Issue, No.21 (March 2022)

The Evolution and the Shape of Inequality in Mali: an Income-based Approach

In discussions on inequalities in Africa, Mali often appears as an exception, being the country with the lowest level of inequalities in the West African sub-region (see for example Oxfam, 2019). In this note, we address this issue by looking into the results of an innovative research on the topic. More precisely, we look at inequality in Mali based on income data rather than the more usual consumption-based approach. This research work stems from a collaboration between three institutes, the Agence Française de Développement (AFD), the Mali National Statistical Institute (INSTAT) and LIS Cross-National Data Center in Luxembourg (LIS). LIS and AFD agreed on a collaboration aimed to expand the LIS Database to middle- and low-income countries to allow for better comparisons among those countries and in comparison to high-income countries. At the same time, AFD and INSTAT signed an agreement aimed at deepening the analysis of INSTAT income data and reinforcing the internal capacities. Within the scope of these agreements, INSTAT has provided LIS with the entire microdata series of the Malian Modular and Permanent Household Survey (EMOP) from 2011 to 2019 for LIS to harmonise it and include it into the LIS Database.

EMOP is a nationwide survey carried out on a sample of about 7,200 households to collect a wide range of socio-economic indicators necessary to monitor and evaluate the progress made in improving the living conditions of households. While it is supposed to cover the whole territory of Mali, the security and institutional instabilities of recent years have made it impossible to cover some regions in all waves (notably, the region of Kidal was excluded from 2013 to 2018). The data provided is of an overall good quality, with sufficient detail and relatively low numbers of missing data, hence allowing for a comprehensive harmonisation of the EMOP data into the LIS Database. The most critical issue was that of creating an exhaustive measure of total household income in line with the LIS definition of disposable income. This was made possible thanks to the availability of all needed income sources in the EMOP data, as well as thanks to a series of exchanges between LIS and INSTAT all throughout the harmonisation work that allowed to solve most critical issues. Some waves presented more issues than others (notably the first two, where not all incomes sources were collected and some inconsistent income patterns were noted), so that any comparison over time should be taken with great care, especially when using those first two waves.

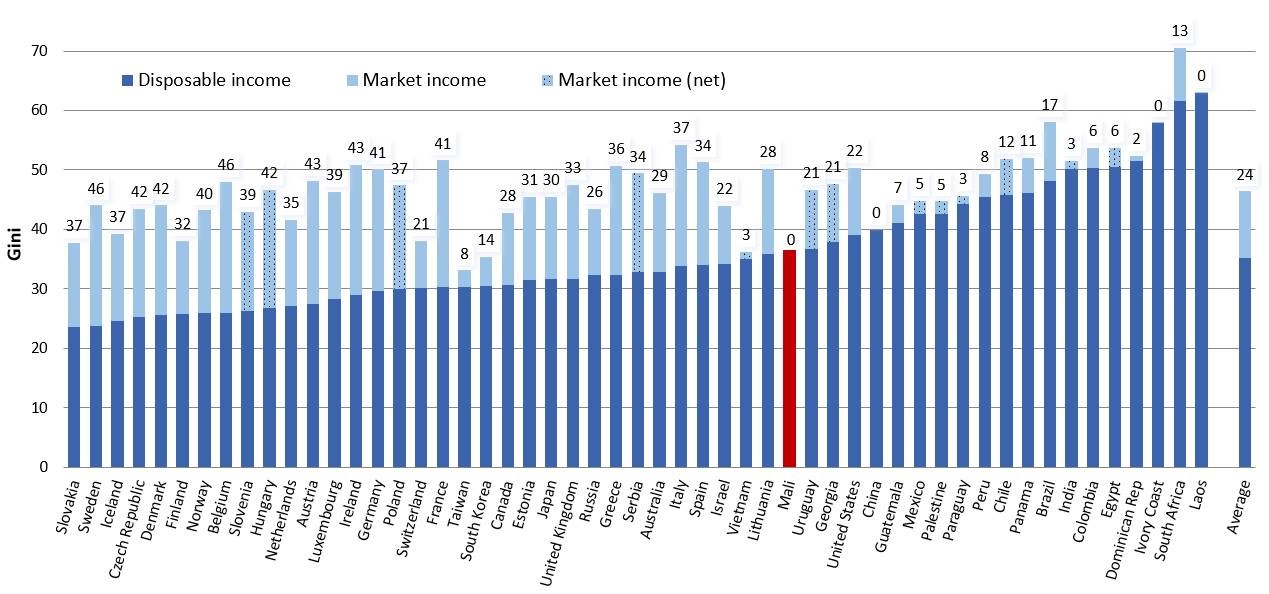

One of the main advantages of having the EMOP data in the LIS Database, is that of being able to easily compare the socio-economic outcomes of the Malian population to that of other countries. Figure 1 shows the Gini index for Mali compared to all other LIS countries for the latest year for which data was available in LIS (dark blue portion of the bar). With a Gini index based on equivalised disposable income of 36.8 for 2019, Mali (highlighted in red) has income inequality slightly above the average Gini level for all LIS countries, but is among the lowest in the emerging economies (which are mostly to the right of Mali in this figure).

