Issue, No.1 (March 2017)

How do consumers discount future? Evidence from the Luxembourg Wealth Study

According to Bozio et al. (2016), time preference1 is usually estimated in the literature by using experimental data: among 42 studies surveyed by Frederic et al. (2002), 34 were using experimental data. Therefore, this study is one of the few articles that explore survey data to highlight household’s time preference. For this purpose, we will explore age-wealth patterns, as shown by Samwick (1998). In this note, we present the results of our estimation using Italian data that are available in the Luxembourg Wealth Study (LWS).

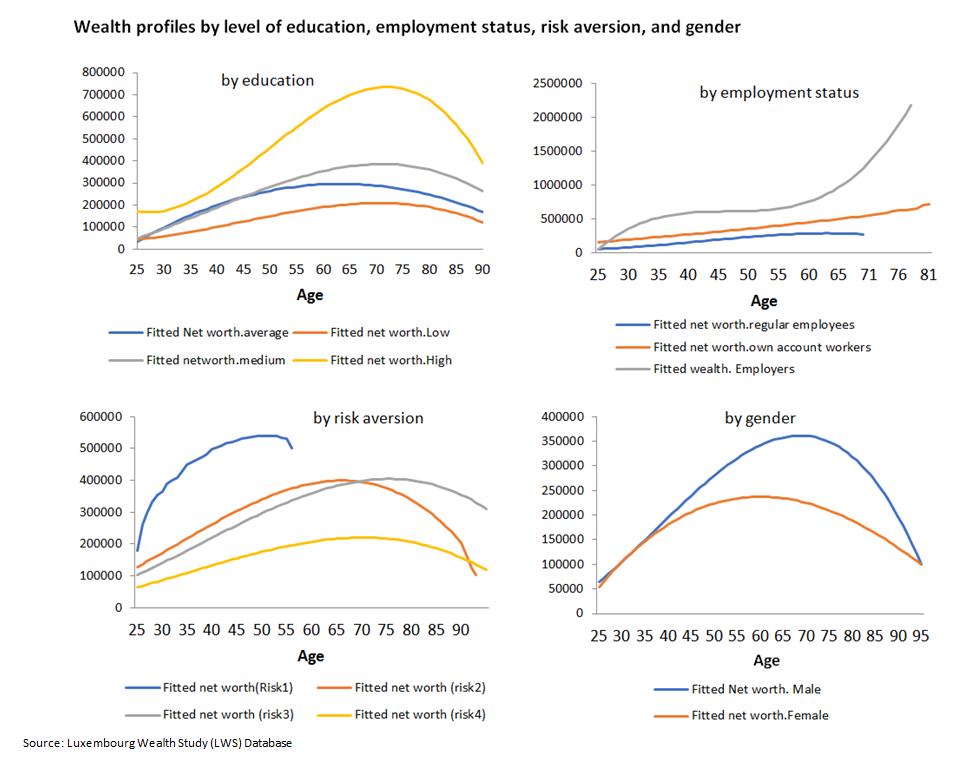

Age-wealth profiles calculate the average net worth over the age. The theory argues that on average, households who accumulate more wealth are more patient2 (Samwick, 1998). We present here the wealth accumulation profiles across level of education, employment status, gender and risk aversion behavior as shown in the figures below.

The results reflect the heterogeneity in time preferences. First, the results by education show that high educated people are more patient than low educated. This is in line with many previous theoretical and empirical studies (Carroll and Summer, 1991).

Secondly, the profiles by employment status reveal that employer and own account workers are more patient than regular employees. Particularly employees, accumulate less wealth during their lifecycle. In the same line, Caroll and Summer (1991) analysed household’s consumption and income profiles to show the heterogeneity in time preference between occupational groups.

Thirdly, this note exhibits the relationship between financial risk attitude3 and patience. This interaction, which is not much discussed in the literature, is a significant determinant of wealth accumulation (Arrondel et al, 2004). Our results by financial risk taking illustrate that more risk tolerant people are more likely to be patient and accumulate more wealth during their lifecycle.

Finally, the analyses by gender show that male are more patient and they accumulate more asset than female. This result is in line with Arrondel et al. (2004). The researchers measured time preference on the French population and found that women are less forward looking than man.

This note can be useful in terms of policy implication, and particularly in the context of pension wealth accumulation. It is well acknowledged that traditional public pension funds are facing financial difficulties and governments tend to encourage people to move to private voluntary pension saving plans. However, the success of this new model of individualised pension accumulation depends on individual patience and willingness to save. According to our result, private pension funds should particularly target men with high level of education, risk tolerance and the self-employed. These categories of household were found to be more forward looking (patient) and thus possibly more likely to save in voluntary pension accounts.

1 In this note, time preference, forward looking and patience are used interchangeably.

2 Patient individual refers to forward looking individuals who prefer future consumption than the present one. Hence, they are more likely to save a part of their income.

3 Risk aversion has been measured asking the following question: “Which of the following statement comes closest to describing the amount of financial risk that you (and your husband/wife/partner) are willing to take when you save or make investment?” The respondent can pick one of the following answers: [Risk1] take substantial financial risks expecting to earn substantial returns; [Risk2] take above average financial risks expecting to earn above average returns; [Risk3] take average financial risks expecting to earn average returns; [Risk4] not willing to take any financial risk.

References

| Arrondel, L., Masson, A., Verger, D., (2004). Mesurer les Preferences Individuelles pour le Present. Économie et Statistique, 374 (1), 87–128. |

| Bozio, A., Laroque, G. & O’Dea, C (2017). Discount Rate Heterogeneity Among Older Households: A Puzzle? Journal of Population Economics, Volume 30, Issue 2, pp. 647–680. |

| Carroll, Christopher D., Lawrence H. Summers (1991): “Consumption Growth Parallels Income Growth: Some New Evidence,” in National Saving and Economic Performance, ed. by B. Douglas Bernheim, and John B. Shoven. Chicago University Press, Chicago. |

| Frederick, S., Loewenstein, G., O’Donoghue, T., (2002). Time Discounting and Time Preferences: A Critical Review. Journal of Economic Literature. Vol Xl, pp351-401. |

| Samwick, A., (1998). Discount Rate Heterogeneity and Social Security Reform. Journal of Development Economics, 57, 117–146. |