Issue, No.2 (June 2017)

Is there a trade-off between tax progressivity and the average tax rate?

Scholars have highlighted four policy levers that affect income inequality: the average rate and progressivity of taxation, and the average rate and targeting of social transfers. Theoretically, stronger targeting and progressivity reduces inequality, ceteris paribus. However, we do not live in a ceteris paribus world. Due to political constraints, changes in targeting and progressivity may cause changes in the average rate of transfers and taxation. There is no obvious intuition of how political bargaining will connect the four levers of redistribution. Ultimately, the connections must be revealed empirically.

The existing empirical literature provides an accurate assessment of the transfer side of redistributive policies, but the measurement and comparison of taxation remains either partial or biased (Marx, Salanauskaite, and Verbist, 2013). In a recent study (see Guillaud, Olckers, Zemmour 2017), we fill this gap by imputing social contributions (employer and employee), a large component of tax revenue that has been ignored in previous research.

Our empirical analysis uses LIS harmonized household survey data to provide an international comparison of 22 countries over the period 1999-2013 (for a total of 67 country-years). After imputing the missing social security contributions, our tax data cover 52 percent of the national tax revenue—in contrast to 35 percent in the initial LIS data. The remaining portion of the tax revenue is mostly due to consumption tax and corporate taxation, which fell outside the scope of household survey data used in LIS.

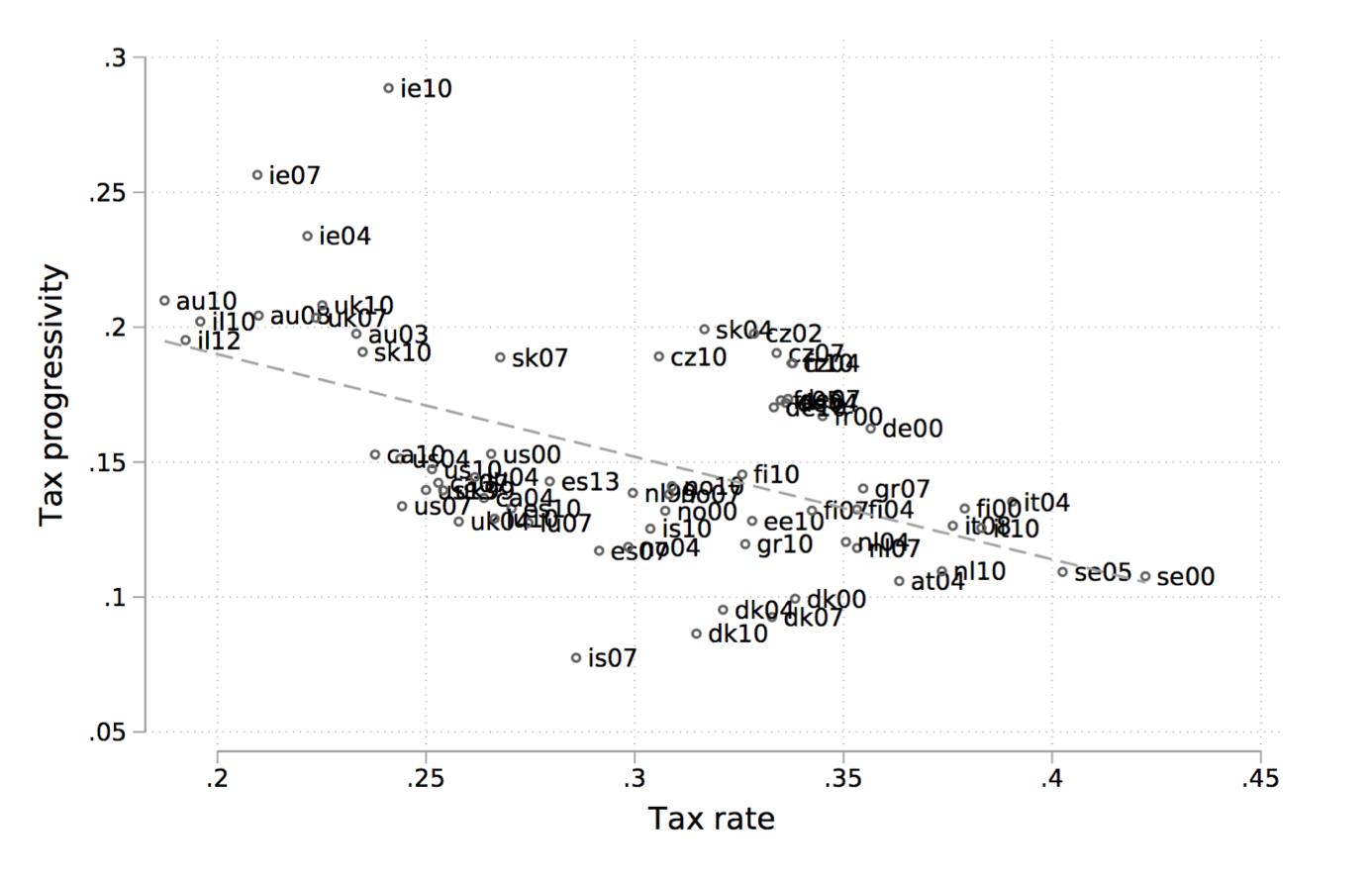

Our results show that democracies face trade-offs between the four levers of redistribution. No country pushes all four levers to their maximum simultaneously. Although any mix of tax and transfers is theoretically feasible, only certain configurations are politically feasible. For example, high tax progressivity appears to be incompatible with a high average rate of taxation (see the figure below).

As shown in the figure, among the 22 observations for which the progressivity is high (Kakwani index > 0.17), none has a high average tax rate. Analogously, among the 15 observations for which the tax rate is high (tax/gross income >.34 percent), none has a high progressivity index.

This apparent trade-off, valid for a large sample of country-years, confirms the finding of Verbist and Figari (2014) on a European sample of 15 countries using the EUROMOD micro-simulation model. It is also in line with the finding that generous social systems (high levels of transfers) are found in economies with low tax progressivity (Lindert, 2004).

Both the progressivity and the rate of taxation influence the level of redistribution. Different countries obtain the same level of inequality reduction through high rates of taxation and through strong progressivity. It is tempting to conclude that even greater redistribution could be achieved by combining high rates of taxation and strong progressivity. Unfortunately, our results suggest that this combination is not politically feasible. Following Korpi and Palme (1998), we call for more careful consideration of the paradox of redistribution. Analyses that focus on one or two specific levers of redistribution among the four we identified could not only lead to flawed results, but also deliver misleading policy recommendations. Our result indicates that governments cannot change redistributive policies in isolation. Pulling down one lever moves another.

References

| Guillaud, E., Olckers, M., & Zemmour, M. (2017). Four levers of redistribution: The impact of tax and transfer systems on inequality reduction. LIS working paper series No. 695. |

| Korpi, W., & Palme, J. (1998). The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries. American Sociological Review, 63(5), 661-687. |

| Lindert, P. H. (2004). Growing public: Volume 1, the story: Social spending and economic growth since the eighteenth century (Vol. 1). Cambridge University Press. |

| Marx, I., Salanauskaite, L., & Verbist, G. (2013). The paradox of redistribution revisited: and that it may rest in peace? LIS working paper series No. 593. |

| Verbist, G., & Figari, F. (2014). The redistributive effect and progressivity of taxes revisited: An International Comparison across the European Union. FinanzArchiv: Public Finance Analysis, 70(3), 405-429. |