Issue, No.4 (December 2017)

Relative vs. absolute income development among the elderly between 2000 and 2010/13

During the last decades, younger cohorts of the elderly population strongly benefitted from the continued maturing of more generous contribution-based pension systems. At the same time, many countries further introduced non-contributory minimum pension protection systems, resulting in a rather steep decrease in poverty rates among the elderly throughout this period. However, besides this positive development, one might wonder what has happened to income inequality among the elderly? Who are the best performers with respect to increased income standards? And is it actually true that the elderly are better off in all advanced economies?

Foremost, the argument in this article concentrates on the technical side, i.e. the choice of measurement techniques for analysing income levels in a comparative perspective. A specific focus is placed on equivalisation, ppp-conversion and the distinction between relative and absolute income measures. Lastly, this article attempts to briefly respond to some of the questions raised with respect to the nuances of income inequality and income growth among the elderly over time.

A standard approach in inequality research is to equivalise household income. This means two things: First equivalisation assumes full sharing of income sources across all household members. Second equivalisation also assumes that larger households share resources and thus need less resources compared to smaller households, they achieve economies of scale (Jenkins and Van Kerm, 2009). This approach has some limitations, which should be acknowledged at this point. In Latin American countries as well as in most other developing countries in the LIS Database, every second person aged 65 or older is living in a multi-generation/family situation. This has two implications: First, the pooling of income sources and equal sharing between all household members is a strong assumption to make for the elderly. And second, the financial well-being of the elderly is heavily defined by the reallocation of other income sources (particularly employment) from other family members. Therefore, these countries are excluded from this comparative overview, the narrative becomes more a story of generosity of pension systems1. For the remaining countries, the common equivalisation approach by LIS is applied, which divides the disposable household income (DHI) by the square root of number of household members. Note the remaining numbers have to be understood as individual level income measure.

