Issue, No.26 (June 2023)

More Unequal or Not as Rich? Revisiting the Latin American Exception

(based on De Rosa, M., I. Flores, M, Morgan. (2022). More Unequal or Not as Rich? Revisiting the Latin American Exception, SocArXiv. August 24. doi:10.31235/osf.io/akq89)

Overview

Income inequality has regained attention in academia and politics, with rising trends observed globally over the past three decades (Alvaredo et al., 2018). Latin America, however, has been seen as an exception to this trend, with numerous studies documenting a decline in income inequality across the region during the first fifteen years of current century (López-Calva and Lustig, 2010; Gasparini et al., 2018; Sánchez-Ancochea, 2021). While recent studies based on administrative data cast serious doubts on this narrative, they cannot result in definitive assessments about the overall distribution due to low population coverage (Alvaredo, 2010; Souza, 2018; Burdíın et al., 2022).

This paper aims to reassess the prevailing narrative of declining inequality in Latin America by adopting an innovative approach (Alvaredo et al., 2016; Zwijnenburg, 2019). We build a comprehensive dataset that combines harmonized surveys, social security and tax data, and national accounts from ten Latin American countries. This approach allows us to reconcile micro and macro income data and address critical gaps, namely, in the coverage of top/capital incomes.

Our first contribution is to bring new evidence to the debate regarding the level and trend of inequality in Latin American countries. By distributing all macroeconomic income, we face a dilemma. If we assume that national accounts provide an accurate benchmark for aggregate incomes, our findings indicate that inequality in the region is much higher than previously believed. However, if we assume that official surveys are more representative of household incomes, the prevailing consensus on declining inequality is supported, albeit with the implication that Latin American households are considerably poorer than suggested by official macroeconomic statistics.

Additionally, while adjustments may cancel out inequality declines in some countries, falling inequality trends persist in others, though to a lesser extent. We also highlight the role of capital incomes and the top 1% in shaping overall inequality dynamics. The increasing contribution of capital incomes and top 1% incomes, combined with rising inequality within the top 1%, reveal the limits of Latin America’s celebrated redistributive efforts, which seem to have been exclusive to the bottom 99%.

As our second contribution, we estimate post-tax income series by considering macroeconomic values of all taxes, transfers, and in-kind spending. We estimate three post-tax distributions: “post-tax spendable,” “post-tax disposable,” and “post-tax national”. This allows us to estimate effective tax rates too, providing more insight to our understanding of redistributive systems in the region. They are mostly characterized by a regressive monetary redistribution, but progressive in-kind benefits, from both health and education spending.

It is important to note that our approach is experimental and tailored to address a specific research question. While it may be of interest to policymakers and the public, it is not considered the gold standard. Our work emphasizes the shortcomings in current income statistics, which obscure our understanding of economic growth and its distribution. This highlights the need for better, more integrated, and coherent income statistics from data producers in the region and worldwide.

The publication of this paper is accompanied by a forthcoming website, expected in September 2023, presenting interactive visualizations and download options to explore our data set.

Data and Methodology

This study builds estimates for ten countries: Argentina, Brazil, Chile, Costa Rica, Colombia, Ecuador, Mexico, Peru, El Salvador, and Uruguay. The data spans from 2000 to 2021.

The data construction involves four main steps. Firstly, we estimate the income distribution using harmonized survey data. Due to the limited representation of top incomes in surveys, administrative records from tax sources are incorporated to provide a more accurate representation of top incomes. 1 Secondly, the main income components, such as wages, property incomes, mixed income, pensions, and imputed rents, are scaled to match their corresponding national accounts aggregates. This scaling process ensures macroeconomic consistency in estimating inequality. Thirdly, additional incomes that are not captured in the household sector, such as corporate retained earnings and other incomes, are imputed to achieve a comprehensive representation of national income.

Post-tax series are generated by considering taxes, monetary transfers, and in-kind public spending. The incidence of personal income tax and social cash benefits is directly observed in administrative records and surveys, respectively. For other items, external sources including OECD and World Bank databases, as well as data from the Commitment to Equity project (CEQ), are used to allocate consumption taxes and in-kind spending to individuals. Micro-simulation techniques or proxies are employed as needed.

Growing richer and less equal?

The new millennium brought exceptional growth to Latin America, largely driven by a global increase in commodity prices. This period is often associated with a falling-inequality narrative based on survey-based statistics.

