Issue, No.6 (June 2018)

Elderly in Paraguay – a vulnerable group

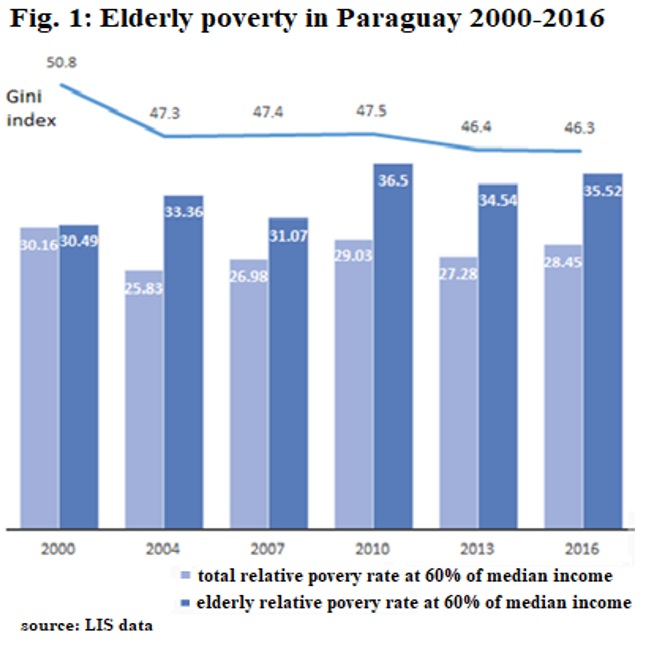

Paraguay is one of the poorest countries in Latin America, although over time a slight decrease of poverty and inequality can be observed. Nevertheless, with a Gini of 46.3 % in 2016, inequality remains at a very high level. Following the same trend, the overall poverty rate (at 60% of the median income poverty) slightly decreased over time, however, not for all groups, as we can see in Fig. 1 below: if in 2000, poverty among the elderly was close to the overall poverty rate, with a bit over 30%; over the years, the elderly poverty increased by 5 percentage points reaching 35.5% in 2016, which represents a gap of more than 7 percentage points compared to the overall poverty rate. Therefore, it seems that the elderly are one of the most vulnerable groups facing poverty in Paraguay, even though the country made recently efforts to implement social policy in order to improve their financial wellbeing.

The question that arises is: why, while the overall situation in the country is improving, the situation of the households with seniors is deteriorating? One of the most evident reasons could be the low coverage of the pension system in Paraguay. As shown by Schwarz (2003), in 2001, only 14% of the total Paraguayan labour force was contributing to the pension system, one of the lowest percentage in the region, in the same cluster with Bolivia (11.7%) and Nicaragua (13.6%). On the other end of the spectrum, there was the leading group of Latin American countries in which at least half of the working force was covered: Argentina (53%), Chile (54.8%), Costa Rica (50%), Panama (51.6%) and Uruguay with an impressive 82% coverage (Schwarz, 2003).

Pension system coverage is an essential indicator of the efficiency of the public policy regarding income security: if the system is not covering most of those who are supposed to be protected against income deprivation, this can be seen as a failure of the state (see Rofman et al., 2007). The vulnerable group of the elderly can be covered by contributory pension schemes or non-contributory ones. In 2016, the coverage of the contributory pension system was still very low in Paraguay, with only 21% of the employed persons participating in a pension scheme (including private ones, which are still very underdeveloped, with under 1% coverage rate). Nevertheless, this represents an increase of 8.6 percentage points over the years since 2000 (LIS data). If the contributory system’s coverage is low, the state could compensate with non-contributory schemes either targeting the most vulnerable elderly (means-tested benefits) or, if the system is financially sustainable, could grant a universal minimum pension to all senior citizens. As Dethier et al. (2010) are stressing, reducing elderly poverty requires a different approach from other age groups for which active labour market policies are more efficient than the passive ones on long term, whereas for the elderly only transfer of real income is efficient.

Seeing other countries from Latin America introducing social assistance targeting the elderly in the mid 2000s, senior citizens from Paraguay were protesting actively to get a pension of their own (see Pension Watch). Finally, their needs were acknowledged by the policy makers, who introduced in 2009 the social pension in Paraguay. The programme is called Adultos Mayores and aims to improve the quality of life of the elderly living in extreme poverty. The implementation of the programme took a couple of years (till 2011) because, besides the minimum required age of 65 years, the eligibility is based on a means test of the household’s income and assets and these needed time to be assessed. Set at 25% of minimum wage, the social pension is slightly above the World Bank recommendation of 2.5 $/day.