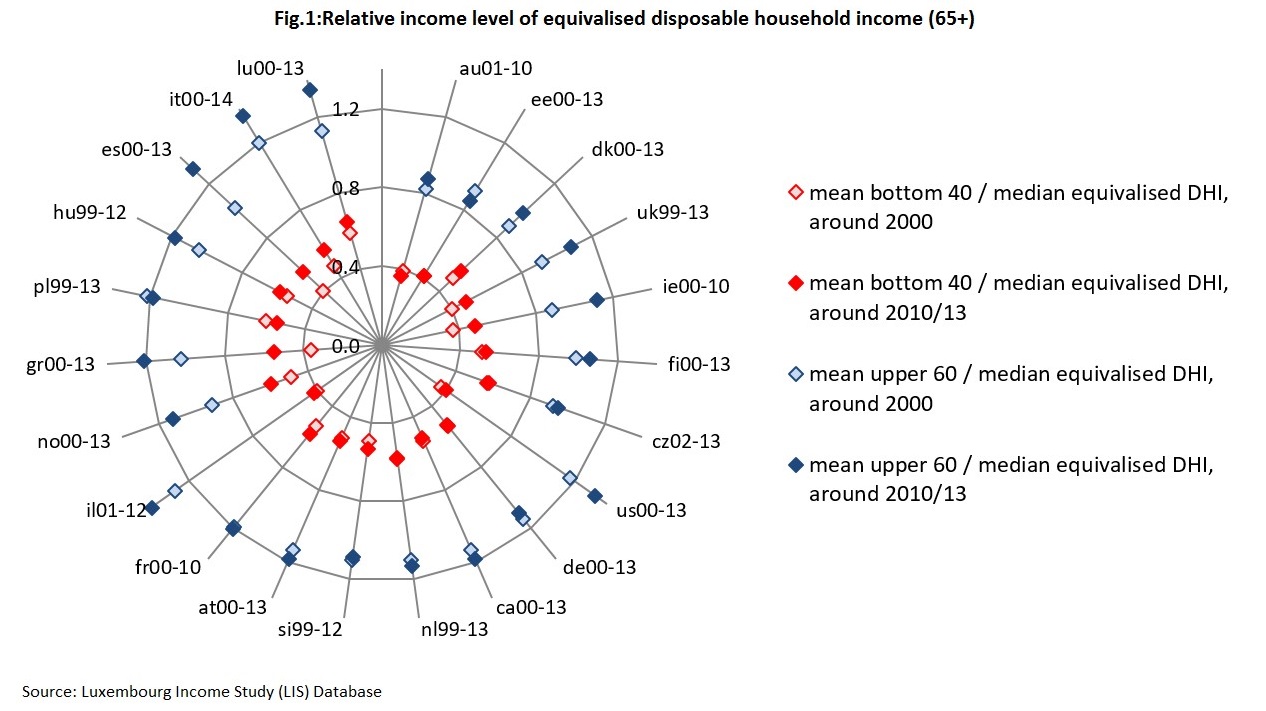

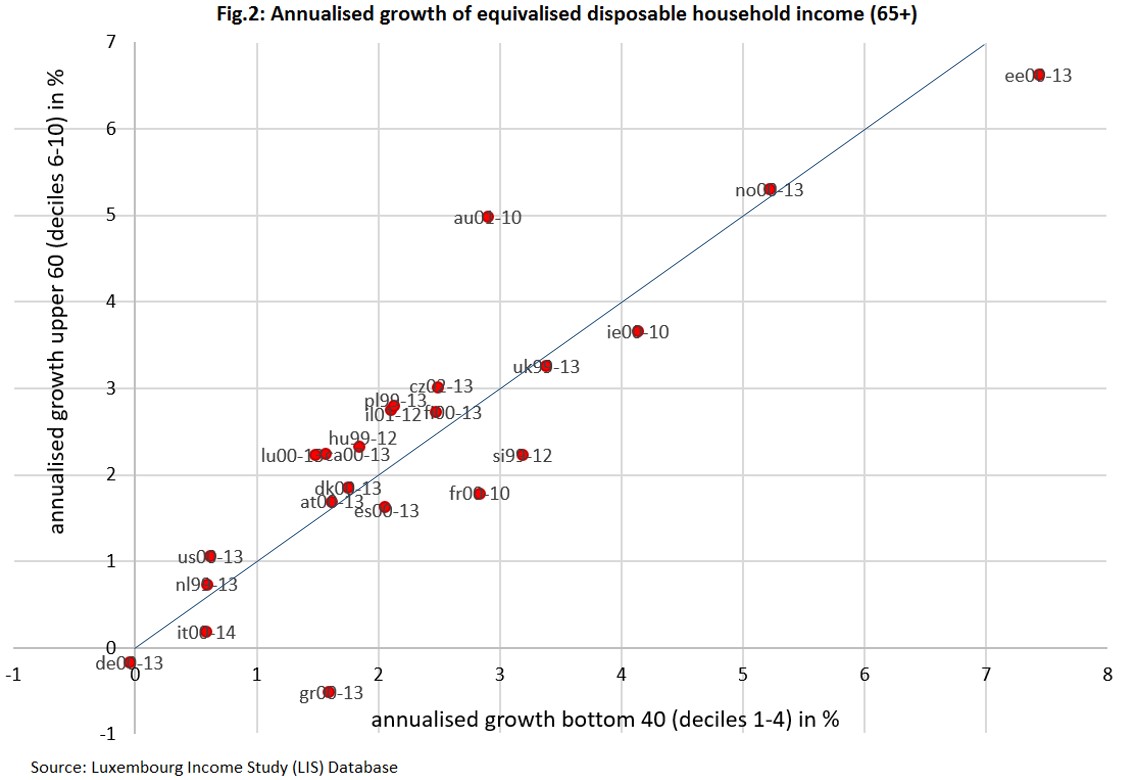

Both figures refer to the same underlying income thresholds. First, the median of equivalised disposable household income (DHI) of the total population was calculated. Then for the reduced sample of the elderly population (defined as persons aged 65+), three thresholds were calculated: the median of equivalised DHI of the 65+, the mean equivalised DHI of the four lower income deciles (bottom 40) of the 65+, and the mean equivalised DHI of the six upper income deciles (upper 60) of the 65+2. For each country two points in time have been selected, one around 2000 and one around 2010/13 depending on data availability.

Figure 1 shows two relative measures applied on both time points (repeated cross-section): the mean equivalised DHI of the bottom 40 respectively the upper 60 of the 65+ each divided by the median equivalised DHI by the total population. The countries are ranked clockwise by starting with the lowest level of median equivalised DHI for the 65+.

Australia’s position in the graph is unique, but acknowledged, as major parts of the contribution-based superannuation schemes were introduced only in the 1980s; those systems need to further mature, persons who started their working career in the 1980s are not yet retired. Hence the current retirees receive only partial benefits from these schemes. Moreover, many pensioners received their pension rather as a lump sum than as an annuity (King et al., 2001). Also, Denmark ranks only third on median equivalised DHI of the 65+. Similarly, like in Australia, the pension system concentrated on providing basic pensions, and only in the 1990s introduced major quasi mandated contribution-based pensions (Andersen, 2011).

