Issue, No.23 (September 2022)

The Paradox of Redistribution in Time

Introduction

Welfare states reduce inequality through taxes and transfers, but countries differ greatly in how they carry out this function, both in their policies and outcomes. An OECD survey shows that the reduction in inequality ranges from 40% in Ireland to 5% in Chile (Causa and Hermansen, 2017). How can we explain this variance? Social policies shape their own support constituencies and complementary institutions, so, once in place, they tend to be very time persistent. Thus, comparative works need to observe how welfare state institutions shape distributive politics to explain differences in redistribution.

Korpi and Palme (1998) made the first empirical analysis of the redistribution achieved by different policies and suggested the existence of a paradox of redistribution. Targeting transfers to the poor may be more redistributive per euro spent, but it generates a zero-sum conflict between the poor and the middle classes, blocking coalitions in favor of welfare state expansion. In contrast, universal programs align the preferences of the poor and the middle classes and receive broader support, leading to higher spending and redistribution. In other words, the paradox states that there is a trade-off between the progressivity (the extent to which transfers focus on the poor) and the size of social spending: redistribution increases as transfers become bigger and less pro-poor.

However, more recent works argue that there is no trade-off between the size and the progressivity of social transfers: redistribution increases as transfers become more pro-poor. According to Kenworthy (2011) and Marx et al. (2016), the most redistributive welfare states are those that practice “targeting within universalism”: after securing universal coverage, they are making greater use of programs directed at the poor. Similarly, Brady and Bostic (2015) and Garay (2017) underline that in elitist welfare systems increasing redistribution requires reaching down the income ladder to include the poor.

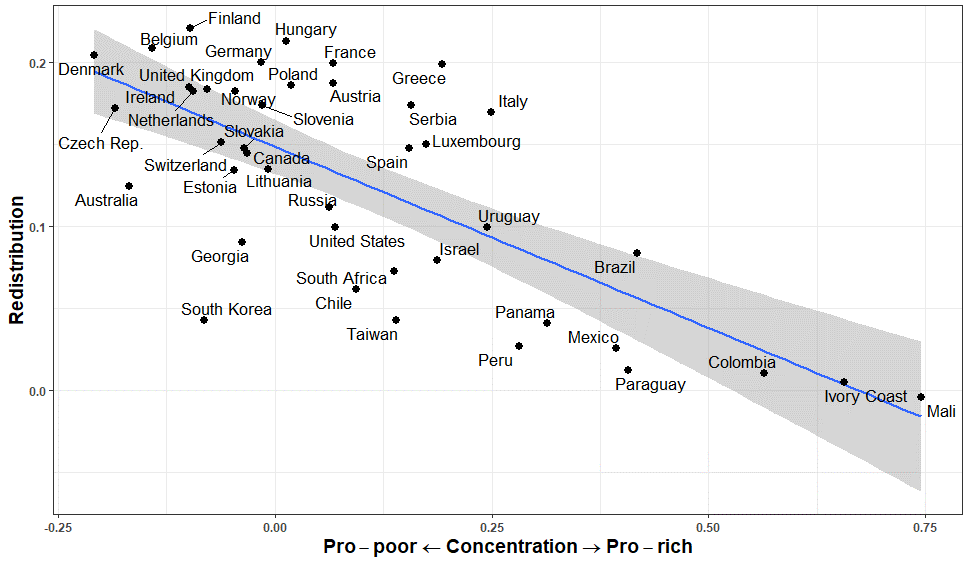

Figure 1 sets redistribution against the concentration of social benefits (a measure of how pro-poor or pro-rich they are) using data from the tenth LIS Wave (2015-2017). As can be seen, more pro-poor transfer systems are more redistributive, which would side with critics of the paradox. However, cross-country snapshots alone cannot capture the arguments made by the literature on targeting vs. universalism.

Figure 1. Concentration of social transfers and redistribution, LIS Wave X (2015-2017)

Source: LIS Wave X, own elaboration. .

Note: Concentration coefficient of net social transfers over disposable income.

