Issue, No.16 (December 2020)

Globalization and Economic Redistribution in Central and Eastern Europe Thirty Years after the Transition

Last year marked the 30th anniversary of the fall of Communism in Central and Eastern Europe (CEE). Three decades ago, the countries in the region embarked on a journey to fundamentally reshape their domestic institutions and establish fully functioning market economies. This transition brought about tremendous challenges as governments sought to overhaul existing structures and insert themselves into the global economy.

Opening up to international trade and foreign capital exposed societies to heightened risks. As domestic enterprises collapsed under the burden of obsolete technology, inefficient production practices, and intense foreign competition, unemployment soared. The decline of entire sectors forced many workers into early retirement. Multiplying bankruptcies and falling wages doomed many to poverty. Inequality rose rapidly as industries stagnated and productivity differentials widened.

National welfare states were thus more important than ever. As they navigated problems that they had not experienced in decades, policy-makers had to re-build their countries’ social protection systems and revamp existing institutions. While doing so, they had to navigate the complexities of the global economy. Two influential strands of academic literature anticipate that the process of economic integration might have had meaningful implications for the nascent welfare states in the region. The race-to-the-bottom hypothesis posits that intensifying globalization forces states to lower taxes and cut social spending in order to create a favourable economic environment and lure foreign direct investment. In contrast, the compensation hypothesis predicts that countries expand their welfare state in order to shield their population from the economic disruptions induced by foreign competition.

How do globalization pressures shape welfare state dynamics today, thirty years after the start of the transition? Does insertion into the global economy induce national governments to limit economic redistribution, or the extent to which government taxes and transfers reduce economic inequality, in an attempt to attract foreign capital? Or does it incentivize them to protect their societies from heightened risk? Do domestic institutions mediate this relationship, or is the effect of economic integration independent of political factors?

To answer these questions, I examine the drivers of economic redistribution in Central and Eastern Europe between 2004 and 2018. State-sponsored redistribution reflects the generosity of a country’s welfare state and the progressivity of its taxation system. Taking the value of 0 (no redistribution) to 1 (perfect redistribution), it is calculated as the difference between the market and the disposable income GINI coefficients expressed as a share of the former. While market income is defined as income from salaries, self-employment, rental property, land, interest, dividends, profit from capital, and pensions from individual private plans, disposable income subtracts taxes paid and adds social exclusion transfers, unemployment, old-age, survivor, and disability benefits, and housing, family, and child and education-related allowances. Data is available through the European Union Statistics on Income and Living Conditions (EU-SILC) database, which provides detailed harmonized information on different income categories for representative national samples of 32 European countries.