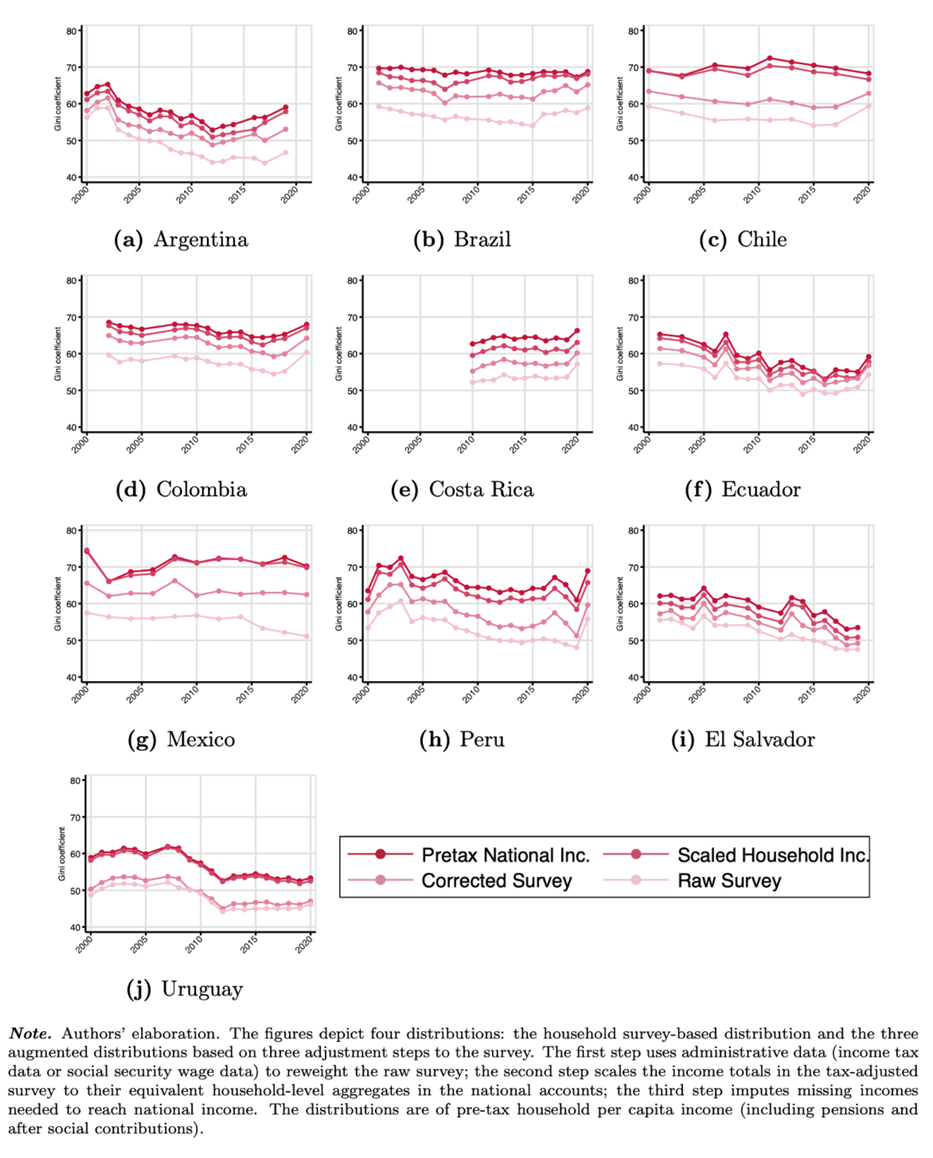

The evolution of the Gini coefficient (pre-tax income) is examined for four different income distributions. Notably, inequality estimates increase after each adjustment to the raw surveys. Adjustments based on tax data and scaling household incomes to national accounts both contribute to an increase in inequality. The allocation of undistributed corporate profits, imputed mostly to top percentiles, further contributes to this trend. These findings suggest that the region may either be more unequal than previously thought or not as economically prosperous as indicated by official macroeconomic statistics.

Figure 1: Gini Coefficients in four distributions

Furthermore, inequality trends show a diverse picture across countries. While some exhibit a downward trajectory throughout the period, others experience stability or even increases. Interestingly, falling inequality can coexist with stable or growing shares going to the top 1%. This highlights the need for a more nuanced understanding of inequality dynamics beyond a simple narrative based on general indices.