Redistribution = Gini net factor income – Gini disposable income

The model

The paradox of redistribution and its critics propose arguments about political dynamics at the country level, so we need a longitudinal perspective to capture the effect of institutional persistence and policy feedback and to observe how redistribution increases over time. Does redistribution increase as countries make their social benefits more pro-rich or more pro-poor?

This research note further elaborates on the data presented in Garcia-Fuente (2021), where I argue that the relationship between redistribution and progressivity (how benefits are distributed) depends on the policy position a country is departing from, i.e., what its initial progressivity level is. This ties in with studies that show that progressivity mediates the relationship between income and preferences for redistribution (see e.g., Beramendi and Rehm, 2016; Holland, 2018). Progressivity determines what groups emerge as net fiscal winners or losers when social spending increases—who benefits and who pays—, which crucially affects the viability and direction of policy change.

In countries with pro-poor transfer systems, increasing social spending involves extending coverage up the income ladder to include richer constituencies. This reduces the number of net fiscal losers (people who pay more taxes than what they receive in benefits), easing the political constraints to increase spending and redistribution. The expansion of advanced welfare states fits this trajectory: departing from relatively pro-poor policies, many countries added earning-related supplements to keep the better-off in public insurance mechanisms (see e.g. Baldwin, 1990). However, as benefits become more pro-rich—or if the upper classes rely on private insurance—the margin to leverage this progressivity-size trade-off narrows.

In countries with pro-rich transfer systems, increasing social spending involves extending coverage down the income ladder to include the poor. Launching programs for the poor requires raising taxes or cutting the benefits of privileged insiders, which turns distributive politics into a zero-sum game: there is a clearly delineated gap between fiscal losers and winners, and increasing redistribution is politically costly. Latin American countries are representative of these dynamics, as rural and informal workers pay few taxes and benefits are captured by middle-class insiders.

Data and indicators

To conduct my analysis, I have extracted data for all LIS datasets available in July of 2022, totaling 646 surveys from 53 countries. To make all surveys comparable, I “net-down” social transfers in gross datasets following Nieuwenhuis et al. (2017). I measure redistribution as the change in the Gini coefficient from the distribution of net factor income (after direct taxes and social contributions, before transfers) to the distribution of disposable income. This isolates the redistributive impact of transfers, treating them as if they were last in the fiscal sequence (it excludes the effect of taxes and in-kind benefits, such as health care). Finally, I include the redistributive effect of pensions in my analysis—I do not consider them market income as other works do.

In what follows, I use several indicators to measure how pro-poor or pro-rich social benefits are, like the concentration index or their distribution across income quintiles. More significantly, I take the distribution of disposable income (after direct taxes and transfers) as the reference point. Models of redistribution based on the median voter theorem link political behavior to market income (before taxes and transfers), but, unless uncertainty over fiscal policy is high, political power and preferences are linked to disposable income. For instance, recipients of generous public pensions might be at the bottom of the market income distribution, but they are not poor in any politically meaningful sense. It is only in relation to disposable income that we can establish how pro-poor or pro-rich benefits are.

