Issue, No.29 (March 2024)

Monetary Policy, Housing and Inequality*

Introduction

Research on the effects of monetary policy is increasingly focusing on areas outside the classic suspects of interest, output and inflation. Especially since the more frequent use of unconventional monetary policy instruments such as large-scale asset purchases, there have been discussions about adverse effects of this unprecedented market interventions on specific markets such as housing markets as well as on inequality. Does monetary policy affect households on certain parts of the wealth distribution more than others? This note emphasizes the channels through which monetary policy influences housing markets and inequality, their interplay, and how these topics are not only “innocent bystanders” (Coibion et al., 2017) of monetary policy but also shape how monetary policy is transmitted to the economy.

Monetary Policy and Housing

The connection between monetary policy and prices in housing markets has been under increasing interest of both academics (Taylor, 2007; Jordà et al., 2015) and policy-makers (Bernanke et al., 2010), especially since the prominent role the housing market played in the Great Financial Crisis of 2008. In a nutshell, the main nexus can be summarized as follows: Interest rate movements influence agents’ decision-making and, therefore, have an effect on real estate prices. Specifically, a reduction in interest rates (caused, for example, by lower policy rates set by the central bank) decreases the cost of borrowing and increases the demand for housing. Since housing supply is inelastic in the short run, only prices can react, so the altered demand for housing leads to a rise in house prices. Hence, expansionary monetary policy in the form of lower interest rates is expected to lead to house price growth.

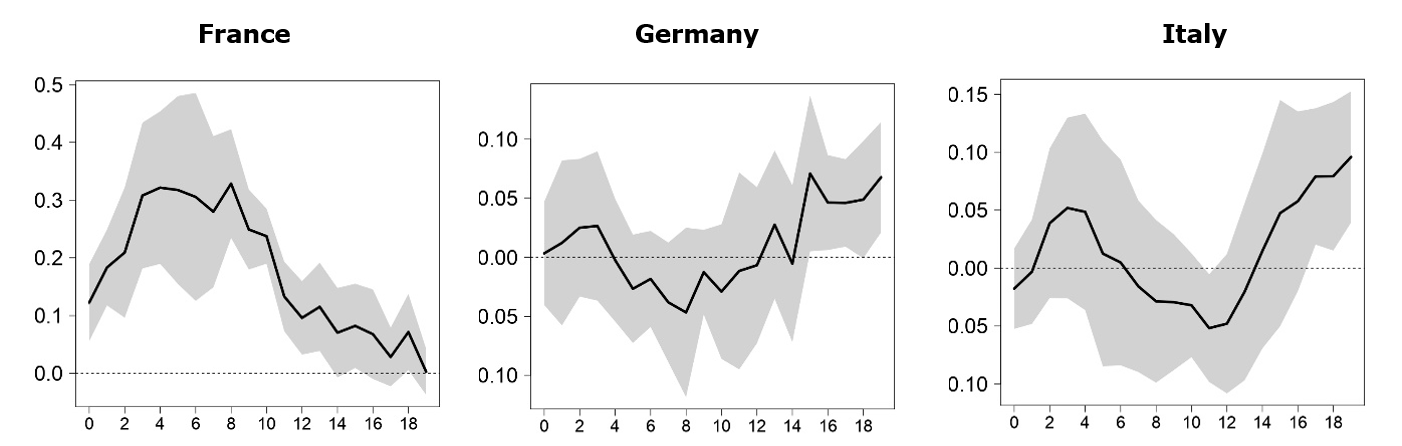

This theoretical reasoning has been supported by empirical research, such as Jordà et al., 2015 for advanced economies. These findings are not limited to interest rate policies (conventional monetary policy), but also unconventional monetary policy such as asset purchase programmes: Figure 1 shows recent estimates from local projections using high-frequency identified quantitative easing shocks from De Luigi et al. (2023). This method uses high-frequency financial data around press conferences of monetary policy decisions by the European Central Bank to identify pure monetary policy surprises in the data as opposed to monetary policy actions that might have been expected and are already priced in. These identified monetary policy shock series are then used to gauge the effect on house prices in a local projection framework.

Figure 1: Responses of house price growth to quantitative easing

Notes: The figure shows impulse responses of the quarter-on-quarter house price growth rate (in percentage points) to an expansionary quantitative easing shock. Bounds respond to 90% confidence intervals. Source: De Luigi et al. (2023)

The results in Figure 1 show how an expansionary quantitative easing shock leads to increases in house prices. The results highlight a central feature in understanding how monetary policy impacts housing markets: There is considerable heterogeneity in the transmission of monetary policy to housing prices. While in France, expansionary monetary policy leads to an immediate, positive and sizeable shock on housing prices, the effects in Germany and Italy are more back-loaded and muted. Similar results are found by Rahal (2016), who finds increasing house prices to expansionary easing and considerable heterogeneity in country-specific impulse responses. Going beyond the country-level, there is also evidence of monetary policy heterogeneity at the regional level, see Flora and Klarl (2024) for Germany.

