Issue, No.27 (September 2023)

2019 Labour Income Tax Reform in Lithuania

In June 2018, the Parliament of Lithuania adopted a six-reform package encompassing labour taxation, pensions, education, innovation, healthcare, and measures targeting the informal economy (Anciūtė et al. 2020). Among these reforms, labour income taxation changes were foreseen for the years 2019-2021. The primary motivation for the tax reform was to increase the competitiveness of labour taxation and make it easier for employees to assess the tax burden on their income (Government of the Republic of Lithuania, 2018). In addition, a reduction in social insurance contributions was followed by an increase in personal income tax, aiming to make it possible to finance the main part of the pension from the state budget.

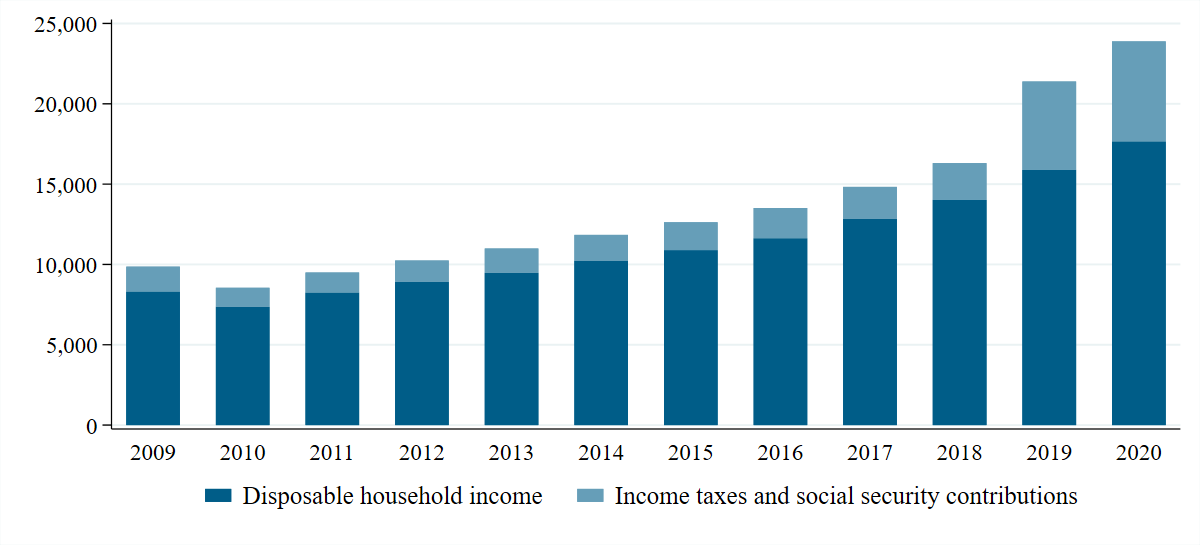

In 2018, employers paid social insurance contributions on behalf of their employees equal to 31.18% of the gross wage, and employees paid an additional 9%. From 2019, the social security contribution payments were nearly entirely shifted from employers to employees (with a lower rate of 19.5% applied on gross labour income paid by employees and 1.77% paid by employers). A mechanical upward compensation was applied to adjust the gross wages accordingly (all the gross wages were multiplied by a factor of 1.289). The reform also included an increase in minimum statutory wage by a factor larger than the mechanical increase in the overall wages. At the same time, the personal income tax rate was raised from 15 to 20%. This reform has been the main reason for the growth in gross wages and taxes and social security contributions observed in 2019 and 2020 in LIS data (Figure 1). Overall, the rates of social security contributions and labour income taxes were lowered, but an increase in the taxable income partially compensated the reduction.

Figure 1. Evolution of household disposable income and household income taxes and social security contributions in LIS data for Lithuania (2009-2020).

Note: amounts refer to nominal mean income received / paid by the household.

Source: Luxembourg Income Study (LIS) Database.

In addition to this, a second tax rate of 27% was introduced on incomes above ten times the average monthly wage in 2019, but it was nearly offset by the established ceilings on social insurance contributions following the same multiples of average wage.1 A gradual increase from 300 EUR in 2019 to 460 EUR in 2022 was also foreseen in the amounts used to calculate the basic allowance, and the scope of the tax allowance application was expanded up to 2 times the average wage. However, social insurance contributions are not deducted from the tax base in Lithuania, which is one reason why low-income Lithuanians face a relatively high average tax rate compared to individuals in other OECD countries (OECD 2022).

Following the reform, an increase in after-tax income was observed for most Lithuanians. Despite that, there were no substantial changes to the tax revenue in 2019, potentially because of simultaneous efforts aimed at improving tax compliance. However, to the comparatively high average tax rate, Lithuanians at the bottom of the income distribution still face lower disposable incomes than in many OECD countries (OECD 2022).

1 By 2021, the top tax rate increased to 32% and the top income threshold was lowered to 5 times the average monthly wage.

References

| OECD (2022), OECD Tax Policy Reviews: Lithuania 2022, OECD Tax Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/53952224-en. |

| Government of the Republic of Lithuania (2018). “2019 metų nacionalinė reformų darbotvarkė” https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/810f32d6759311e99ceae2890faa4193?jfwid=92zt7snss |

| Anciūtė, A., Ivaškaitė-Tamošiūnė, V., Maftei, A., & Varga, J. (2020). Labour Tax and Child Benefits Reform in Lithuania: For Better or Worse? (No. 059). Directorate General Economic and Financial Affairs (DG ECFIN), European Commission. https://op.europa.eu/en/publication-detail/-/publication/3e1c30fc-27b9-11eb-9d7e-01aa75ed71a1 |