Results

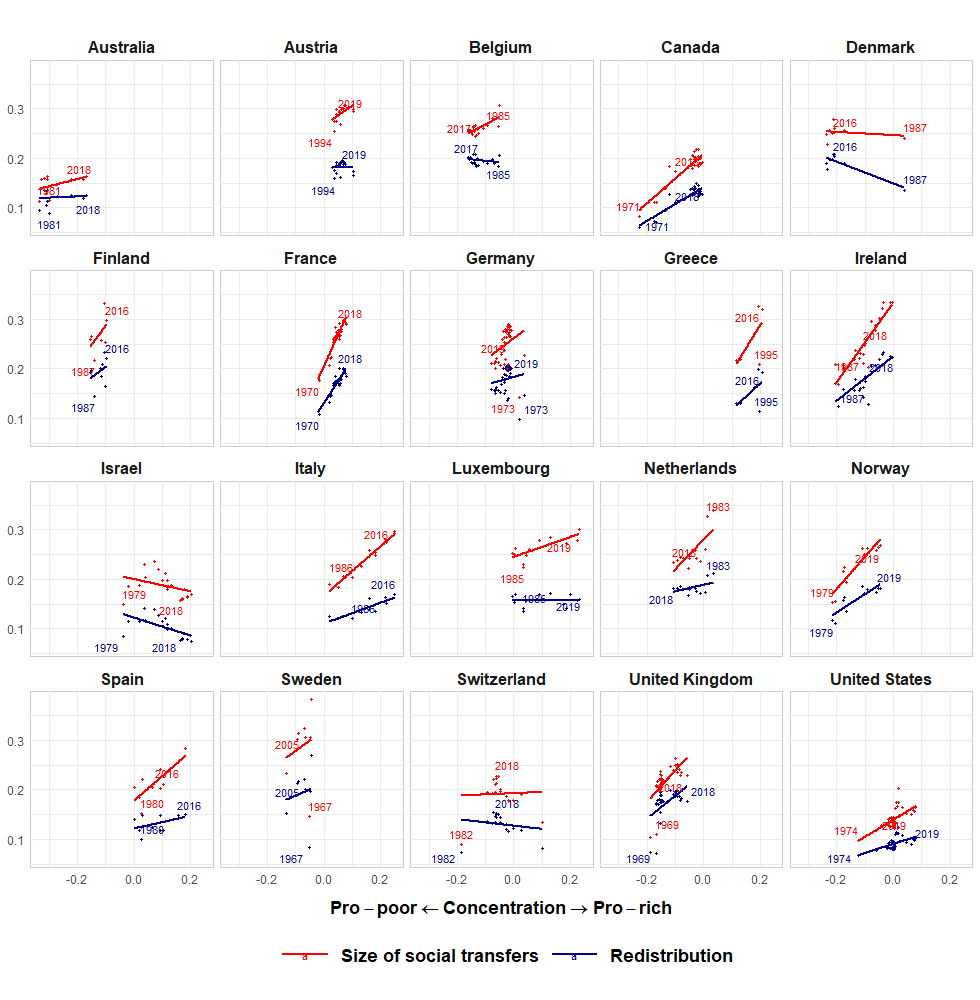

Figure 2 shows the relationship between the concentration of social transfers, their size (in red) and the redistribution they achieve (in blue). In most of them, redistribution is either uncorrelated with concentration or correlated with more pro-rich transfers. The relationship between concentration and the size of social transfers is clearer: higher spending is tied to more pro-rich transfers in most countries. Thus, there is a trade-off between the size and the progressivity of social benefits, which matches the predictions of the paradox.

Figure 2. Concentration, size, and redistribution of social transfers in 20 rich countries

Source: LIS Wave X, own elaboration. .

This pattern is especially strong in Ireland, Canada, the United Kingdom and Norway. Starting from markedly pro-poor positions, these countries have improved redistribution increasing spending and reducing their focus on the poor. For instance, redistribution through social transfers in the United Kingdom increased from 7 Gini points in 1974 to 18 Gini points in 2018, while the share of total transfers received by the poorest quintile decreased from 37% to 16%. However, this trade-off is not limited to the most progressive welfare states: Spain, Italy and Greece—which were not very pro-poor to begin with—have also increased redistribution by making their transfers bigger and more pro-rich. Overall, other than Denmark—the poster child of “targeting within universalism”—and Israel, there are no examples of countries in which redistribution is higher when benefits are more pro-poor.

