Issue, No.6 (June 2018)

Unsustainable inequality? Empirical evidence for Latin American countries

Disclaimer: Opinions expressed in this publication are those of the authors and do not necessarily reflect the official opinion of the Italian Ministry of Economy and Finance.

Introduction

Seminal literature studies the relationship between inequality and economic growth. More than fifty years have passed since the classic works of Lewis and Kuznets, speculating about the causal link between them. The earliest studies can be connected with contemporaneous Kaldor (1956, 1957), and later with Stiglitz (1969). In general terms, inequality is claimed to favor growth by providing incentives by promoting both savings and investment because rich people save a higher fraction of their income and thus for accumulation, innovation and entrepreneurship (Lewis, 1954; Kaldor, 1957). Not all scholars share the opinion, however. Some claim inequality to be harmful for growth as it deprives the poor of the ability to stay healthy and to accumulate human capital; it may generate political and economic instability that cuts down investment, and finally it may impede social consensus. Benhabib (2003) finds the inequality/growth relationship to be generally nonlinear.

Inequality matters for poverty, matters for growth, and matters in its own right. Greater inequality is a significant factor behind crime, social unrest and violent conflict. Hence, this paper revolves around some big questions (that can only be tangentially treated) such as: How much inequality is too much?

In this connection, several authors have pointed out that countries with high-income inequality, experience an equally great pressure for redistribution. However, evidence is not clear-cut, only part of the ambiguity stemming from the fact that many studies are forced to using imperfect proxies for redistribution1. Still, this is a key concern lying in the background motivations of our work. We argue, e.g., that unequal income distribution may result into an unstable socio-political environment, and high levels of inequality would tend to be socially unsustainable.

In fact, this article will show that the existence, as it emerges from an analysis of a set of Latin American Countries (LACs), of a threshold level of income inequality such that income inequality (pre-)determines its own dynamics and induces reversal dynamics. We believe our research to be the first attempt in the literature to show such a result.

LACs have specific characteristics that motivate the choice of our sample. A known peculiarity is that they represent an area with the greatest unequal distribution of income, and for this very reason they are “outliers”’ in a cross-country distribution (see e.g. Palma, 2011)

One more stylized fact of LACs is that main inequality indicators have decreased over the last decade (CEPAL 2010, 2011), whereas they had dramatically increased during the 1980s and ’90s. Trying to understand the determinants of such a change is challenging: this change of dynamics does not seem to be based on a change in fundamentals.

Why LACs?

As briefly indicated in the introduction (and, at length, reviewed in previous contributions), the relationship between growth and inequality has been discussed within two distinct frameworks. More recently, it has made its appearance within the growth approach, where its stability and directional causality were questioned, basically without generally accepted conclusions. On the other hand, originally it had emerged within the framework of development theory (being associated with Simon Kuznets, and his famous Kuznets Curve). The KC posits causality from per capita GDP (pcGDP) to a measure of income concentration (most often the Gini coefficient) together with a nonlinear functional relation describing a process of stages of growth first with increasing which is followed, after reaching a turning point in pcGDP, by diminishing income concentration. In cross-section analyses, such a curve with an inverted-U graph, appears recurrently, one way or another. Often, the literature has raised the fundamental question of its very existence: e.g., Palma (2011) has shown a horizontal distribution of developing and developed countries in 2005, arguing that a KC could be recovered only by adding the LACs, even though the latter are obviously outliers. This fact partly explains the special attention for LACs in this article.

On the other hand, some raw data for several LACs seem to support well that income inequality has first increased, along low levels of income, to then decline once reached a certain pcGDP level. However, the latter largely varies across countries, whereas the KC literature tries to estimate a common and punctual switching value. Thus, this raises our key question in this respect: is it really pcGDP that – beyond a certain level – induces income inequality to decrease after an often long increase?

