Issue, No.27 (September 2023)

Wealth Inequalities and Homeownership – Two Perspectives*

1. Introduction

The provision of affordable housing has been a matter of great concern in almost all middle- and high-income countries for at least the last two decades. To address this challenge, various policies have been developed and implemented. While wealth inequality has generally risen in the last three centuries (Pfeffer & Waitkus, 2021), Dustmann et al. (2022) demonstrate that “changes in the housing market can be a key driver for increased inequality in income after housing expenditure (…)”. Their study illustrates that housing affordability of the bottom income quintile decreased while housing became more affordable for high-income earners, thus showing that housing in general and housing policies in specific are a matter of great concern for inequality research.

For many households, the own home is the single biggest asset. Accordingly, homeownership plays a key role in shaping wealth inequalities. To examine how different housing regimes indicators – homeownership in particular – influence wealth inequalities, I look at a few exemplary European countries which exhibit differing housing regime indicators. In this short paper, I first briefly discuss these specific indicators. Secondly, I calculate Gini coefficients in order to examine wealth inequalities with and without housing wealth and for subdivisions of renting and owning households. Finally, I demonstrate how the different housing regimes indicators are reflected in wealth inequalities in the exemplary countries (Austria, Germany, Slovakia, Spain, United Kingdom) in an explorative and descriptive way. For this purpose, I make use of wave X of the Luxembourg Wealth Study (LWS) which harmonises survey data from a total of 22 countries.

2. Housing Regimes

While the main goal of housing policies typically is to provide (eligible) population groups with (affordable) housing, they are also used to promote homeownership. Both objectives can contribute to wealth inequality. Two policies that subsidise mostly renting households are (i) direct housing allowances to eligible households (demand-side) and (ii) building social housing units (supply-side). Both raise (to a different degree) disposable income after housing costs of the targeted population and decrease income inequality after tax and transfers (Berard & Trannoy, 2023). Moreover, living in a public housing can also lead to a higher chance of acquiring homeownership due to the possibility of a higher saving rate during the subsidised tenancy (Goffette-Nagot & Sidibé, 2016).

A more direct policy intervention is to either regulate rent prices directly or to design legal protections of renters from unilateral terminations. The intensity of such policies vary across time and jurisdictions (Kholodilin, 2020). Besides the negative externalities of rent regulations, historical data shows a negative correlation between the degree of rent regulation and wealth inequality (Kholodilin & Kohl, 2023).

The most prominent example of how a housing policy can shape the distribution of wealth in a country is the promotion of homeownership. Homebuyers accumulate housing wealth by repaying their mortgage. Increasing the possibility to purchase a dwelling for the marginal household (i.e., the household that can just so afford no homeownership) should hence increase housing wealth for a larger number of households. In the same context, mortgage markets are important. An easier access to a loan could push the marginal household down in the income or wealth distribution (Flynn, 2020).

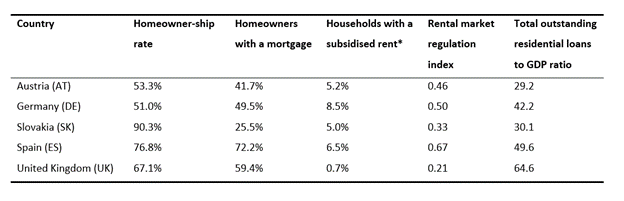

Table 1 gives a brief summary of some selected housing market and policy characteristics. These characteristics vary widely between the countries, which is why I will focus on a few remarkable numbers: Slovakia exhibits the highest share of owners and the lowest share of mortgage holding owners. Accordingly, Slovakia’s outstanding residential loans are – in tandem with Austria – the lowest among these five countries. The United Kingdom displays the lowest share of subsidised rents and rent regulation. At the same time, it has a comparably high share of indebted homeowners.

Table 1: Selected Characteristics of a Housing Regime

Note: All numbers refer to the year 2017 to be consistent with the later calculated wealth inequalities. *This includes renters living in a public housing unit and renters paying a subsidised or not rent.