Figure 1: Inequality reducing effect of redistribution of public transfers and taxes

Note:Market income is defined as the sum of labour income, capital income, occupational and private pensions and private transfers. The number at the top of the bar represents the percent reduction of Gini after redistribution of public transfers and taxes. Countries denoted Maket Income (net) are countries where only net incomes are available (so that redistribution includes transfers only); Mali belongs to that group.

Source: Luxembourg Income Study (LIS) Database, http://www.lisdatacenter.org. March 2022. Luxembourg: LIS.

One aspect where Mali behaves rather differently than most other LIS countries, is the effect of the redistribution of public transfers and taxes. By comparing the Gini index computed on market income (defined as earnings, capital income, private pensions and private transfers) with that on disposable income (i.e. after the government intervention through public transfers and taxation), it is possible to obtain a measure of the impact of the public redistribution on inequality. The reduction in Gini for Mali is practically none, due to an almost inexistent social welfare system.

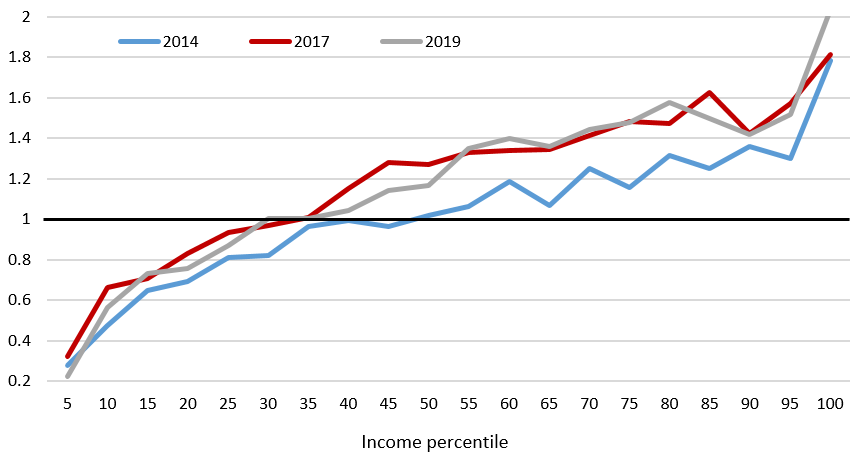

To get a better sense of the evolution and the shape of inequality in Mali, we report the main findings of the in-depth analysis which has emerged during the collaboration with AFD, INSTAT and LIS (see Alkemade et al, 2021). Our analysis points to three main findings. The first one is linked to the recent evolution of inequality in Mali. While the country is often presented as one with a relatively low and stable inequality, we see a noticeable uptick in inequality since 2017, with the Gini coefficient based on per capita income reaching 40 (and exceeding 50 for individual incomes). The second finding is the specificity of inequality patterns in Mali. On the one hand, contrary to empirical results for other countries, we do not see any significant difference between income and consumption inequality when measured with the Gini coefficient. Albeit the high poverty rate (the national absolute poverty rate is estimated at 42.3% for 2019, see INSTAT 2020), we could expect that income would be more unequally distributed compared to consumption. Our results show that this hypothesis is true only for the extremes of the distribution and that the Gini coefficient, giving more weight to the middle of the distribution, mitigates the difference (see Fig. 2).

Figure 2. Income to consumption ratio by income percentile

Source: Luxembourg Income Study (LIS) Database.

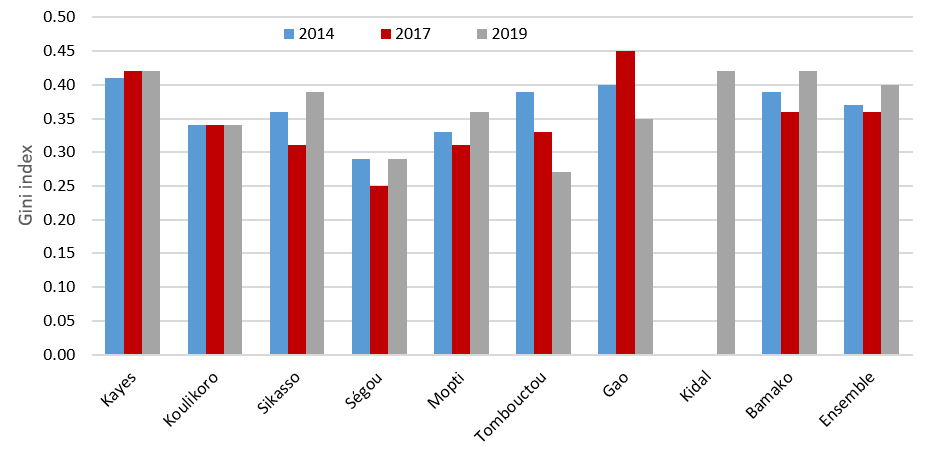

The profile of inequality in Mali also stands out due to a relatively high level of spatial inequality. Even beyond the dualism between unequal urban areas and relatively equal rural areas, we see significant differences among regions concerning the income distribution (see Fig. 3). Regions such as Ségou or Tombouctou show relatively low levels of inequality while regions such as Kayes are highly unequal. Beyond these differences among regions, it is worth noting that when using the between/within decomposition, the share of inequality between regions is relatively high compared to other countries.