The literature generally agrees that the high-income inequality afflicting Latin America for centuries has its roots in the concentration of land, assets, and political power in the hands of a privileged few inherited from the colonial era. This would have led to developing institutions that, well into the 1980s and 1990s, perpetuated the privileges of small agrarian, commercial and financial oligarchies. For the last quarter of the twentieth century, Latin America suffered low growth, rising inequality, and frequent financial crises (CEPAL, 2010; Lopez-Calvaa and Lustig, 2010). Although poverty rates clearly decreased in the last decade, in most countries 15% of the population who got out of poverty, has living standards just above the minimum threshold and suffers a constant risk of new social decline; meanwhile, the richest 10% own about 50% of national income (CEPAL, 2011). Extreme inequality shows up not only in terms of income and wealth, but also in a disparate access to land and essential public services such as education, health and social security. Women, children, the elderly and certain ethnic groups are particularly disadvantaged, an impairment that is a structural issue in Latin America, as access to positions and social goods represents permanent, consolidated constraints spanning over generations.

Such persistence of the extreme social inequality is even more striking especially because, throughout its often tormented history, a variety of different development models have been implemented in the region, at times, also elaborated instances associated to a welfare regime.

Burchardt’s (2010) “Latin American Paradox”, i.e. the persistent convergence between democracy and social inequality even in periods of economic prosperity, is often attributed (though the position is also questioned) to political and institutional “defects”, as well as to insufficient resources devoted to welfare.

At any rate, between 2002-10, inequality, at least as measured by the Gini coefficient, fell and, by 2010, the region had returned to levels of inequality of pre-liberalization, i.e. of early 1980s. Such a drop appeared to be permanent, for inequality continued to fall even during the crisis of 2009-12. The exceptionality of such dynamics is exposed by the fact that during the 2000s no other region experienced a comparably sizeable and generalized decline of inequality (Cornia, 2014).

In the 2000s, Latin America appears to have entered a new stage of the political cycle. In several countries, new Administrations came into power promising a more active role of the State in the economy and to implement ambitious redistributive policies. Besides the rhetoric, some governments did engage in a more active role in the labor market, widened the scope and coverage of social policy, nationalized enterprises, intervened in some of the markets, and subsidized certain bundles of goods and services. It is very likely that these measures had equalizing results, still more research is needed for a complete assessment of their effective impact on the income distribution, the factual progressiveness of the subsidies introduced, and their long-term consequences.

In other words, there may be many plausible factors behind the fall in inequality in the LAC region, e.g. (i) employment growth, (ii) a change in relative prices, (iii) realignments after reforms, (iv) realignments after macro shocks, (v) cash transfer programs, and (vi) increased concerns for inequality.

Thus, we would be arguing that the changes in income inequality sprung up from several forces often operating in distinct directions, with GDP having a little or no effect on them. In particular, we are going to conclude that high levels of income inequality are socially and politically unsustainable. It is this hypothesis that we test for 13 of the Latin American countries.

The Econometrics

Countries considered in our sample are: Argentina, Brazil, Chile, Colombia, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Paraguay, Peru and Trinidad and Tobago.