Data source: Luxembourg Wealth Study (LWS) Database, except for the regulation index (Kholodilin, 2020) and the outstanding loans ratio (European Mortgage Federation, 2023).

3. Wealth Inequality in Five Countries

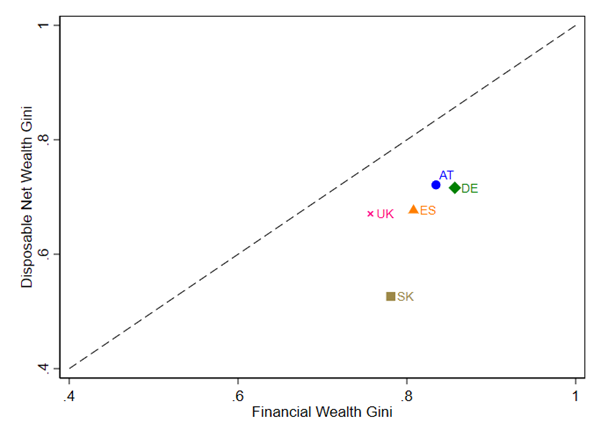

Homeownership accounts for the greatest part of a household’s wealth and has an equalising effect on wealth inequality (Pfeffer & Waitkus, 2021). For the selected five countries, the inequality of financial net wealth (which I define as disposable net wealth excluding net wealth of the primary residence) is higher than total disposable net wealth inequality (Figure 1). Excluding housing wealth, the inequalities in the two renting societies Austria and Germany are still higher than in Slovakia, Spain, and the UK.

Figure 1: Inequality of Disposable Net Wealth and Financial Wealth

Note: Disposable net wealth is defined as the sum of financial and non-financial assets, excluding pension entitlements, minus liabilities. I define financial wealth as the difference between disposable net wealth and the net wealth of a household’s primary residence (home equity).

Data source: Luxembourg Wealth Study (LWS) Database.

Figure 2 shows that the inequalities of the net and gross value of the primary residence are in all cases smaller than the inequality of total net wealth. For this sample it holds true that the higher the homeownership rate is in a country, the more unequal gross housing wealth is distributed. Net housing wealth is more unequally distributed than gross housing wealth in all countries. The differences in these inequalities do not precisely correspond to the mortgage market indicators (see section 2) but the difference is highest in Spain and the UK which both have a more liberal mortgage market.

Figure 2: Inequality of Disposable Net Wealth and (Net) Housing Capital

Note: It is displayed the Gini of gross (hollow marker) and net (filled) wealth of a household’s primary residence. The net value is calculated by subtracting the liabilities for that housing from its gross value.

Data source: Luxembourg Wealth Study (LWS) Database.

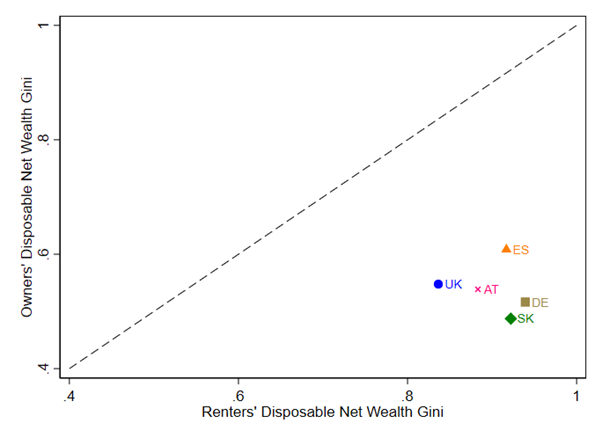

To investigate the differences of disposable net wealth of renters and that of owners, I calculate the Gini coefficients and contrast them in a scatter plot (Figure 3). It becomes visible that wealth inequality among renters is much higher than among owners. The highest inequality among renters is found in Germany with a Gini of 0.94. The UK exhibits the lowest coefficient (0.83). While the difference between the Gini of owners’ and renters’ wealth is lower in Austria, Spain, and the UK (0.29 – 0.34), it is larger in Germany (0.42) and Slovakia (0.44).

