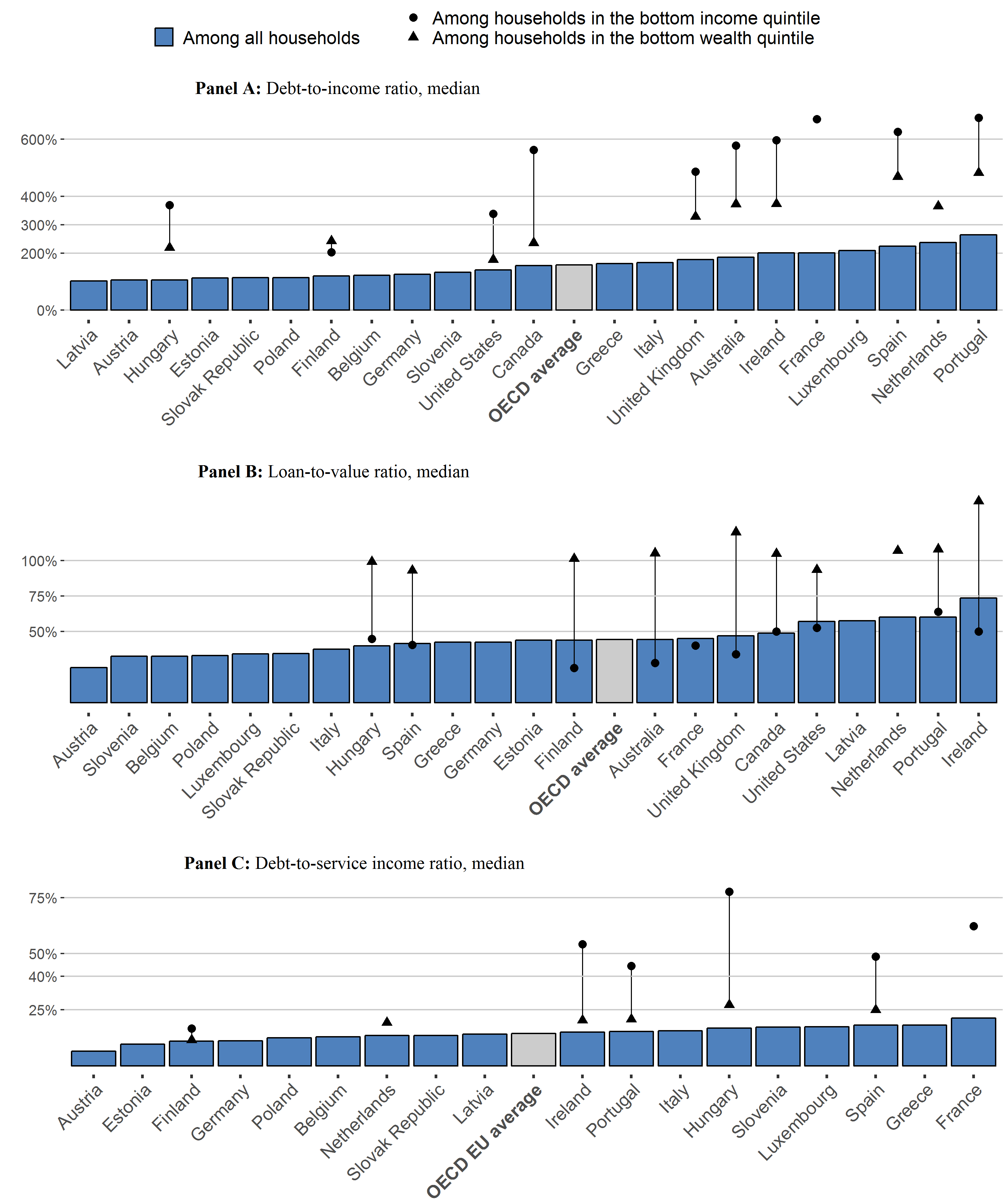

Information on the distribution of mortgage debt across socioeconomic groups is important for determining vulnerabilities associated with the sensitivity of households to income losses, declines in house prices and increases in interest rates. Figure 3 analyses financial vulnerability associated with mortgage debt by focusing on three complementary prudential indicators (ECB, 2009): the debt-to-income ratio, the loan-to-value ratio and the debt-to-service income ratio. These indicators are based on micro data, which allows for a focus on bottom income and wealth households as relevant at-risk population groups. The numbers should be taken with caution, given that samples are sometimes relatively small and may not be fully representative of the whole population.4 Still, these indicators provide a broad picture of financial vulnerability associated with mortgage debt.