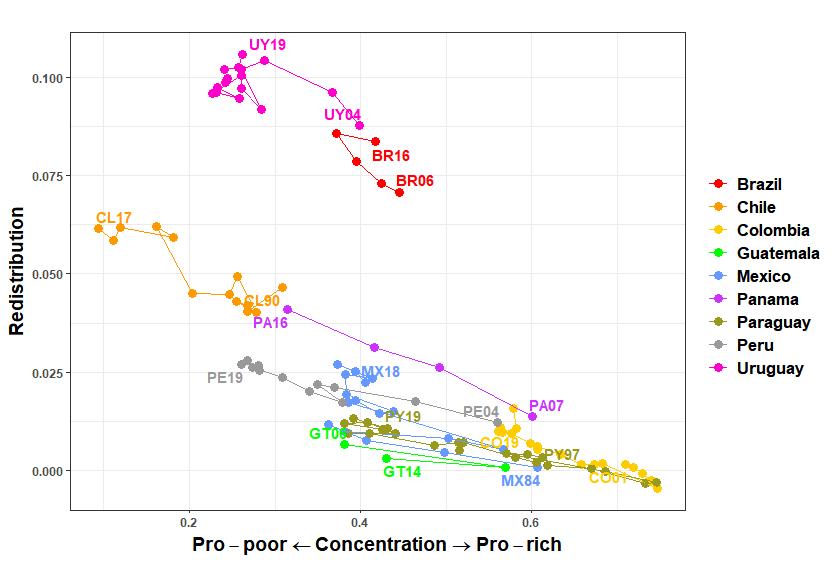

On the opposite side of the policy spectrum, social transfers in Latin America are very pro-rich (their concentration indexes are significantly higher than in advanced welfare states) and achieve little redistribution (see Figure 3). Their trajectories show that they are slowly becoming more pro-poor, but this has translated into small improvements in redistribution. In Mexico, for example, between 1984 and 2018 the share of total social transfers obtained by the poorest quintile went from 2% to 10%, while the share received by the richest quintile decreased from 66% to 52%. Yet, redistribution through social transfers remains very low (2.2 Gini points in 2018, from 0.1 Gini points in 1984).

Figure 3. Concentration of social transfers and redistribution in Latin America

Source: LIS Wave X, own elaboration. .

The results above show that the relationship between the progressivity, size and redistributive impact of social transfers varies depending on the policy position a country is departing from, which is consistent with the model of distributive politics described above. In many advanced welfare states, higher spending and redistribution are correlated with transfers being more pro-rich, which matches the paradox of redistribution. In contrast, the paradox does not capture the relationship between progressivity and redistribution when social policies focus on the rich. Spending more is not sufficient in countries with pro-rich programs—they would also have to direct a growing share of their social transfers to the poor to increase redistribution.

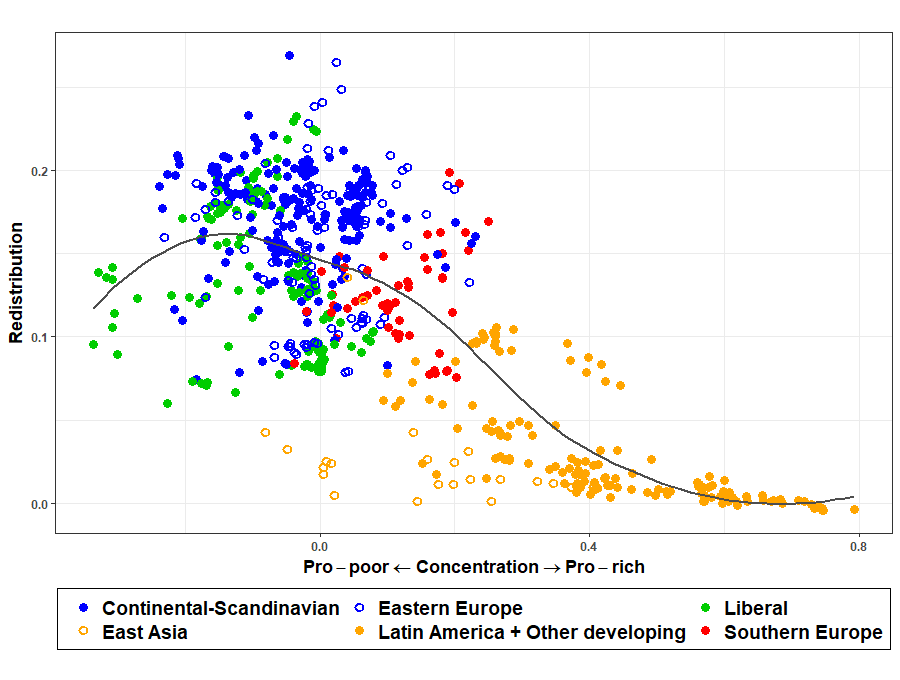

Taking this into account, the achievements of advanced welfare states in the postwar era might not be replicable in Latin America and other middle-income countries. Figure 4 shows data on concentration and redistribution for all the observations in my sample. Latin American and other developing welfare states (in orange) start from a position that is significantly more biased towards the rich, which questions their capacity to match the redistributive levels of advanced welfare states.