Figure 3: Inequality of Disposable Net Wealth of Renters and Owners

Note: The Gini coefficients of disposable net wealth are calculated separately for two groups of the country’s population: Homeowners who self-occupy their (partly) owned dwellings, and renters who pay (market, subsidised, or free) rent for their dwellings.

Data source: Luxembourg Wealth Study (LWS) Database.

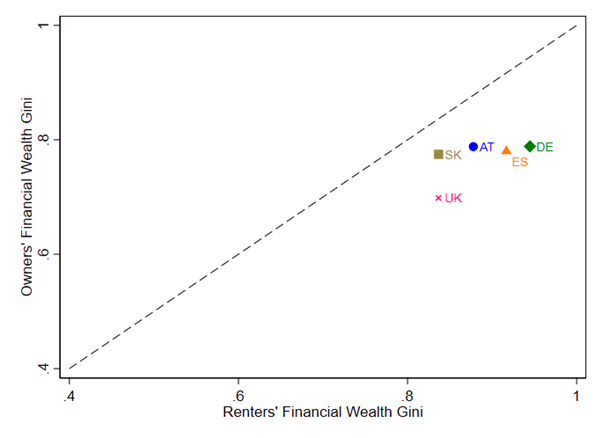

This difference is not all caused by the owner-occupied housing capital, as shown in Figure 4 which depicts the Gini coefficients of owners’ and renters’ wealth excluding housing capital. Even after excluding housing wealth, the inequality among renters is higher compared to owners in all five countries. While Germany exhibits again a larger renter-owner difference than Austria and the UK, Slovakia’s coefficient jumps down very close to its total wealth coefficient.

Figure 4: Inequality of Financial Wealth of Renters and Owners

Note: The Gini coefficients of financial wealth are calculated separately for two groups of the country’s population: Homeowners who self-occupy their (partly) owned dwellings, and renters who pay (market, subsidised, or free) rent for their dwellings.

Data source: Luxembourg Wealth Study (LWS) Database.

4. Discussion and Conclusion

From the above presented exploratory analyses, I raise the following four main points for further investigation. First, the (net) wealth of a self-occupied house reduces wealth inequality the most in Slovakia which has the highest share of homeowners in the sample. Austria and Germany with the lowest ownership shares have both the highest wealth inequality with and without the inclusion of housing capital. Although the UK and Spain have a comparably high share of homeowners, the equalising effect of home equity is similar to both of the aforementioned renting nations.

Second, gross housing wealth is more equally distributed than net housing wealth. The highest differences are found in Spain and the UK where a liberal mortgage market is in place.

Third, wealth inequality among renters is much higher than wealth inequality among owners. This again hints to an equalising general effect of homeownership. Slovakia and Germany expose similar inequalities among renters and owners while having widely differing homeownership rates.

Finally, wealth inequality of renters is still higher when excluding housing wealth. The discrepancy of wealth inequality between renters and owners is smallest in Slovakia and Austria – two countries with a highly different homeownership rate.