Over the last decades, and in particular prior to the financial crisis, the strong expansion in mortgages led to an increase in the debt-to-income ratios for households with mortgage debt. This ratio is well above 100% in most OECD countries and it exceeds 200% in some of them such as Portugal, Spain and the Netherlands (Figure 4, Panel A). This is likely to partly reflect, at least for the Netherlands, the prevalence of interest-only and contractual savings mortgages which delay repayment of the principal (ECB, 2009). Households at the bottom of the income distribution are particularly vulnerable, with debt-to-income ratios exceeding the conventional at-risk threshold value of 300%. Associated risks seems to be particularly significant in some Anglo-Saxon countries (e.g. Canada and Australia). This may reflect the strong increase in house prices over the last decade, especially in Canada, triggering an increase in mortgage debt.

Figure 3. Participation in the mortgage market by young households tends to narrow the difference between homeownership among the young and the rest of the population

Note: Homeownership age group spread refers to the difference in homeownership rates between young households and all households. The numbers refer to principal residence debt only.

Source: OECD Wealth Distribution Database (oe.cd/wealth).

The loan-to-value ratio can be considered as a solvency risk indicator. It tracks households’ ability to pay back their mortgages, assuming that their house can be sold at the prevailing market price if the household faces serious difficulties in repaying its debt. The highest values of this ratio, more than 50%, are in Ireland, Portugal and the Netherlands (Figure 4, Panel B), potentially reflecting recent declines in house prices in these countries. The loan-to-value ratio is highest at the bottom of the net wealth distribution, especially in countries characterised by widespread participation in mortgage debt. For indebted households in the bottom quintile of the net wealth distribution, loan-to-value ratios exceed the conventional at-risk threshold value of 75%. While this is somewhat definitional as households at the bottom of the net wealth distribution are often the most indebted and/or those that experienced asset price depreciation, the conclusion is still that excessive leverage can expose vulnerable households to solvency risk in case of house price busts.

The debt service-to-income ratio can be considered as a liquidity risk indicator. It measures the amount of income that households pay for interest and to repay the principal. This indicator can be used for evaluating the vulnerability of households to changes in their capacity to reimburse mortgage debt in cases of various shocks to their income. Overall, the debt service-to-income ratio is well below the conventional at-risk threshold value of 40% (Figure 4, Panel C). Hungary, Ireland, France, Portugal and Spain are countries where households at the bottom of the income distribution devote more than 40 % of their income to servicing their mortgages. This could signal particular vulnerability to sudden drops in incomes and increases in interest rates when mortgages are taken out at variable rates. According to HFCS data, variables rates are prevalent in Portugal and Ireland (93.9% and 86.0% respectively), slightly less so in Hungary (54.4%), and relatively infrequent in France (9.8%).5

Figure 4. Mortgage debt exposes households to financial vulnerability

Note: The numbers refer to principal residence debt only. These ratios are calculated only for households with principal residence mortgages. The calculation is done only in cases where the number of observations exceeds 50, which is why some data is not shown for bottom income and wealth households. The debt service-to-income ratio calculation can only be calculated for European countries on the basis of HFCS data.

Source: HFCS database, LWS database.

From a household perspective, mortgage debt is both an opportunity and a risk. On the one hand, it allows households, especially young households and those with few initial assets to accumulate wealth. On the other hand, it can expose households, especially those at the bottom of the distribution, to financial risks in the event of income losses, of house price declines as well as interest rates increases. The implication is that mortgage-related policies need to strike the right balance between allowing access to mortgage debt as an opportunity to accumulate wealth, and preventing the building up of excessive leverage with potential large economic and social risks. Macroprudential policies are the core of this trade-off.

Reducing household-level vulnerabilities through macroprudential regulation

The implementation of borrower-based prudential regulation may raise distributional concerns6. As discussed above, borrowers with high loan-to-value ratios are concentrated at the bottom of the wealth distribution and borrowers with high loan-to-income ratios at the bottom of the income distribution. Subsequently, caps on loan-to-value and debt-to-income may exclude low-income and low-wealth households from the mortgage market. The down-payment constraint resulting from more restrictive caps will be particularly binding for first-time buyers and liquidity-constrained households, e.g. younger and low-income households (see e.g. (Ortalo-Magne and Rady, 2006)). Recent analysis by (Kelly, Le Blanc and Lydon, 2018) on the effect of tightening credit standards on the distribution of borrowers shows that European countries that experienced a boom-and-bust in the housing market saw the composition of buyers shifting from young and low-income to old and high-income households after 2010.

However, distributional concerns associated with the implementation of borrower-based macroprudential policies are likely to fade out over a longer-term horizon. Excessive expansions of mortgage credit can trigger higher house price increases, which reduce housing affordability, and thus price out low-income households from the market. By curbing the joint increase of credit volume and house prices during leverage cycle booms, macroprudential caps may enhance housing affordability (see (Mian and Sufi, 2008), (Glick and Lansing, 2010) (Kohl, 2018)).