Existing welfare policies play a key role in this regard. Developing countries have expanded social assistance and other non-contributory provisions in the last decades, but it has been difficult to scale them up to achieve truly universal outcomes. The upper-middle classes block the expansion of programs that are fiscally costly and exit those that are less generous or dilute their entitlements, whereas the poor are often not supportive of government intervention and prefer low taxes and informal employment instead (for a detailed review of these issues see Holland and Schneider, 2017; Franzoni and Sánchez-Ancochea, 2016).

Figure 4. Concentration of social transfers and redistribution by region (1967-2019)

Source: LIS, own elaboration .

Concluding remarks

The main takeaway from this research note is that welfare state institutions condition the expansion of social spending and the possibilities for inequality reduction. Two points are worth emphasizing.

First, the experience of advanced welfare states shows that increases in redistribution come almost invariably from making social transfers bigger and less pro-poor. However, distributive conflicts around the expansion of social protections unfold very differently in countries with pro-rich programs. Thus, the policies and political strategies employed in the expansion of advanced welfare states—and the theoretical models that describe them—might not be directly applicable in cases where distributive politics is zero-sum. For instance, issues of timing and sequence—who gets what, but also when—are essential to understanding differences between welfare states. A necessary factor for the small redistributive power of developing regions is that generous social insurance for the middle classes developed before the extension of universal safety nets, precluding the kind of expansion that characterized advanced welfare states.

Second, the same level of inequality reduction can have very different social and normative implications depending on which needs and groups are getting recognized and which are not. In theory, a system of generous contributory pensions and a comprehensive social assistance program can achieve the same level of redistribution. Redistribution by itself does not tell us how egalitarian or inclusive a welfare state is. However, this does not mean that redistribution is a poor yardstick for comparative analysis and policymaking, or that we need to narrow it by excluding the effect of pensions and social security programs, as some works do. Instead, we must supplement data on redistribution with measures of coverage and the distribution of social benefits to obtain a more precise estimation of what needs slip through the net.

References

| Baldwin, P. (1990). The Politics of Social Solidarity: Class Bases of the European Welfare State, 1875-1975. Cambridge University Press. |

| Beramendi, P. and Rehm, P. (2016). Who gives, who gains? Progressivity and preferences. Comparative Political Studies, 49(4):529–563. |

| Brady, D. and Bostic, A. (2015). Paradoxes of social policy: Welfare transfers, relative poverty, and redistribution preferences. American Sociological Review, 80(2):268–298. |

| Causa, O. and Hermansen, M. (2017). Income redistribution through taxes and transfers across OECD countries. OECD Economics Department Working Papers, No. 1453. |

| Franzoni, J. and Sánchez-Ancochea, D. (2016). Achieving universalism in developing countries. Background paper for Human Development Report, UNDP. |

| Garay, C. (2017). Social policy expansion in Latin America. Cambridge University Press. |

| Garcia-Fuente, X. (2021). The Paradox of Redistribution in Time. Social Spending in 53 Countries, 1967-2018. LIS Working Paper Series, No. 815. |

| Holland, A. C. (2018). Diminished expectations: Redistributive preferences in truncated welfare states. World Politics, 70(4):555–594. |

| Holland, A. C. and Schneider, B. R. (2017). Easy and hard redistribution: The political economy of welfare states in Latin America. Perspectives on Politics, 15(4), 988-1006. |

| Kenworthy, L. (2011). Progress for the Poor. Oxford University Press. |

| Korpi, W. and Palme, J. (1998). The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries. American Sociological Review, 63(5):661–687. |

| Marx, I., Salanauskaite, L., and Verbist, G. (2016). For the poor, but not only the poor: On optimal pro-poorness in redistributive policies. Social Forces, 95(1):1–24. |

| Nieuwenhuis, R., Munzi, T., and Gornick, J. C. (2017). Comparative research with net and gross income data: An evaluation of two netting down procedures for the LIS Database. Review of Income and Wealth, 63(3):564–573. |