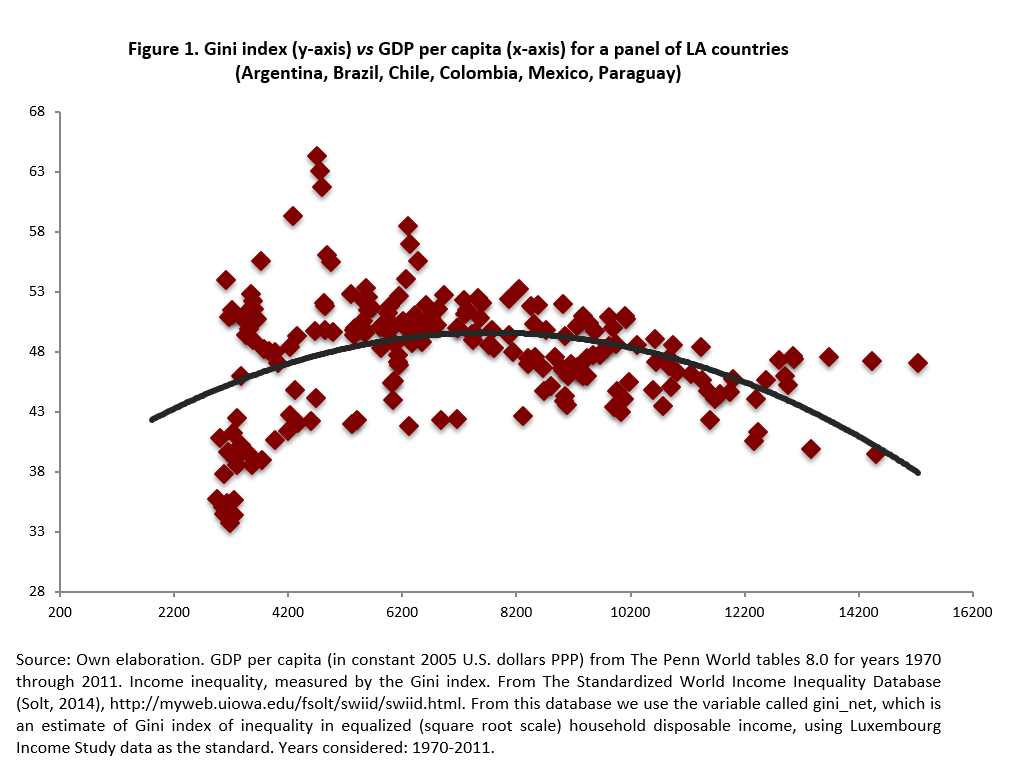

As in any empirical analysis, it is desirable to have a database of acceptable quality that allows comparisons both between countries and over time. Data on income inequality has generally been unevenly distributed among nations and over time, which has led to using only a subset of the data or some form of interpolation. Especially, the effect of income inequality on long run economic growth has remained an open question mostly due to insufficient data on income distribution. Fortunately, in continuing contributions since 2011, Solt has gathered data for the Gini-index that has a consistent, long time series for several countries. Thus, our inequality measure will be the Gini index, calculated on the per capita family income. The path of inequality in most LACs has been upwards but, once reached the first half of the 2000s, it turned to decrease. Hence, the downward tendency in Gini values from the beginning to the mid 2000 years could be explained by the existence of a “turning point’”. Figure 1 plots an example of the data used, over the period 1970-2011, for this relationship “Gini vs GDP per capita” for a set of six LA countries: Argentina, Brazil, Chile, Colombia, Mexico, Paraguay. It can be noticed that an inverse u may exist, so our aim in what follows is to statistically test its significance.

We performed tests to check for non-stationarity. Both levels and first differences of the Gini index of income inequality are stationary according to various tests.

We used a log transformation of the macroeconomic variables, which provides a better fit in the class of nonlinear models. Then, a threshold model is estimated using a panel fixed effect (following Hansen (1996, 1999, 2000)). By estimating it for different values of a parameter GINI* , chosen in ascending order, the latter’s optimal values obtained by finding such a value that minimizes the residual sum of squares (RSS) of the regression2. Parameter GINI* represents the threshold level such that the relationship between the current variation of income inequality (i.e. today) and past inequality is given by:

- At Low inequality: β1, and

- At High inequality: β1 + β5

Table 3 (Policardo, Punzo and Sanchez Carrera, 2018) reports the main results of the threshold regression. These are:

- Below a Gini = 44, neither income nor the previous values of Gini index are able to explain variations in income inequality today.

- Estimation finds a threshold around a Gini value equal to 44, beyond which an increment in past levels of Gini implies a negative variation of Gini today.

- Beyond Gini = 44, per capita GDP and square per capita GDP remain not significant in the determination of ΔGINI, and past values of Gini becomes significant in explaining negatively variations in actual levels of income inequality.

Then, it seems that the dynamics of economic inequality is explained by itself, with a turning point of inequality around a Gini level of 44, while per capita GDP seems to have no statistically significant effect on such dynamics.