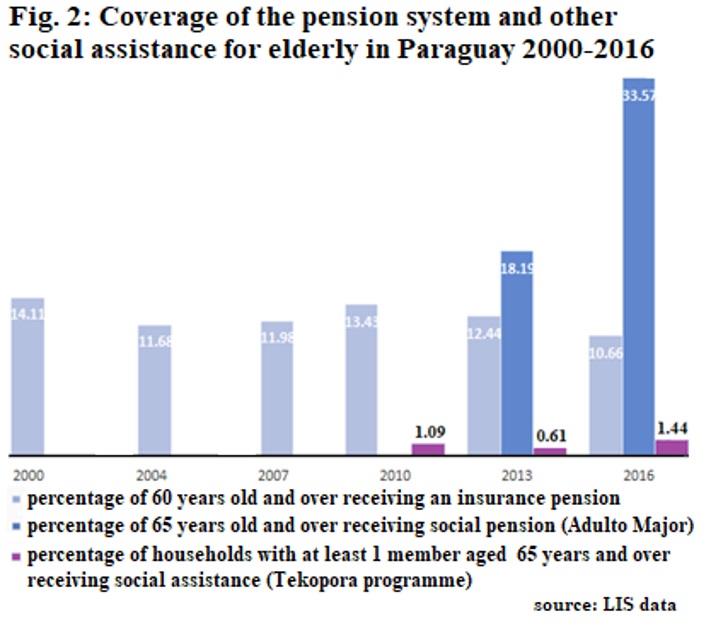

Looking at the overall coverage in Fig. 2 we can see that in 2016 only 10.7% of the elderly of 60 years and over were receiving an insurance based pension, while 33.6 % of the elderly aged 65 years and over were receiving the assistance pension (LIS data). This represents an impressive increase of 15.4 percentage points in coverage of assistance pension since 2013. However, at the same time, with the introduction of the social pension, coverage of the insurance-based pension is decreasing, as well as decreasing over time since 2000, in a non-linear way.

One explanation of this divergent trend could be the fact that the two types of pensions are non-cumulative, therefore if the social pension was higher than the insurance-based one, seniors would opt for the latter. However, even with such a substantial increase in social pension coverage, the poverty rate of the elderly still increased by 1 percentage point between the two waves, therefore the effectiveness of the Adultos Mayores programme still needs to be evaluated in detail in order to see why a substantial impact on improving the living conditions of the elderly was not observed so far. In fact, the Paraguayan Government is running a survey to assess the programme’s full impact on the seniors’ wellbeing.

In order to have a comprehensive picture of the coverage of assistance benefits, we looked also at other social benefits that can reach the seniors. In 2005, the first conditional monetary transfer programme was introduced, called Tekopora, targeting vulnerable groups in Paraguay, including also households with elderly in poverty (means tested). Still, as we can see from Fig. 2, only a bit over 1% of the households with at least one member aged 65 years and over received this type of assistance transfers in 2010. The decrease by almost half by 2013 is explained by the fact that, since the introduction of the social pension, having a household member aged 65 years or older is no longer among the eligibility criteria for receiving this benefit. Some households with seniors continue to receive it because they fulfil other eligibility criteria (minor children, pregnant women, disabled person). Nevertheless, the Tekopora programme contributed to the decrease of the overall poverty rate during the last decade in Paraguay.

To conclude, although policy efforts were made, the coverage of social assistance towards vulnerable groups is still rather low in Paraguay, targeting only the extreme poor. One of the explanation can be seen in the limited financial resources, for example in 2010 only 0.25% of GDP was allocated to the Tekopora programme and this number decreased to 0.14% of GDP by 2013. In contrast to this, Uruguay is allocating to a similar assistance programme (Asignaciones Familiares) 0.46% of its GDP for 2015 (Ministry of Finance, Paraguay, 2016). With the highest pension coverage from the continent, Uruguay had an elderly poverty rate of only 18.4% in 2016, below the overall poverty rate of 20.7% (LIS data). This is an leading example to be follow by the other countries in the region, including Paraguay. A coherent social policy, focusing on increasing the coverage of both current labour force for future contributory benefits and current social assistance benefits needs to be implemented in order to reduce elderly poverty in Paraguay. Furthermore, such policy should not only target people in extreme poverty, but aiming to reach more people in need and especially people from vulnerable groups such as elderly who cannot provide for themselves anymore.

References

| Dethier, J., Pestieau, P. and Ali, R. (2010). “Universal Minimum Old Age Pensions Impact on Poverty and Fiscal Cost in 18 Latin American Countries”, Policy Research Working Paper 5292, World Bank. |

| Ministry of Finance, Paraguay (2016). “Evaluación de impacto del programa Tekoporã”, May 2016, available here |

| Rofman, R. and Lucchetti, L. (2007). “Pension Systems in Latin America: Concepts and Measurements of Coverage”, SP discussion paper no. 0616. |

| Schwarz, A. (2003). “Old Age Security and Social Pensions Social Protection”, World Bank. |

Websites sources

| Global Age Watch |

| Paraguay Government |

| Pension Watch |

| Poverty in action |

| World Bank |