Given the importance of the housing market for households, in upcoming work, Poyntner and Waltl (2024) use a survey experiment to assess how households view the relationship between monetary policy and housing prices.1 Regarding the understanding of monetary policy actions, we see that conventional monetary policy (interest rate setting) is generally well understood in the European countries we survey. However, the understanding of unconventional monetary policy is very limited. Moving to house price reactions to interest rate movements, we find that survey participants overwhelmingly associate decreasing interest rates with rising house prices, as predicted by theory. When confronted with information about this connection, respondents are willing to update their answers when the information comes from academic economists but are more reluctant to do so when the information comes from a central banker. These findings have important ramifications for the communication of monetary policy, financial literacy and the transmission of monetary policy.

Housing and Inequality

For most households, housing wealth is the most important component of their balance sheet. However, there is considerable heterogeneity in household wealth distribution between countries. Using data from the Household Finance and Consumption Survey (HFCS), property wealth of households can be compared between countries. In Austria and Germany, for instance, property wealth is negligible for the average household in the lower half of the wealth distribution, whereas in Italy and Spain, housing wealth is prominent in the lower part of the distribution as well De Luigi et al. (2023).

This reflects differences in housing markets regarding financing, ownership structure, and other factors. These differences govern the availability and relative prices of renting, buying, or public provision of housing. Data from the Luxembourg Wealth Study Database (LWS) show that in Germany, about 50% of households rent, while in Italy, only about 17%.

These differences in housing markets have important ramifications for the translation of monetary policy to household wealth: In countries where housing wealth is more evenly distributed, rising housing prices will potentially decrease wealth inequality, while in countries where property wealth is concentrated at the top of the distribution, house price increases will lead to higher wealth inequality. Given the importance of property assets for household wealth, the effects on the wealth distribution in this area are often quantitatively more important than those of financial asset price reactions to monetary policy. Equity price increases elevate wealth inequality across all euro area countries because they are concentrated at the top.

Taken together, it is both the differential initial distribution of housing wealth in the first place and the heterogeneous effect of monetary policy on house prices that make monetary policy transmission to inequality through asset prices a highly granular matter, posing challenges, especially for the Eurozone, where the same monetary policy stance can have possibly significantly different effects for different regions as well as population strata.

Implications

These findings are not only interesting for research on inequality but also are influential for the transmission of monetary policy. There is considerable heterogeneity in the transmission of monetary policy in euro-area countries. Corsetti et al. (2020) show that differences in housing markets contribute significantly to this heterogeneity. Specifically, differences in mortgage market characteristics can explain one-third of the differences in the transmission of monetary policy to output and consumption. In recent models incorporating household heterogeneity (Kaplan et al., 2018), households’ liquid and illiquid wealth positions play a key role for the propensity to consume and consequently the transmission of monetary policy.

* This article is an outcome of a research visit carried out in the context of the (LIS)2ER initiative which received funding from the Luxembourg Ministry of Higher Education and Research.

1 Please contact the authors before quoting.

References

| Bernanke, B. S. et al. (2010). Monetary policy and the housing bubble: a speech at the annual meeting of the American Economic Association, Atlanta, Georgia, January 3, 2010. |

| Coibion, O., Gorodnichenko, Y., Kueng, L., and Silvia, J. (2017). Innocent bystanders? Monetary policy and inequality. Journal of Monetary Economics, 88:70–89. |

| Corsetti, G., Duarte, J. B., and Mann, S. (2020). One money, many markets: monetary transmission and housing financing in the euro area. International Monetary Fund. |

| De Luigi, C., Feldkircher, M., Poyntner, P., and Schuberth, H. (2023). Quantitative easing and wealth inequality: the asset price channel. Oxford Bulletin of Economics and Statistics, 85(3):638–670. |

| Flora, M. and Klarl, T. (2024). Heterogeneous effects of ECB’s unconventional monetary policy on regional housing markets: A structural investigation of the recent housing boom in Germany. Mimeo. |

| Jordà, O., Schularick, M., and Taylor, A. M. (2015). Betting the house. Journal of International Economics, 96: S2–S18. |

| Kaplan, G., Moll, B., and Violante, G. L. (2018). Monetary policy according to HANK. American Economic Review, 108(3):697–743. |

| Poyntner, P. and Waltl, S. R. (2024). How do monetary policy decisions relate to price changes in housing markets? An assessment of public perceptions across five European countries. Mimeo. |

| Rahal, C. (2016). Housing markets and unconventional monetary policy. Journal of Housing Economics, 32:67–80. |

| Taylor, J. B. (2007). Housing and monetary policy. Technical report, National Bureau of Economic Research. |