Issue, No.14 (June 2020)

Still the Lands of Equality? On the Heterogeneity of Individual Factor Income Shares in the Nordics

As far as standard measures of income inequality are concerned, the Nordic countries rank among the most equal economies in the world. We study whether and how this picture changes when the focus is on inequality of income composition, meaning the heterogeneity in the factor income shares of individuals. Income composition inequality is measured in our study through the ICI index introduced in Ranaldi (2020).

If we divide individual income into labour and capital, income composition inequality is high whenever the bottom and the top of the total income distribution separately own the two income sources. As an example, whenever the total factor income of wealthy individuals is made up of a higher share of capital income relatively to the poor, income composition inequality is high. Such an economy approaches the ideal-type Milanovic (2017) defines as classical capitalism. In contrast, whenever individuals across the total income distribution own equal shares (with respect to their own total factor income) of capital and labor income, income composition inequality is low. The latter defines a situation of new capitalism in which both rich and poor individuals own different sources of income. Notice that even in a world in which income composition inequality were to be low, there would still be individuals with higher total incomes than others, and significant inequalities might therefore persist.

In order to provide estimates of income composition inequality for the Nordic countries we utilize the LIS (2020) data, which is harmonized and allows a cross-country comparison. For all of the four countries under analysis, the source of the data included in the LIS database is derived from the national statistical institutes, with relatively high population coverage.

In the core of the paper we adopt a single baseline definition of income, based on the LIS factor income, hence excluding transfer income.1 The use of market factor income, rather than net disposable income, allows us to measure the pre-tax concentration of factor incomes across the income distribution.

We define capital income (Π) as the sum of property income (Πpr), comprising rental income, interest, dividends and capital gains and the capital component of net self-employment income (Πse). Labor income (W) includes wage income (Wwa) and the labor component of net self-employment income (Wse).

As regards the unit of analysis, we employ household-level data adjusted by the LIS (2020) database sample weight (hpopwgt). Then we multiply the LIS (2020) household weights by the number of household members (given by the variable nhhmem in the LIS (2020) data variable list).