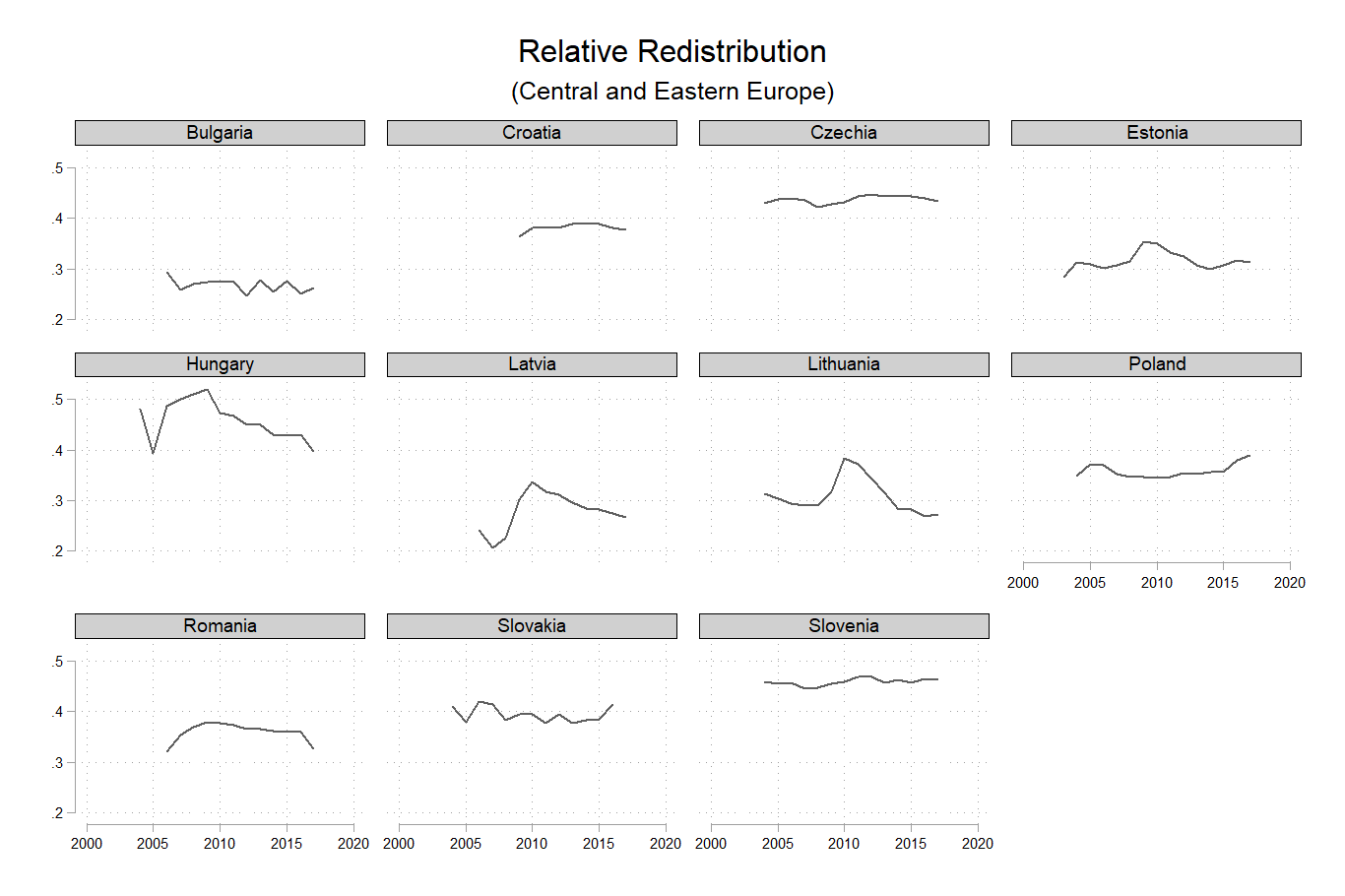

In this article, I focus on the eleven countries that joined the European Union in the 2004, 2007, and 2013 accession waves – Bulgaria, Croatia, Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia – between 2004 and 2018. Figure 1 below shows the level of economic redistribution in this sample. The plot reveals considerable variation over time and across space: while redistribution exceeded 40% in Czechia, Hungary, and Slovenia, it barely reached 30% in Bulgaria and Latvia. Furthermore, the early 2010s witnessed noticeable increases while the late 2010s brought about steep falls in redistribution in Hungary, Latvia, Lithuania, and Estonia. On average, governments in Central and Eastern Europe reduced income differences by approximately 38% in 2010 and 35% in 2018.

Figure 1. Relative redistribution in 11 Central and Eastern European countries (2005 – 2017)

Source:EU-SILC.

Did globalization influence these dynamics? A series of statistical models reveals that, ceteris paribus, economic integration emerges as a meaningful predictor of economic redistribution. Globalization is captured through measures of openness to trade (exports and imports as a share of GDP), foreign direct investment (FDI) inflows, and capital account openness. Focusing exclusively on temporal variation and controlling for a number of political, economic, and demographic factors,1 fixed effects models indicate that integration into the world economy is correlated with greater efforts to alleviate income differentials in Central and Eastern Europe during the 2000s and the 2010s. In line with the compensation hypothesis, globalization is linked to a more active role for the state in socio-economic affairs. This effect is not negligible in size – a one-standard-deviation change in capital openness, FDI inflows, and trade is related to a 0.554, 0.030, and 0.268 standard-deviation change in redistribution, respectively.

In a second step, I explore whether domestic institutions mediate the impact of economic globalization on state-sponsored redistribution. Institutions structure the political process; they determine the incentives and constraints that policy-makers face, shape agenda-setting, and affect the ease with which new policies are adopted and implemented (Immergut 1992, Huber, Ragin, and Stephens 1993). Existing work has shown that institutions can facilitate far-reaching reforms or promote policy drift (Enns et al. 2014); that they can perpetuate inequalities or ensure a more equitable distribution of resources among different constituencies. They can therefore condition the development of the welfare state.

Two specific types of institutions are especially relevant: accountability before voters and the disproportionality of the electoral system. Vertical accountability explicitly measures the electorate’s capacity to hold the government accountable. It reflects citizens’ ability to freely organize in political parties and participate in free and fair elections. Data is available through the Varieties of Democracy project (Coppedge et al. 2020). Higher disproportionality, on the other hand, enables political parties to gain higher/lower representation in the national legislature than their vote share warrants. This weakens the connection between representatives and their constituency. It also alleviates the pressure on elected legislators to respond to the electorate’s demands as it undermines voters’ ability to punish officeholders for failing to deliver on their promises. The commonly used Gallagher index measures disproportionality (Armingeon et al. 2020).