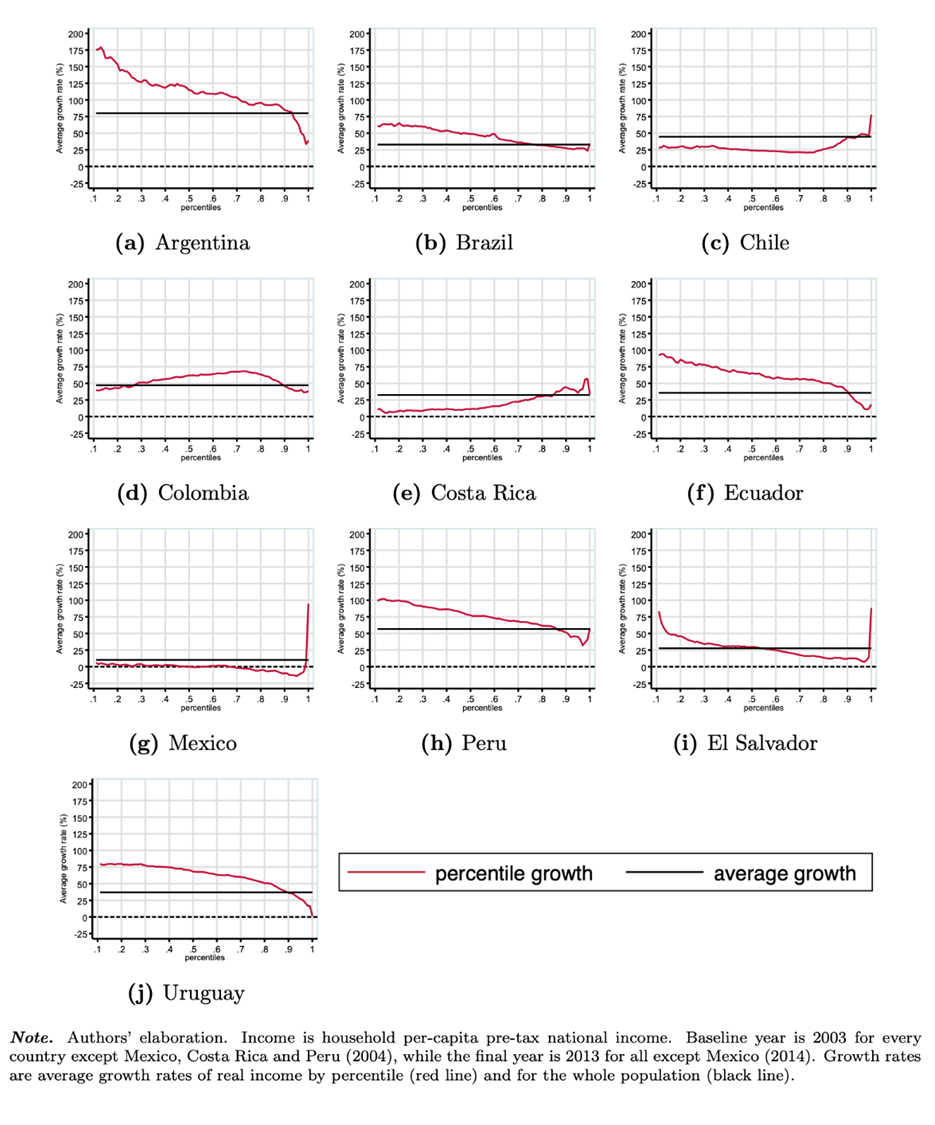

Growth incidence curves of pre-tax national income during the commodity boom period reveal that, in many cases, lower income groups experienced higher growth rates than the average. However, the top 1% outperformed the average in a few countries. Argentina and Uruguay stand out as countries where lower incomes consistently benefited from higher growth rates across all percentiles.

These findings emphasize the importance of adopting a macro-consistent framework that integrates various data sources and considers both measurement and conceptual differences.

Figure 2: Growth incidence curves during the commodity boom

Redistribution: Taxation, Transfers, and Spending

Previous studies have shown that direct taxes and cash transfers have a limited impact on reducing income inequality compared to wealthier countries (see Lustig et al., 2014). However, when considering social spending, the redistributive effect becomes more evident. Our study takes a comprehensive approach by analyzing the totality of national income, including national taxes, and national social expenditures.