More generalised, the higher the distance between the bottom 40 and upper 60, the more stratification in elderly income there is in a country. This is partly related to primary market inequality which is translated to the retirement phase (Ebbinghaus and Neugschwender, 2011). The best examples in this respect are the United States and Israel, both countries compare reasonably well with respect to median equivalised DHI of the 65+. However, both countries (as also Australia and Estonia) remained in 2010/13 at a level of only 40 percent of median equalised income for the bottom 40 of the 65+3. On the other hand, the United States and Israel are also among the countries with the highest relative levels for the upper 60 group.

For Figure 2, all amounts were converted to real amounts (ppp-adjusted), applying Consumer Price Indices (CPI) and conversion factors to adjust to 2011 country’s currency as calculated by the World Bank Development Indicators for 20114. Figure 2 takes these ppp-adjusted and equivalised mean DHI values for each group, the bottom 40 respectively the upper 60 of the 65+, and looks at the overall percentage increase between the two points in time. As the interval between the country years varies, the numbers are converted to annualised growth rates by dividing the overall increase by the number of years between the earlier and the later year. Data points below the diagonal signify decreases in the distance between the bottom 40 and the upper 60 measure; in these countries, over the whole period, income levels among the bottom 40 have grown more as compared to the upper 60.

A broader research agenda is needed for carefully interpreting Figure 2. Reasonably high numbers in growth might be linked to high wage growth, depending on existing indexation rules in the various pension schemes. Also, the countries below the diagonal may have concentrated rather on better inclusion or higher generosity of targeted pensions to the income poor elderly; hence these countries have undertaken a relatively higher investment in increasing income of the poor elderly as compared to increasing payments from contribution-based schemes. Cost containment in pension systems might particularly affect the upper 60 group in future, when e. g. partly privatised pension provision for future retirees does not result in a replacement of previous public provision. On the other hand, cross-national and intertemporal variation in continued employment beyond the legal retirement age among the elderly across this period may heavily affect this narrative. Future research may aim at better capturing the joint analysis (multivariate modeling) of institutional characteristics of pension systems, living arrangements and labour market attachment, and its overall implication for pension outcomes and inequality trends among the elderly.

1 see Chapter 3 on the living arrangements, labour market attachment, and the income mix of the elderly for LIS countries in Neugschwender (2016). The remaining country group is characterised by a rather high share of single/couple elderly households, hence a substantial share of income is drawn from pension income in these countries.

2 The breakdown in Bottom 40 and Upper 60 has been borrowed from the ‘Poverty and Shared Prosperity’report by the World Bank (2016).

3 This measure mirrors the highest at-risk-of-poverty for the elderly in these countries in these four countries, see LIS Key Figures.

4 PPP deflators (Consumer Price Index (2011 = 100), and conversion factor to adjust 2011 country’s currency into 2011 international USD) adjusted to the LIS country years can be found on the following LIS webpage.

References

| Andersen, J. G. (2011). ‘Denmark: The Silent Revolution toward a Multipillar Pension System’, in B. Ebbinghaus (ed.), The Varieties of Pension Governance: Pension Privatization in Europe. Oxford: Oxford University Press, 183-209. |

| Ebbinghaus, B., and Neugschwender, J. (2011). ‘The Public-Private Mix and Old Age Income Inequality in Europe’, in B. Ebbinghaus (ed.), The Varieties of Pension Governance: Pension Privatization in Europe. Oxford: Oxford University Press, 384-422. |

| Jenkins, S. P., and Van Kerm, P. (2009). ‘The Measurement of Economic Inequality’, in W. Salverda, B. Nolan and T. M. Smeeding (eds.), The Oxford Handbook of Economic Inequality. Oxford: Oxford University Press, 40-67. |

| King, A., Baekgaard, H., Harding, A. (2001). ‘Pension Provision in Australia’, in R. Disney & P. Johnson (eds.) Pension Systems and Retirement Incomes Across OECD Countries, Cheltenham, UK, Edward Elgar, 48-91. |

| Neugschwender, J. (2016). Pension Systems and Income Inequality among the Elderly in Europe, Mannheim [Dissertation], https://ub-madoc.bib.uni-mannheim.de/41262/. |

| World Bank (2016). Poverty and Shared Prosperity 2016: Taking on Inequality. Washington, DC: World Bank. doi:10.1596/9781464809583. |