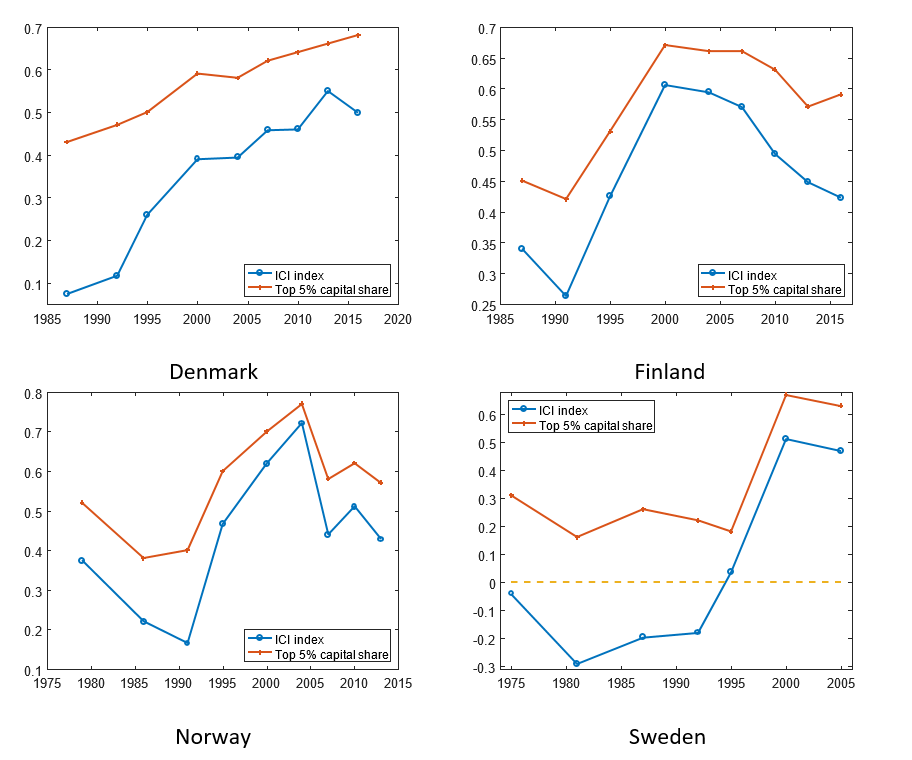

We highlight the structural change that has been taking place in all the Nordic countries since the early 1990s, visible from Figure 1, with rising inequality in the composition of individual incomes due mostly to a shift in capital incomes towards the top of the distribution. In fact, the evolution of capital shares accruing to the top 5% in the distribution of total factor income is closely related to the trends in the ICI index. This result indicates that in the last decades the Nordic countries have been moving towards the ideal-type of economic system of classical capitalism, as defined by Milanovic (2017).

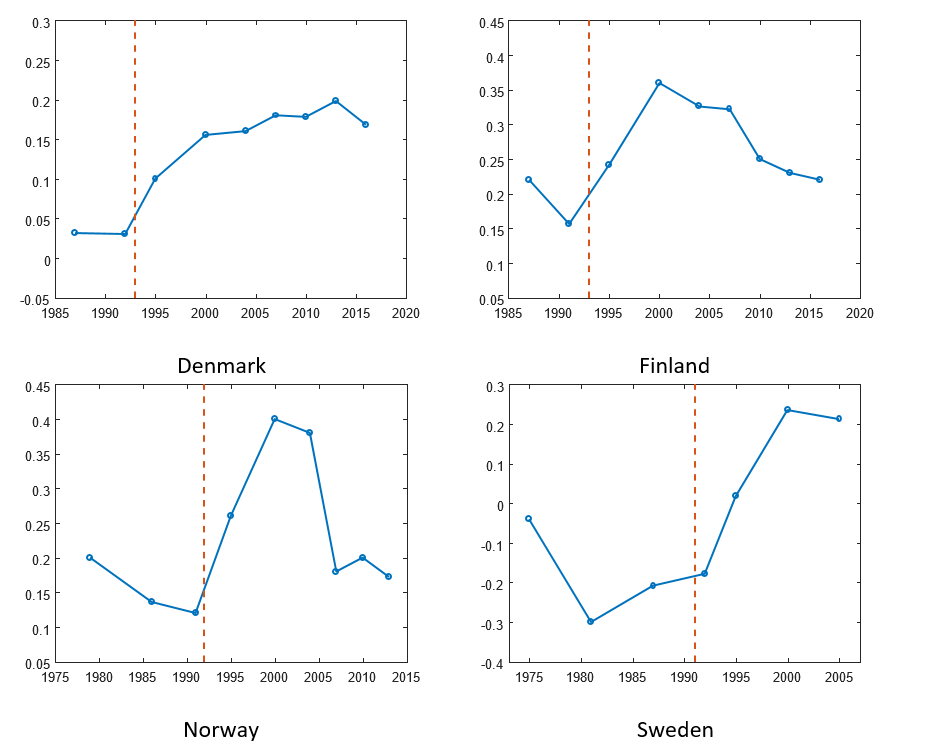

What is also striking is that the start of the increasing trend in income composition inequality in all the Nordic economies corresponds to the years of the introduction of Dual Income Taxation reforms in the 1990s. These reforms reduced tax rates on capital incomes, shrinking the progressivity of the rates or even reducing them to a proportional flat tax. In Figure 2 we plot the elasticities of the Gini coefficient to changes in the aggregate capital share of income estimated from the index. The vertical lines correspond to the introduction of the DIT system in the different countries. What this figure shows is that a reduced progressivity in the tax system, and an increased asymmetry in factor taxation, might not only increase income inequality directly but also indirectly by increasing the elasticity of personal income inequality to changes in the capital share of income. It also suggests that the ICI index is able to capture increasing asymmetries in taxation, which is typically not directly observable from the Gini coefficient.