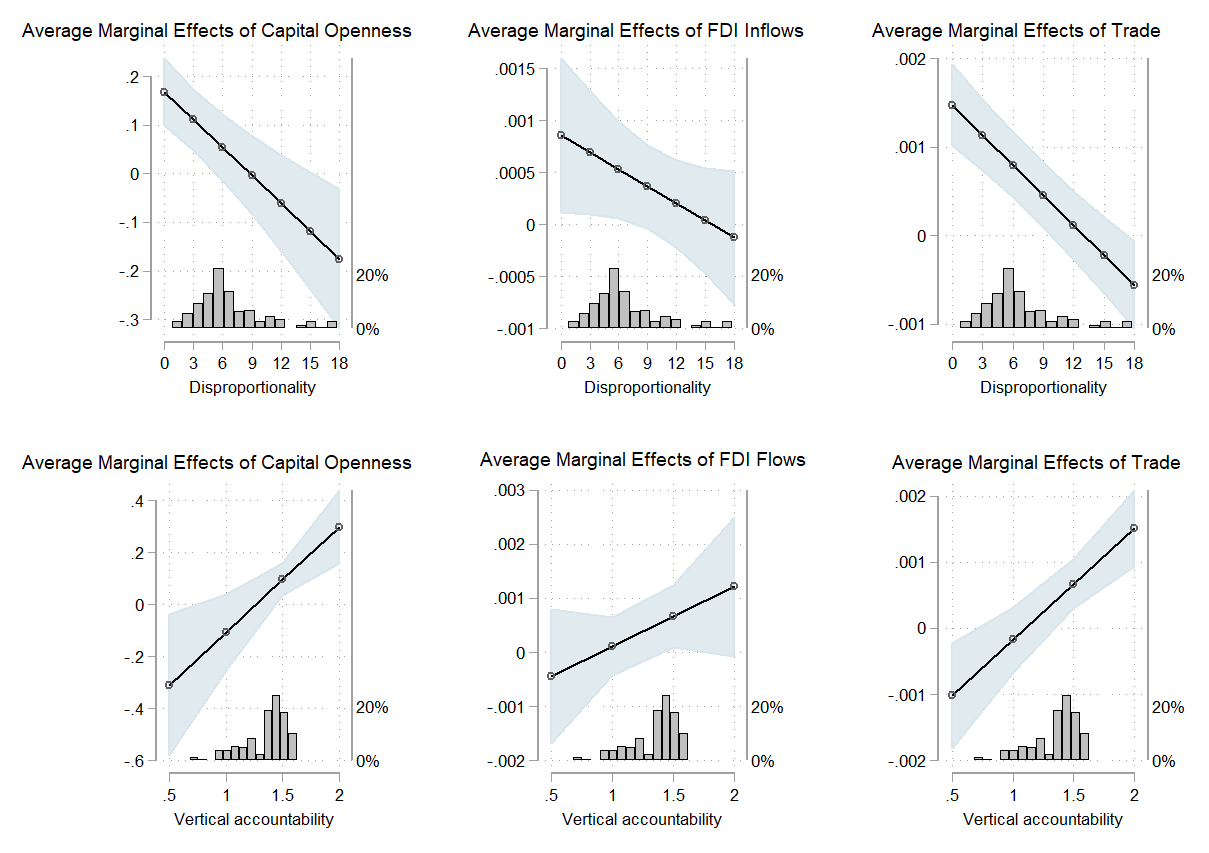

To assess whether institutions condition the effect of globalization on economic redistribution, I re-run my models including an interaction term between trade, FDI inflows, and capital account openness on the one hand, and disproportionality and vertical accountability on the other. Figure 2 below plots the marginal effect of globalization over the range of institutions. The shaded areas present 95% confidence intervals while the gray bars at the bottom show the distribution of the two political variables. As before, the models include fixed effects.

Figure 2. Average marginal effects of globalization on relative redistribution over the range of electoral disproportionality and vertical accountability

Source:EU-SILC.