As a result, macroprudential policies can enhance microeconomic resilience, especially for those households most vulnerable to price and income shocks. Even though related credit constraints may prevent young households from accumulating wealth through homeownership, long-term positive gains are likely to outweigh short-term costs and therefore such instruments can be welfare improving by: i) preventing young households from prematurely investing in housing hence reducing vulnerability to price and income shocks, ultimately allowing better consumption smoothing (Xiong and Mavropoulos, 2018); and ii) more generally, contributing to housing affordability by curbing leverage-induced increases in house prices. The effectiveness of such instruments will ultimately depend on specific policy design: research progress is still needed to properly evaluate the distributional effects of various macroprudential instruments.

1 In line with the definition of housing as household main residence, mortgage debt refers to principal residence debt throughout the paper unless otherwise stated.

2 Luxembourg Wealth Study (LWS) Database, http://www.lisdatacenter.org (Austria, Canada, Greece, Norway, United Kingdom, United States, June 2018 to December 2018). Luxembourg: LIS.

3 The literature is largely consensual in finding that young households are overly sensitive to mortgage market design and regulation in terms of e.g. loan-to-value and loan-to-income ratios. See e.g. (Chiuri and Jappelli, 2003) (Xiong and Mavropoulos, 2018) (Andrews and Caldera Sánchez, 2011). Young households are also overly sensitive to access to stable jobs, which largely condition access to (mortgage) credit.

4 The calculation is not performed for income and wealth groups in countries where underlying sub-samples are considered as too small. This happens mostly in countries where a relatively low share of households hold mortgage debt (because the calculation is conditional on having mortgage debt).

5 Not shown for space-saving reasons are calculations based on HFCS.

6 See (Alam et al., 2019) for recent evidence on the effects of loan-targeted instruments on aggregate household credit and consumption

References

| Alam, Z. et al. (2019), Digging Deeper-Evidence on the Effects of Macroprudential Policies from a New Database IMF Working Paper Monetary and Capital Markets Department Digging Deeper-Evidence on the Effects of Macroprudential Policies from a New Database. |

| Andrews, D., A. Caldera Sánchez and Å. Johansson (2011), “Housing Markets and Structural Policies in OECD Countries”, OECD Economics Department Working Papers, No. 836, OECD Publishing, Paris, https://dx.doi.org/10.1787/5kgk8t2k9vf3-en. |

| Causa, O., N. Woloszko and D. Leite (2019), “Housing, wealth accumulation and wealth distribution: Evidence and stylized facts”, OECD Economics Department Working Papers, No. 1588, OECD Publishing, Paris, https://dx.doi.org/10.1787/86954c10-en. |

| ECB (2009), Housing Finance in the euro area, European Central bank, http://www.ecb.europa.eu. |

| FCAC (2017), Home Equity Lines of Credit: Market Trends and Consumer Issues: Public Research Report, Financial Consumer Agency of Canada (FCAC). |

| Glick, R. and K. Lansing (2010), “Global household leverage, house prices, and consumption”, FRBSF Economic Letter, http://homepage.ntu.edu.tw/~nankuang/Global%20Household%20Leverage,%20House%20Prices,%20and%20Consumption-1.pdf (accessed on 4 December 2018). |

| IFS (2018), The IFS Green Budget: October 2018 The Institute for Fiscal Studies. |

| Kelly, J., J. Le Blanc and R. Lydon (2018), “Pockets of risk in European Housing Markets: then and now”, Research Technical Papers, https://ideas.repec.org/p/cbi/wpaper/12-rt-18.html (accessed on 28 November 2018). |

| Kohl, S. (2018), “More Mortgages, More Homes? The Effect of Housing Financialization on Homeownership in Historical Perspective”, Politics & Society, Vol. 46/2, pp. 177-203, http://dx.doi.org/10.1177/0032329218755750. |

| Makoto, N. (2012), Everything You Always Wanted to Know About Reverse Mortgages but Were Afraid to Ask, Federal Reserve of Philadelphia Business Review, http://www.philadelphiafed.org. |

| Mian, A. and A. Sufi (2011), “House Prices, Home Equity–Based Borrowing, and the US Household Leverage Crisis”, American Economic Review, Vol. 101/5, pp. 2132-2156, http://dx.doi.org/10.1257/aer.101.5.2132. |

| Mian, A. and A. Sufi (2008), “The Consequences of Mortgage Credit Expansion: Evidence from the U.S. Mortgage Default Crisis”, SSRN Electronic Journal, http://dx.doi.org/10.2139/ssrn.1072304. |

| OECD (2018), A Broken Social Elevator? How to Promote Social Mobility, https://doi.org/10.1787/9789264301085-en. |

| OECD (2018), Taxation of Household Savings, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264289536-en. |

| Ortalo-Magne, F. and S. Rady (2006), “Housing Market Dynamics: On the Contribution of Income Shocks and Credit Constraints”, Review of Economic Studies, Vol. 73/2, pp. 459-485, http://dx.doi.org/10.1111/j.1467-937X.2006.383_1.x. |

| Xiong, Q. and A. Mavropoulos (2018), Housing Consumption and Macroprudential Policies in Europe: An Ex Ante Evaluation, http://www.iwh-halle.de. |