Our estimates of the degree of income composition inequality also allow a descriptive analysis of the role of functional distribution as a determinant of personal income inequality in the Nordics. Piketty (2014)’s finding of capital having made a comeback and the related prediction that an increased capital share of income would imply higher personal income inequality has spurred an interesting debate. Bengtsson and Waldenström (2018) in a cross-country study find that the relationship between share of capital and personal income inequality varies across time and countries. Milanovic (2017) defines two necessary and sufficient conditions for the prediction being true. Ranaldi (2020) summarizes these two conditions into one, namely a high degree of income composition inequality.

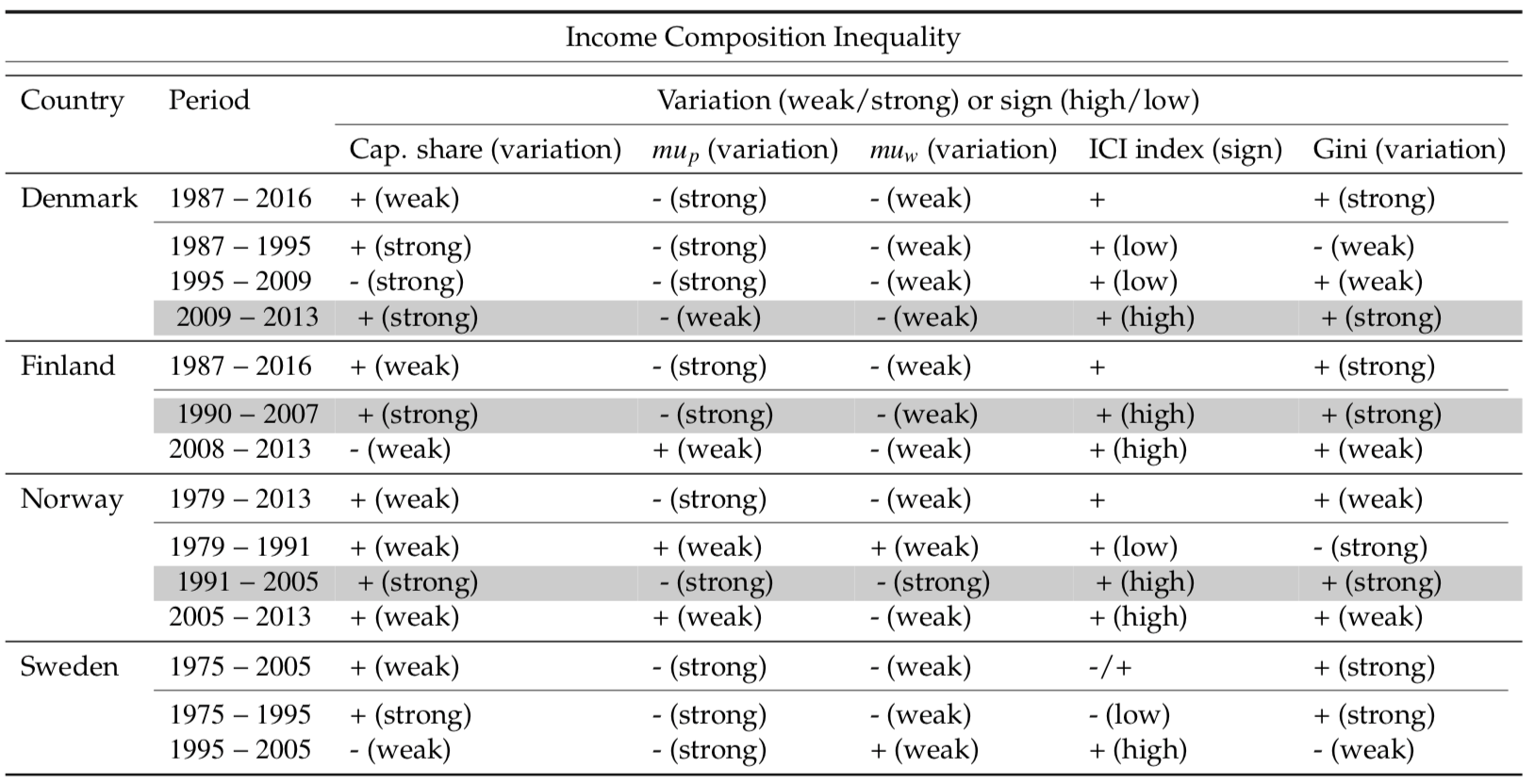

We summarize the main results of the paper in Table 1. For each country and period under study, the table shows the variation in the aggregate net capital share2 , the evolution of the areas below the concentration curves respectively for capital income (µp) and labor income (µw), these being the building blocks affecting the sign and magnitude of the ICI index. Finally, the table presents the variation in the market Gini coefficient3.

We show that for Denmark in the period 2009−2013, Finland 1990−2007, and Norway 1991− 2005, rising capital shares of income contributed to changes in personal income inequality, whilst for Sweden the evidence leads to disregard the capital share as a determinant of income inequality. In the summary of results shown in Table 1, the shaded sub-periods refer to years in which we observe an increasing aggregate capital share together with high levels of the ICI index and rising income Gini coefficients. The high level of the ICI index suggests that in those periods the capital share has been a relevant determinant of personal income inequality in these countries. The other sub-periods are characterized by either an ICI index that is quite low in absolute value and close to 0 or by limited variations in the capital share.

Given the non-constant and country-specific nature of the relation between functional and personal income inequality, the approach used in this work represents a way to study this heterogeneity in depth. Moreover, the income composition inequality index proposed by Ranaldi (2020) might represent an important source of information for the design and the understanding of the results of broader cross-country analysis on the topic.