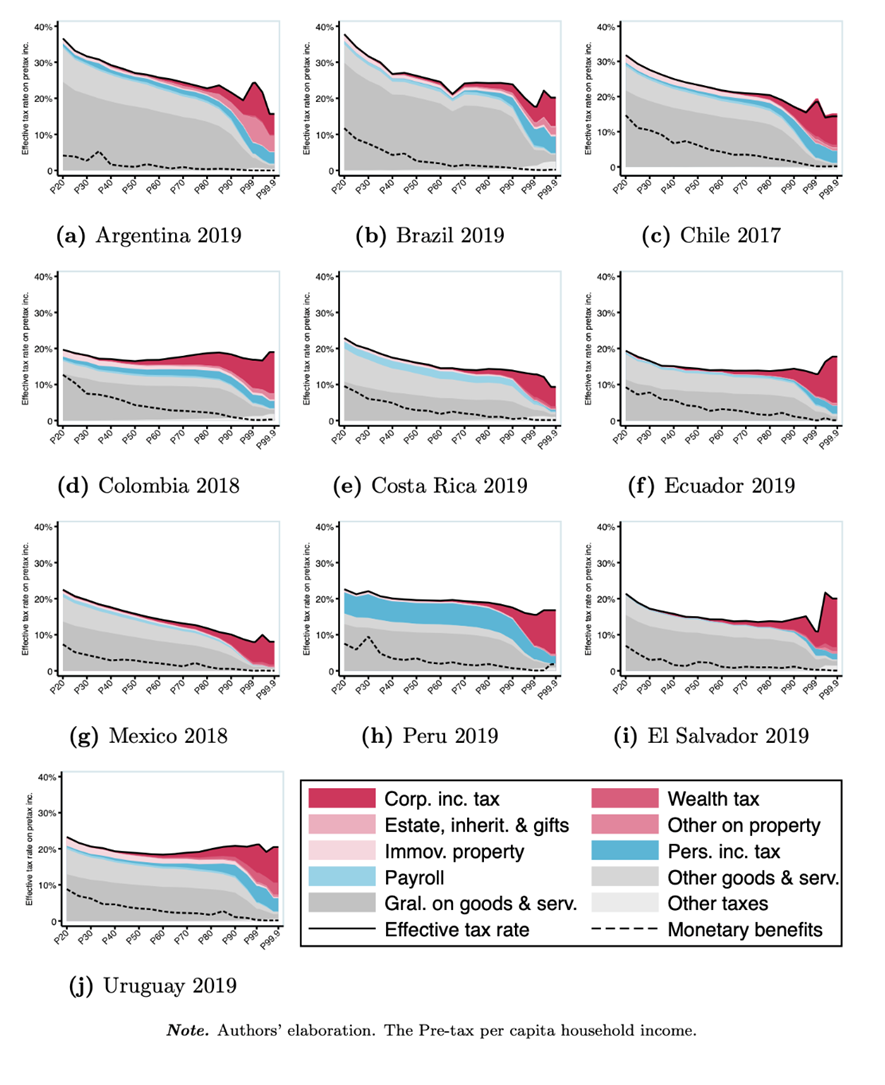

Examining the composition of national taxes in the region, we observe diverse patterns among countries. Consumption and production taxes constitute more than half of the total tax revenue in the region, while personal income taxes represent a relatively small share. Social security contributions vary considerably across countries, and property and corporate income taxes together make up about a quarter of total taxes.

Among progressive taxes, personal income taxation is redistributive in every country except for Peru. Wealth/property taxes and corporate income taxes also exhibit a progressive incidence, while taxes on goods and services, along with the residual category of “other taxes,” display regressive patterns. Monetary benefits, in the form of transfers, demonstrate a clear progressive profile across all countries.

The overall effect of taxes and transfers on the income distribution remains slightly regressive or neutral at best. Value-added taxes contribute significantly to the regressiveness, and their removal results in a substantial reduction in inequality throughout the region. The redistributive effect of the remaining taxes and transfers is mild, and their impact on reducing inequality is limited, except for specific periods in Brazil and Uruguay. Consequently, changes in the income distribution are primarily driven by pre-tax incomes.