Figure 2 shows that trade and capital account openness are associated with lower redistribution at very low levels of vertical accountability. When governments are not accountable to the electorate, incumbents seem to lack incentives to use social benefits to reduce income differentials. Nevertheless, when accountability exceeds a threshold of 1 (for capital openness) and 1.5 (for trade), the effect of globalization becomes positive: office-holders do in fact rely on redistribution to alleviate inequality. This suggests that, by themselves, the pressures of economic openness are not enough to induce a more active role for the state in socio-economic affairs. It is only when voters have the capacity to effectively punish governing parties that the latter engage in redistribution in response to external shocks.

The models with disproportionality lead to similar conclusions. The impact of trade and capital account openness is positive at low and medium levels of disproportionality, but turns negative once votes are decoupled from parliamentary seats. In this sense, when political parties’ representation within national assemblies is tightly tied to their electoral performance, political elites are more likely to attempt to address any disruptions brought about by globalization with social transfers. In contrast, when the link between votes and seats is weakened, attributing responsibility becomes more challenging, and punishing incumbents is not always effective, incumbents are less likely to redistribute income in response to external pressures.

These findings suggest that political elites – even those of countries outside of the wealthiest capitalist democracies of Western Europe and North America – do not always opt for lower redistribution in an attempt to create a business-friendly climate and attract foreign direct investment. In fact, higher openness to the global economy is associated with a more pronounced role for the government in reducing income differentials in Central and Eastern Europe. This might be because support for state-sponsored redistribution, which has traditionally been high in the region (Pop-Eleches and Tucker 2017), remains significant. According to the European Social Survey, large majorities, approaching 90% in Croatia, Bulgaria, and Hungary agreed with the statement that the government should reduce differences in income levels in 2018 (the only exception was the Czech Republic, where only 49% of respondents supported redistribution). Welfare state retrenchment might therefore be perceived as politically costly by incumbents and policy-makers might be motivated to redistribute more in order to shield the most vulnerable from the risks that globalization brings.

This is most likely to occur where institutions promote accountability and responsiveness. It is mainly in those contexts that democratic elites respond more strongly to external pressures. This implies that a country’s institutional set-up has important repercussions for the way in which its insertion into the global economy shapes domestic inequality and redistribution. Indeed, improving vertical accountability and reducing electoral disproportionality could lead to more generous welfare states.

1The fixed effect models explore the drivers of change over time and account for time-invariant country characteristics. The full model specification controls for economic growth, GDP per capita, market income inequality, government partisanship, veto points, voter turnout, disproportionality, unemployment, the age dependency ratio, fiscal constraints, membership of the European Monetary Union, and the global economic crisis of the late 2000s.

References

| Armingeon, K.; Wenger, V.; Wiedemeier, F.; Isler, C.; Knöpfel, L.; Weisstanner, D.; Engler. S. (2020). Comparative Political Data Set 1960-2018. Zurich: Institute of Political Science, University of Zurich. |

| Coppedge, M.; Gerring, J.; Knutsen, C. H.; Lindberg, S. I.; Teorell, J.; Altman, D.; Bernhard, M.; Fish, M. S.; Glynn, A.; Hicken, A.; Knutsen, C. H.; Lührmann, A.; Marquardt, K. L.; McMann, K.; Paxton, P.; Pemstein, D.; Seim, B.; Sigman, R.; Skaaning, S.-E.; Staton, J.; Cornell, A.; Gastaldi, L.; Gjerløw, H.; Mechkova, V.; von Römer, J.; Sundtröm, A.; Tzelgov, E.; Uberti, L.; Wang, Y.-T.; Wig T.; Ziblatt, D. (2020). ”V-Dem Codebook v10” Varieties of Democracy (V-Dem) Project. |

| Enns, P. K.; Kelly, N. J.; Morgan, J.; Volscho, T.; Witko, C. (2014). Conditional status quo bias and top income shares: How US political institutions have benefited the rich. The Journal of Politics, 76(2), 289-303. |

| European Social Survey (2018). ESS Round 9 Source Questionnaire. London: ESS ERIC Headquarters c/o City, University of London. |

| Huber, E.; Ragin, C.; Stephens, J. D. (1993). Social democracy, Christian democracy, constitutional structure, and the welfare state. American journal of Sociology, 99(3), 711-749. |

| Immergut, E. M. (1992). The rules of the game: The logic of health policy-making in France, Switzerland, and Sweden. Structuring politics: Historical institutionalism in comparative analysis, 4(4), 57-89. |

| Pierson, P. (2000). Increasing returns, path dependence, and the study of politics. American political science review 251-267. |

| Pop-Eleches, G., & Tucker, J. A. (2017).Communism’s shadow: Historical legacies and contemporary political attitudes. Princeton University Press. |