We argue that if the trends of increased heterogeneity among individual factor shares uncovered in this work persist, and if these are coupled with more significant increases in the aggregate capital share, the transmission from the functional to the personal distribution of income might represent an important factor potentially increasing personal income inequality in the Nordic economies in the future.

Figure 1: Income Composition Inequality index

Note: For each of the four countries under analysis, we plot the series of the elasticities, obtained by using the series of the µπ and µw. The vertical reference line signals the introduction of the DIT system: 1993 for Denmark and Finland, 1992 for Norway, 1991 for Sweden.

Table 1: Summary of results by country

Figure 2: Elasticities and Dual Income Taxationy

1In the paper we perform a robustness check by including transfer income and it turns out that the trends in the evolution of the index do not change significantly.

2 The series for the capital share of income (value added net of capital depreciation minus compensation of employees) are obtained from the Bengtsson-Waldenström Historical Capital Shares Database (Bengtsson and Waldenström, 2018). Capital share is computed as the sum of capital incomes (interest, profits, dividends, realized capital gains), divided by value added calculated at factor cost, net of capital depreciation.

3 The series of the Gini coefficients in the Nordic countries are all retrieved from the World Inequality Database, WID.World (2020). The Gini coefficients are computed from pre-tax national income, the unit of analysis being individual adults (equal-split series).

References

| Bengtsson, E. and Waldenström, D. (2018). Capital Shares and Income Inequality: Evidence from the Long Run. The Journal of Economic History, 78(3):712–743. |

| Luxembourg Income Study (LIS) Database, http://www.lisdatacenter.org (multiple countries; January 2020 – April 2020). Luxembourg: LIS. |

| Milanovic, B. (2017). Increasing capital income share and its effect on personal income inequality. In Boushey, H., de Long, B., and Steinbaum, M., editors, After Piketty: The agenda for economics and inequality, pages 235–239. Harvard University Press. |

| Piketty, T. (2014). Capital in the 21st century. Harvard University Press. |

| Ranaldi, M. (2020). Income Composition Inequality. Stone Center for Socio-Economic Inequality Working Paper Series, no.7, City University of New York (CUNY). |

| WID.World (2020). World Inequality Database. https://wid.world/data. |