Issue, No.2 (June 2017)

Highlights of the first LIS/LWS User Conference

The aim of the first LIS User Conference was to bring together scholars using our databases: Luxembourg Income Study (LIS) or Luxembourg Wealth Study (LWS). We received many good submissions, and 15 papers from economics to political sciences, sociology and social policy were retained, reflecting the diversity of topics that can be studied using our databases, from inequality and poverty to labour market participation, from saving patterns to class composition. The papers were selected by a Scientific Committee that included: Louis Chauvel (University of Luxembourg), Daniele Checchi (University of Milano & LIS), Conchita D’Ambrosio (University of Luxembourg), Janet Gornick (The City University of New York (CUNY) & LIS), Aline Muller (LISER), Carmen Petrovici (LIS), Eva Sierminska (LISER), and Philippe Van Kerm (University of Luxembourg & LISER).

The conference was held on 27-28th of April 2017 in the Foyer of the Maison de Sciences Humaines of Belval Campus, which is the host of LIS offices and of our co-sponsoring partner, the Faculty of Language and Literature, Humanities, Arts and Education (FLSHASE) of the University of Luxembourg.

The conference was opened with a welcome word by Georg Mein, the Dean of FLSHASE, who spoke about the importance of having good quality data for analysing inequality and for research in general.

The conference started with a session about education chaired by our director, Daniele Checchi. Eyal Bar-Haim and Anne Hartung from University of Luxembourg presented a paper focused on overeducation across birth cohorts; they found that high education is sometimes more necessary because relative returns of investment in human capital increased over time but usually less sufficient since absolute returns decreased. Daniele Checchi, as discussant, stressed that educational reform may affect returns to education and that we should look more in-depth into gender differences in earning profiles, as well as life cycle projections in earning profiles and to country differences in the end of tertiary education/entry to labour market and exit from the labour market. Steven Presman pointed that higher cost of education in countries like UK and US are an important factor because return of investment in education is reduced with increased costs. On the same topic, Tomáš Jagelka from University Paris-Saclay, France, presented a paper that looked at the investment in human capital, showing that investing in specific skills increases expected job tenure by one extra year. Filippo Gregorini from EUROSTAT, the discussant, stressed the importance of ‘soft skills’ on the labour market and pointed out that there is still a large heterogeneity in the rigidity of the educational system and labour market performance between EU countries.

An interesting paper for the LIS team and not only was presented by Thomas Goda from EAFIT University, Colombia, who, in order to correct for the underreporting of top incomes in survey data, adjusted top incomes using the National Accounts (NA) for 40 countries, distinguishing between labour and capital income. LIS is also doing comparison of our data and NA. Charles-Henry Dimaria, the discussant, who worked with NA in The Luxembourgish National Statistical Institute (STATEC), pointed out that each country has a different methodology for calculating NA, and there is the need to look into country differences in order to distinguish better to whom the difference in income between NA and the survey data could be attributed.

Another big theme of the conference was fiscal redistribution and its effects in reducing inequalities. Young-Hwan Byun from SOFI, Stockholm University, Sweden, looked at it from a political sciences point of view: he found that the benefit level to the middle class has significant and positive effects on popular support for redistribution, whereas the tax level on low incomes has negative effects. His discussant, Pierre Picard from University of Luxembourg, pointed to the endogeneity issue between the tax and benefit legislation and the voters’ preference for redistribution. He also mentioned that there are other factors that might affect their preferences such as social status, economic risk or income mobility.

David Jesuit from Central Michigan University, US, presented trends in fiscal redistribution over time, since the 1980s to 2014 in all countries for which the data is available in LIS and concluded that there is substantial variation in levels of pre- and post-government transfers between countries and their impact on poverty reduction. He noted that pensions make up the vast majority of transfer income and that direct taxes, when examined separately, tend to increase poverty. He refers to the ‘Robin Hood Effect’: reductions in poverty rates came at the expense of the affluent ones who pay higher taxes and receive less back. Therefore, redistribution really matters even for the size of the middle class: Denmark has the largest middle class pre-taxes and –transfers; while after redistribution, Sweden ranks first in the size of the middle class. As suggestion for the future, an improvement would be to simulate indirect taxes in the data. At the same time, also the importance of providing the macrodata to other LIS users was emphasised, and LIS provides a platform on our website dedicated to this. His discussant, Steven Pressman from Colorado State University, US, pointed out to the difficulty to fully separate transfers from taxes; without taxes there would not be transfers, plus some transfers are taken place under the form of tax credits.