Figure 3. Inequality of per capita income by region

Source: Luxembourg Income Study (LIS) Database.

Another striking specificity with regard to the inequality profile in Mali is related to its evolution throughout the life cycle. While one would expect a certain degree of convergence towards the end of the life cycle due to capital accumulation and/or social protection mechanisms, we see very little variation in the level of inequality across age cohorts in Mali. The inequality increases significantly when moving from the youth cohort to the non-youth one (from 44 to 50 in 2019), but remains relatively stable afterwards indicating a significant lack of access to capital and to social protection.

The third finding of our analysis is the crucial role played by the labour market and the informal sector in shaping income inequality in Mali. It is well known that one of the necessary conditions for reducing poverty and inequality is to achieve growth that creates jobs and income-generating activities for the poor and it is striking to see that almost 97% of employed individuals in Mali are in the informal sector. On average, wages in the informal sector are one third of those in the formal sector and it is noteworthy to mention that even for the upper quantile of the household income distribution, the share of individuals working in the informal sector reached 92% in 2019. When looking at the decomposition of inequality across sources of income, we find that while labour market income is the predominant type of income (and thus drives the income inequality), it is not the most unequally distributed. Incomes from capital, private transfers and social protection are much more unequally distributed and while one could have expected this to be the case for capital and private transfers (mainly remittances), the case of social protection benefits is more surprising. Again, this result needs to be placed in the context of the high prevalence of the informal sector, which results into a small share of individuals being able to access social protection benefits. The main implication is that in highly informal and vulnerable contexts, social insurance mechanisms can play a role in increasing inequality.

Overall, our results show that, despite Mali’s image as a country with low levels of inequality, inequality has recently increased and measures are needed to reduce it, especially in light of the Covid-19 pandemic and its economic consequences. Our analysis aims to identify some levers on which public policies could focus to move towards a more equal income distribution. The prevalence of the informal sector, with its low wages, is considered a strong determinant of inequality. The inclusion of this sector into the economy is the first step towards formalisation through public policies. International institutions, recommend the formalisation of the informal sector, despite the difficulties inherent in the situation. Moreover, the informal economy is also marked by a high degree of heterogeneity at the regional level and especially at the residence areas. The adopted policies should as well promote sustainable and decent jobs in all sectors of activity particularly in the informal sector (formalisation of small and microenterprises) in the urban areas, and in the agricultural sector in the rural areas, where the majority of the most vulnerable people work. Efforts should be made to reinforce the regulatory framework for economic activities and to extend social protection to all workers.

Social protection policies represent another strong lever for reducing inequality because, as the results indicate, social transfers are yet too limited to have a positive impact on income distribution. Currently, the social protection system in Mali is largely based on a contributory scheme, which covers only a minority of the population given the size of the informal sector. The extension of social coverage could be achieved through: (i) the implementation of the Universal Health Insurance Schemes (UHIP, RAMED, mutual health insurance schemes); (ii) more widespread social transfers (cash transfers, vouchers, effective support, construction/rehabilitation of livelihood means) targeted to vulnerable groups; (iii) the extension of social protection to the agricultural sector and the informal sector; and (iv) the development of mechanisms to strengthen the effectiveness and efficiency in the implementation of social protection initiatives for the benefit of the population, particularly the most vulnerable segments.

While the analysis on income inequality is still very scarce in low- and middle-income countries, these first findings based on income data for Mali show that there can be an undiscovered potential within these data. The results are very encouraging in that they confirm existing analysis based on consumption data, but complement it along dimensions that are not typically available when only looking at consumption. While we recommend caution when analysing income data from countries which typically rely on consumption, we are looking forward to see further analysis that help understanding the interplay between income and consumption, with an in-depth decomposition of inequality by socio-demographic dimensions.

References

| Alkemade, P, Checchi, D. Cissé S., Coulibaly, A., David, A., Koné, A., Munzi, T., Sodio. T. et Sougane, A. (2021), Analyse des inégalités de revenu au Mali, Papiers de Recherche AFD, N. 221, November 2021, AFD Editions. |

| INSTAT (2020), Consommation, pauvreté, bien-être des menages- Rapport d’analyse EMOP Passages 1-4, May 2020. Institut National de la Statistique, Bamako. |

| Oxfam, I. (2019), La crise des inégalités en Afrique de l’Ouest. Quelles sont les solutions face à l’échec des pays d’Afrique de l’Ouest à réduire les inégalités?, July 2019, United Kingdom : Oxfam GB. |