Conclusion

Our findings are best to be read against established (e.g. Kuznets’ own) and more recent research. The analysis developed by the former sees economic growth to affect income inequality and it links such relationship to a theory of the stages of economic development. Kuznets’ argument, recall is based on the idea that economic growth is a process strictly associated with the industrialization process of an essentially rural economy. The average incomes earned in the two sectors being different, the transfer of labor from the rural to the industrial sector would reduce inequality. Then, for the lesser-developed countries, the relationship between inequality and development is positive, though, with the level of per capita GDP increasing along with the industrialization process. The correlation with income concentration would turn out to be negative. This result has been later confirmed by the estimation of an augmented Kuznets curve, thus confirming also the existence of such an inverted-U relation. We have extended such a model with the inclusion of a human capital-related variable (Human capital index (HC), from the Penn World tables 8.0, for years 1970 through 2011).

Rejecting the existence of the KC, Palma (2011) shows that more than 80% of the world countries have a Gini index not far from 40, despite huge differences in their development levels. Countries exhibiting the “inverted-U” behavior would be in Latin America and South Africa. The outlier nature of these countries is crucial for testing the “inverted-U” hypothesis: were both these regions excluded, or (more appropriately) were they controlled by a dummy variable, the “inverted-U” hypothesis would no longer appear. We looked at LACs for a confirmation of Palma’s conclusions, though we came to an altogether different explanation.

Maybe, our results accommodate Piketty’s view that capitalism would be geared to favor the wealthy ones, for the wealth of the latter increases faster than the incomes of the workers. However, history would also show how: “capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based”. In fact, our detected turning point in income inequality exhibits the unsustainability of levels of inequality that are perceived to be excessive, one of the key questions mentioned above.

Future research should concentrate on understanding the different cultural, institutional, socio-political factors that, together with economic factors, contribute to the inequality’s turning point and its unsustainability.

1 While we may think of some categories of spending as redistributive (such as education or social insurance spending), they need not be redistributive in practice, consider spending on post-secondary education in poor countries or on social protection for formal sector workers in many developing countries.

2 In practical terms, we run this regression starting from an arbitrarily threshold level for GINI equal to 39, and then go up to 60. The initial value for Gini is set to 39 because we want at least 30 observations below that threshold.

References

| Burchardt, H. (2010). “The Latin American Paradox: Convergence of Political Participation and Social Exclusion”, Internationale Politik und Gesellschaft No 3, pp. 40-51. |

| CEPAL (Comisión Economica para America Latina y el Caribe). Panorama social de America Latina, ONU, Santiago de Chile, noviembre de 2010 e noviembre 2011. |

| Cornia, A. (2014). Falling Inequality in Latin America: Policy Changes and Lessons. Oxford University Press. |

| Kaldor, N. (1956). “Alternative theories of distribution”. The Review of Economic Studies 23(2), 83-100. |

| Kaldor, N. (1957). “Alternative theories of distribution”, The Economic Journal 67(268), 591-624. |

| Lopez-Calva L., and N. Lustig (2010). “Declining Inequality in Latin America. A Decade of Progress?”. Programa de las Naciones Unidas para el Desarrollo (pnud) and Brookings Institution Press, Nueva York-Washington, DC. |

| Palma, J. G. (2011). “Homogeneous middles vs. heterogeneous tails, and the end of the ‘Inverted-U’: It’s all about the share of the rich”, Development and Change 42(1): 87-153. |

| Policardo L., L. Punzo, and E. Sanchez Carrera (2018). “¿Desigualdad insostenible? Evidencia Empírica para países de América Latina”, in America Latina en la larga historia de la desigualdad, Puchet Anyul and Puyana Mutis (Eds). FLACSO – Mexico, Press. |

| Solt, Frederick (2011). “Standardizing the World Income Inequality Database”, Social Science Quarterly 90(2):231-242. |

| Stiglitz, J. (1969). “The distribution of Income and Wealth Among individuals”, Econometrica 37(3): 382-397. |