On the same subject, Elvire Guillaud, from University Paris1 Pantheon-Sorbonne, France, presented their results and stated that for international comparisons a valuable measure of inequality reduction should use a global perspective looking at four levers of redistribution: the tax rate, the progressivity versus the transfer rate, and the targeting of beneficiaries. The scholars concluded that, in order to explain cross-national variation in inequality reduction, targeting does not matter, only the transfer rate does, while both progressivity and tax rate are relevant. An additional contribution of the paper is the imputation of the missing individual social security contributions and employer contributions for some countries in the LIS database, which increases comparability across countries. Furthermore, the authors showed their willingness to make this macro data available for other users. The discussant, Denisa Sologon from LISER, suggested discussing the results in terms of clusters of countries and comparing their simulation with the ones from EUROMOD.

Another big theme of the conference was the middle class. Steven Pressman started with the history of the first poverty measure and walked us through different definitions of the middle class; he concluded that we need to control for regional differences in cost of living when measuring the middle class, and stressed that we need to look deeper to the causality of the decline of the middle class in US and other developed nations; among explaining factors could be demographics and the lack of financialization. The discussant, Anne Hartung from University of Luxembourg, pointed out that focusing on disposable income ignores important facets of the middle class like their wealth, housing prices relative to income or intra-household earnings ratio.

More on the methodological contributions, André-Marie Taptué from Laval University, Canada, presented a method to measure the size of the middle class using the alienation component of polarization. Conchita D’Ambrosio from University of Luxembourg, his discussant, highlighted the methodological contribution of the paper, adding to the existing polarisation measures, by introducing a threshold under which distances from the median income are not considered and testing it on the LIS data.

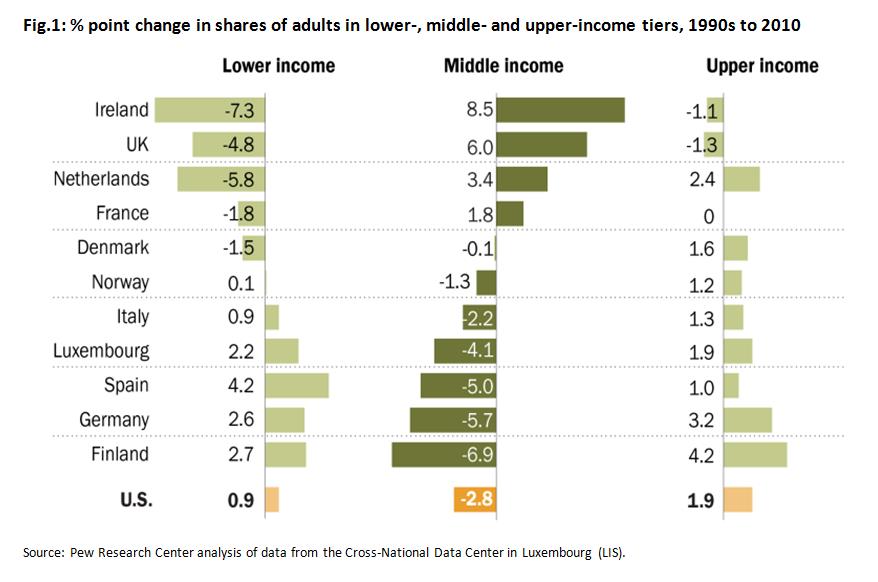

Just a couple of days after his report made the big lines (see New York Times article), Rakesh Kochhar from Pew Research Center, US, presented his results showing the decline of the US middle class over time and its socio-political implications in a comparison with West European countries. However, it is important to also look where people that used to be middle class moved to: down or up the ladder; Fig. 1 illustrates changes over a 30 years period in the selected countries from which we observed that, with a very few exceptions (France for ex.), movements are in both directions, however with different trends between countries.

The discussant, Giuseppe Pulina from Banque Centrale du Luxembourg (BCL) pointed out that the picture could look substantially different if we look at wealth as well and take into account the taxation system.