Incorporating social spending in-kind, particularly in health and education, alters the narrative. However, the literature on income inequality in Latin America often overlooks in-kind social spending. Usually, inequality studies do not fully account for the entire tax and transfer system. In a cash basis, disposable income profiles exhibit regressiveness due to the weight and regressive nature of consumption taxes.

Overall, our findings indicate that the redistributive effect of public policies in the region, considering the totality of national income, taxes, transfers, and social spending, is limited. While personal income taxation and certain wealth/property and corporate income taxes exhibit a progressive impact, the dominance of regressive consumption taxes offsets the overall redistributive effect. Monetary transfers demonstrate a clear progressive profile but are insufficient to significantly reduce inequality. When in-kind social spending is incorporated, especially in health and education, inequality trends change, leading to falling inequality in most countries. The role of pre-tax income remains paramount in shaping income distribution, emphasizing the importance of addressing pre-tax inequality as a key driver of income disparities.

Figure 3: Incidence of taxes and transfers

Conclusion

This paper discusses trust in data sources and its impact on understanding dynamics. If we accept the region’s reported macroeconomic data, it implies greater wealth but also updating inequality estimates upward. However, by analyzing combined sources, we observe that inequality trends in big economies like Brazil, Mexico and Chile are flat or increasing during the high-growth years of 2003-2013. Adjustments to the raw survey data hamper the declining trend elsewhere, and in the post-2015 period of low growth, inequality increases faster in the augmented series compared to the raw series.

Our results indicate that the Latin America’s exceptionalism narrative is incomplete. While inequality decreased for the bottom 99% and wages regionally, this was not uniformly true when considering top income groups and capital incomes from outside the survey. This highlights limitations in the region’s redistributive experience. We also find that the falling inequality narrative becomes stronger when in-kind social spending is considered.

Although our analysis relies on imperfect and diverse data, it represents a unique effort to provide conceptually consistent inequality estimates by utilizing a wide array of data sources. However, we acknowledge the need for country-specific research to address data gaps and their implications for inequality analysis.

1 In practice, we use the method described in Blanchet, Flores, and Morgan (2022), which uses the ratio of survey observations to administrative observations by income percentile beyond a cut-off point (or “merging point”) to adjust survey weights, using the survey calibration theory. Please refer to the paper for more details.

References

| Alvaredo, F. (2010). The rich in Argentina over the Twentieth Century, 1932-2004. In A. B. Atkinson and T. Piketty (Eds.), Top incomes: A global perspective, pp. 253–298. Oxford University Press |

| Alvaredo, F., Chancel, L., Piketty, T., Saez, E., & Zucman, G. (Eds.). (2018). World inequality report 2018. Belknap Press. |

| Alvaredo, F., Atkinson, A., Chancel, L., Piketty, T., Saez, E., & Zucman, G. (2016). Distributional National Accounts (DINA) guidelines: Concepts and methods used in WID. world. |

| Blanchet, T., Flores, I., & Morgan, M. (2022). The weight of the rich: improving surveys using tax data. The Journal of Economic Inequality, 20(1), 119-150. |

| Burdín, G., M. De Rosa, A. Vigorito, and J. Vilá (2022). Falling inequality and the growing capital income share: Reconciling divergent trends in survey and tax data. World Development 152, 105783. |

| Gasparini, L., J. Bracco, L. Galeano, and M. Pistorio (2018). Desigualdad en países en desarrollo: ¿ajustando las expectativas? Documentos de Trabajo del CEDLAS; no. 224. |

| López-Calva, L. F. and N. C. Lustig (2010). Declining Inequality in Latin America: A Decade of Progress? Brookings Institution Press and United Nations Development Programme |

| Lustig, N., C. Pessino, and J. Scott (2014). The impact of taxes and social spending on inequality and poverty in Argentina, Bolivia, Brazil, Mexico, Peru, and Uruguay: Introduction to the special issue. Public Finance Review 42 (3), 287–303 |

| Sánchez-Ancochea, D. (2021). The surprising reduction of inequality during a commodity boom: what do we learn from Latin America? Journal of Economic Policy Reform 24 (2), 95–118. |

| Souza, P. (2018). A history of inequality: top incomes in Brazil, 1926–2015. Research in Social Stratification and Mobility 57, 35–45 |

| Zwijnenburg, J. (2019). Unequal distributions: EG DNA versus DINA approach. In AEA Papers and Proceedings (Vol. 109, pp. 296-301). |