Summarising, it becomes evident that homeownership plays a great role in attenuating wealth inequality, however it cannot fully explain wealth inequality neither between countries nor the differences within a country between renters and owners. Besides the mere focus on homeownership rates, focusing on household finance and the interplay with the mortgage market might be a promising field of future research (Ansell, 2019; Blackwell & Kohl, 2018). It might be of interest to disentangle possible reducing factors of mortgages on entry barriers to homeownership and the risk of an overburden of debt. Furthermore, the basis of the wealth inequality calculation could be changed by the inclusion of household’s future pension claims. This resonates since homeownership is often seen as a part of the retirement plan. Once the mortgage is repaid, housing costs drastically decrease which lowers total living expenses. For this reason, the inclusion of pension/social security entitlements to a measure of the so-called augmented wealth could be beneficial. As the measurement is difficult and the question of pension claims is often excluded in the common surveys, it is also not part of the datasets used from the LWS. Recent literature estimates that wealth inequality (Gini) decreases by 0.08 to 0.3 looking at augmented wealth for retirees (Wroński, 2023). For the entire population, the Gini coefficient decreases by approximately 0.2 in Austria and 0.24 in Germany (Bönke et al., 2020; Knell & Koman, 2022). The reduction in the other three countries (SK, ES, UK) is far less between 0.06 and 0.14 (Sierminska & Wroński, 2022). Under full consideration of the role that homeownership plays as a retirement provision, the focus on augmented wealth inequality could open up a strand of future housing policy literature.

* This article is an outcome of a research visit carried out in the context of the (LIS)2ER initiative which received funding from the Luxembourg Ministry of Higher Education and Research.

References

| Ansell, B. W. (2019). The Politics of Housing. Annual Review of Political Science, 22(1), 165–185. https://doi.org/10.1146/annurev-polisci-050317-071146 |

| Berard, G., & Trannoy, A. (2023). Housing Policy Impacts on Poverty and Inequality in Europe (Working Paper 640). ECINEQ. http://www.ecineq.org/milano/WP/ECINEQ2023-640.pdf |

| Blackwell, T., & Kohl, S. (2018). The origins of national housing finance systems: A comparative investigation into historical variations in mortgage finance regimes. Review of International Political Economy, 25(1), 49–74. https://doi.org/10.1080/09692290.2017.1403358 |

| Bönke, T., Grabka, M. M., Schröder, C., & Wolff, E. N. (2020). A Head-to-Head Comparison of Augmented Wealth in Germany and the United States. The Scandinavian Journal of Economics, 122(3), 1140–1180. https://doi.org/10.1111/sjoe.12364 |

| Dustmann, C., Fitzenberger, B., & Zimmermann, M. (2022). Housing Expenditure and Income Inequality. The Economic Journal, 132(645), 1709–1736. https://doi.org/10.1093/ej/ueab097 |

| European Mortgage Federation. (2023). Hypostat 2023: A Review of Europe’s Mortgage and Housing Markets. EMF. |

| Flynn, L. B. (2020). The young and the restless: Housing access in the critical years. West European Politics, 43(2), 321–343. https://doi.org/10.1080/01402382.2019.1603679 |

| Goffette-Nagot, F., & Sidibé, M. (2016). Housing wealth accumulation: The role of public housing. Regional Science and Urban Economics, 57, 12–22. https://doi.org/10.1016/j.regsciurbeco.2015.11.004 |

| Kholodilin, K. (2020). Long-Term, Multicountry Perspective on Rental Market Regulations. Housing Policy Debate, 30(6), 994–1015. https://doi.org/10.1080/10511482.2020.1789889 |

| Kholodilin, K., & Kohl, S. (2023). Rent price control – yet another great equalizer of economic inequalities? Evidence from a century of historical data. Journal of European Social Policy, 33(2), 169–184. https://doi.org/10.1177/09589287221150179 |

| Knell, M., & Koman, R. (2022). Pension Entitlements and Net Wealth in Austria (Working Paper 238). Working Paper. https://www.econstor.eu/handle/10419/264830 |

| Pfeffer, F. T., & Waitkus, N. (2021). The Wealth Inequality of Nations. American Sociological Review, 86(4), 567–602. https://doi.org/10.1177/00031224211027800 |

| Sierminska, E., & Wroński, M. (2022). Inequality and Public Pension Entitlements (Working Paper 1212). GLO Discussion Paper. https://www.econstor.eu/handle/10419/267551 |

| Wroński, M. (2023). The impact of social security wealth on the distribution of wealth in the European Union. The Journal of the Economics of Ageing, 24, 100445. https://doi.org/10.1016/j.jeoa.2023.100445 |