Another big theme of the conference was how we measure inequality and at which level? Alice Krozer from Cambridge University, UK, stressed the importance of choosing the right indicators for research, but also for advocacy/policy making, and the indicator could differ depending on the purpose of its use. She proposed as an alternative to Gini the different Palma ratios, that divide the share of the top (1%/ 5%/ 10%) by the share of bottom 40 % in order to detect changes in the tails, and applied the measure with different thresholds to LIS data. Philippe van Kerm from LISER and University of Luxembourg, the discussant, pointed out that the lower 40 percent is not really homogenous across countries, and the thresholds are rather arbitrary and the size on top can be an issue. He went a step further by applying the Palma indicators to wealth data, however, using HFCS Wave 1 for 15 countries to test, the constancy of upper-middle group share does not appear to hold for wealth, therefore the index needs extra refinements.

At which level should we measure inequality? Country, state, region, city, neighbourhood even? Two papers attempted to answer to this geographical dimension. The first one, presented by Javier Martín-Román from Fundation UNED, Spain, examined six decentralized countries (Australia, Canada, Germany, Italy, Spain and United States) during a decade focusing on the territorial variable to determine inter and intra-regional inequality. His approach allows him to find important disparities in the contribution of the regional variable and substantial differences not only in the magnitude of the results, but also in the sign of variation. The discussant, David Jesuit from Central Michigan University, US, pointed out that redistribution seems stronger in more decentralised regions, exemplified by the fact that using the territorial component in three countries (Spain, Germany and Canada) in which inequality increased over time, it reduced the inequality indeces.

The second paper, which looked at the state level versus de federal one in a study case of US, was presented by Zach Parolin from Herman Deleeck Centre for Social Policy, University of Antwerp, Belgium. He also brings a methodological contribution by applying augmented survey data by imputation of certain benefits that are underreported in order to produce “more accurate, precise, and internationally comparable estimates of poverty”. He shows that focusing on the state level, can offer a more useful evaluation of the efficacy of local social policies and more useful understanding of high levels of child poverty. Steven Pressman, his discussant, acknowledges that there is a severe underreporting problem in CPS and that the data is as good as people commit to report correctly, however disaggregating to different family types and state unit could become problematic due to sample size.

Another level at which we can analyse inequality with LIS data is interhousehold or even intra-household inequalities; these topics were presented in 2 papers. In the first one, presented by Rense Nieuwenhuis from SOFI, Stockholm University, Sweden, the authors looked at the impact of family policies on women’s earnings, and relative inequality among households from 1981 to 2008 and found out that reconciliation policies are associated with higher women’s earnings, therefore reducing household inequality. He pointed out that is not enough to look at inequality between individuals, but that it is necessary to look at inequality between groups and by gender as well. His discussant, Hema Swaminathan from Indian Institute of Management, Bangalore, India, highlighted the key contributions of the paper: multiple pathways linking family policies and earnings inequality and recommended to extend the analysis to non-OECD countries to see if the results observed are similar.

Hema Swaminathan’s own paper, presented by her co-author, Deepak Malghan from Indian Institute of Management, Bangalore, looked deeper into the household at intra-household gender inequality and concluded that the household can be the site of severe inequalities in resource distribution; there is a need for more investigation into this and a need for data at individual level on income and especially on wealth which usually is collected at household level only. Rense Nieuwenhuis, the discussant, pointed out that the within-part of inequality, expressed as a percentage of total inequality, is not only shaped by the size of the within-household inequality, but also by the size of between-household inequality.

The presentations ended with a paper presented by Walid Merouani from Centre de Recherche en Economie et Management (CREM-CNRS), France, about saving for retirement preferences that used our new LWS database. He stressed that it is important to offer low risk pension products and the importance of socio-demographic factors for retirement saving and other behavioural determinants such as confidence in retirement systems that could explain the demand in private pensions. His discussant, Christos Koulovatianos from University of Luxembourg, stressed the importance of the topic in nowadays societies. He considered a necessary empirical research done in this paper that generates new questions like ‘does the pension choice depends on trust regarding macroeconomic and political stability?’ that could be answered in a future paper.

The conference ended with an ad-hoc round table in which the researchers gave feed-back to the LIS team about using the data and the new documentation system, METIS, and made suggestions about possible developments/improvements in the future. In the same time, the LIS team answered to the questions researchers had about data, meta data, or specialisation among the team.

Additionally, the conference Social Dinner, that took place in an Italian restaurant in the Belval Campus, created new opportunities to exchange ideas among researchers and between users and the LIS team in a convivial environment.

The first edition of our User Conference proved to be a success. An important outcome of the conference is that some of the presented papers will be published in a Special Issue of the Journal of Income Distribution (JID) with research based on LIS/LWS data.